In brief

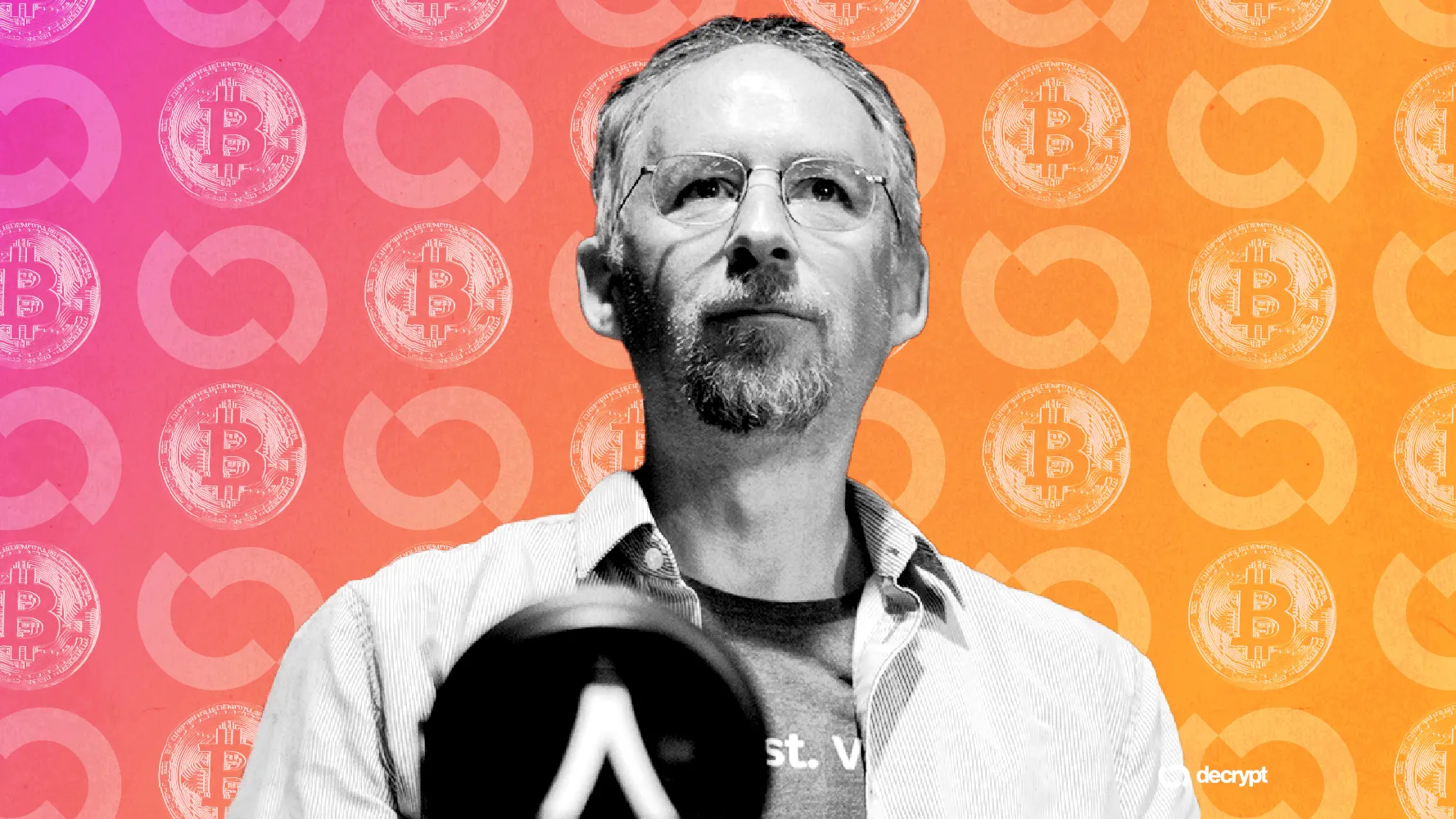

- Blockstream CEO Adam Back says Trump’s presidency is accelerating government interest in Bitcoin by decades.

- Back, a veteran cypherpunk, views the shift as a departure from Bitcoin’s anti-government roots.

- While welcoming the momentum, Back warns the political embrace of crypto complicates investor confidence.

Although U.S. President Donald Trump isn’t slated to attend this year’s Bitcoin conference in Las Vegas, his presence is being felt, with scheduled speakers like Vice President JD Vance and regulatory tailwinds that everyone seems excited to discuss.

For Blockstream CEO and British cryptographer Adam Back, the dynamic feels like a far cry from Bitcoin’s early days, when he and other cypherpunks worked tirelessly to undermine centralized authorities, including the U.S. government, using cryptography.

Protecting privacy and promoting free speech seemed inherently anti-government at the time. Since Trump’s inauguration in January, a new set of industry-specific challenges has emerged.

Bitcoin no longer faces the threat of overzealous regulators, advocates say. However, Trump-linked crypto ventures, such as the president’s meme coin, are overshadowing legislative initiatives on Capitol Hill and are drawing rebukes from Democratic lawmakers.

Bitcoin Inventor Satoshi Nakamoto Emails Revealed in Court

Satoshi Nakamoto, the pseudonymous inventor of Bitcoin, still hasn’t been identified 15 years after the cryptocurrency was launched—despite claims by computer programmer Craig Wright to be the man behind the myth. But in the latest court case to try to dispel his claims, some real emails from Satoshi finally entered the public record. Cryptographer and cypherpunk Adam Back—CEO and co-founder of Blockstream—was interviewed as a witness in the UK High Court of Justice on Tuesday in the ongoing cas...

In an interview with Decrypt on Tuesday, Back said that Trump’s embrace of the crypto industry is a net positive for the space, even if that may be diluting Bitcoin’s anti-government origins.

“It’s useful to have politicians who are business and economic savvy, so that they make an environment that is conducive to making progress, but it’s a bit tricky to manage [people’s] confidence,” he said. “I don't know what the solution is, but it's a factor.”

Other cypherpunks, including Ethereum co-founder Vitalik Buterin, have warned against crypto-friendly politicians who don’t embody cypherpunk values. Even then, Buterin’s word of caution received notable industry pushback before Trump’s White-House victory last year.

At the end of the day, Back said that the Trump administration is accelerating the timeline for governments' adoption of Bitcoin, whether that’s through prompting state-level initiatives, sovereign wealth funds, or the establishment of a strategic Bitcoin reserve.

That’s beneficial, as it opens up another level of demand beyond retail investors and corporations, he said.

“The concept of governments buying Bitcoin—people probably thought that was four decades away in 2015,” he said. “But here we are.”

What It Was Like Inside the Trump Crypto Dinner

A room full of crypto bros eagerly awaited President Donald Trump’s arrival at his National Golf Club in Washington, D.C. on Thursday, anticipating an announcement about the future of crypto in the United States. Bitcoin had just hit a new all-time high, the vibes were tremendous and expectations were grand. That’s when Nicholas Pinto, a 25-year-old social media influencer and self-described car enthusiast, burst through the door of the golf club. Sweating slightly as he made his way in, Pinto t...

Back is the inventor of Hashcash, a proof-of-work consensus mechanism that underpins Bitcoin's block generation process.

Satoshi Nakamoto cited his work in Bitcoin’s whitepaper, and over the years, his name has been routinely floated as a potential candidate for Bitcoin’s pseudonymous creator. Back has consistently denied those claims.

For individual investors, Back posited that they may be better off if governments accumulated Bitcoin slowly, giving them more time to purchase the asset on their own. Still, if governments ignore Bitcoin, they risk losing their economic standing and competitiveness, he said.

Along those lines, Trump’s reelection wasn’t a make-or-break moment for the digital assets industry. Even if the previous White House administration was antagonistic, advancements, including the approval of spot Bitcoin ETFs in the U.S., still happened.

“They were creating friction, which was really pushing innovation [and] technology offshore,” he said. “There’s still limitations, but in practice, it’s been gradually accepted and regularized.”

Edited by Sebastian Sinclair