Key Insights

- Sui’s average daily DEX volume hit another all-time high of $304.3 million in Q1 2025, a 14.6% quarter-over-quarter (QoQ) increase. Cetus and Bluefin led with $171.0 million and $68.5 million in average daily DEX volume, respectively.

- In Q1, SUI’s circulating market cap declined 40.3% QoQ to $7.2 billion, underperforming the broader crypto market, which declined by 18.2% over the same period.

- Institutional interest in Sui accelerated in Q1, highlighted by Grayscale adding SUI to its GSCPxE Fund, Libre Capital enabling access to tokenized funds on Sui, and Canary Capital filing for the first U.S.-based SUI ETF.

- Sui expanded access in Q1 through integrations with Phantom, Binance, RedStone, and Wallet in Telegram, bringing native asset support and DeFi infrastructure to over 100 million users.

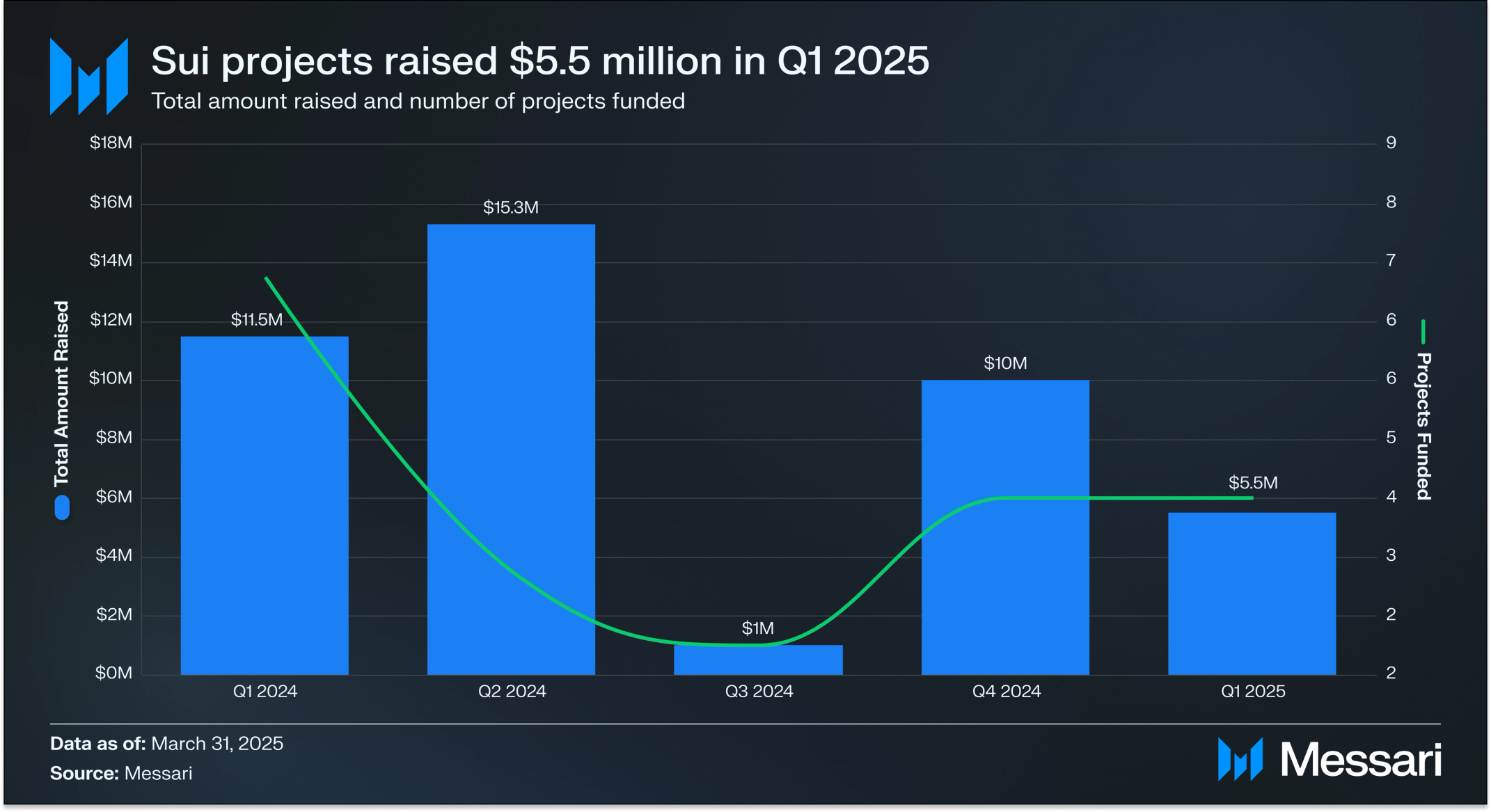

- Sui projects Haedal Protocol, SEED Combinator, Printr, and M10 raised $5.5 million in Q1, and Mysten Labs acquired Web3 gaming infrastructure startup Parasol.

Primer

Sui (SUI) is a delegated proof-of-stake (DPoS) Layer-1 blockchain designed for high scalability and low-latency transactions optimized for mass adoption. Sui’s core developer, Mysten Labs, was created in 2021 by Evan Cheng, Sam Blackshear, Adeniyi Abiodun, Kostas Chalkias, and George Danezis. These founders previously led Meta’s Diem and Novi blockchain projects and have experience at Apple, the Alan Turing Institute, Microsoft, R3, and Oracle. Mysten Labs raised $336 million in the 2021 Series A and 2022 Series B rounds. Sui’s mainnet launched in May 2023.

Sui’s technological stack features many novel aspects, including its object-centric data model, Mysticeti consensus mechanism, Sui Storage Fund, and Sui Move programming language. Sui Move builds on the original Move language, which was created by Mysten Labs co-founder Sam Blackshear. It offers enhanced flexibility and safety compared to other Web3 programming languages. Unlike Solidity's reliance on sequential transaction processing, which can lead to inefficiencies and higher gas fees, Sui Move's object-centric data model enables parallel transaction processing, enhancing efficiency. Additionally, five of the OWASP Top 10 vulnerabilities are not possible in Move, and three others are partially mitigated.

Several other protocols and products to improve user onboarding and experience have been released on Sui. These include:

- Sponsored transactions: allow gas fees to be abstracted away from end users

- zkLogin: enables Sui users to transact using OAuth credentials

- Sui Bridge: a native bridge for cross-chain interoperability

- Sui Kiosk: a decentralized system for commerce applications

Growth of the Sui ecosystem is led by the Sui Foundation, with Mysten Labs being the initial contributor to the development of the Sui blockchain protocol. For a complete primer on Sui, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

Key Metrics

Financial Analysis

In Q1 2025, SUI’s circulating market cap declined 40.3% QoQ to $7.2 billion, underperforming the broader crypto market, which declined by 18.2% over the same period. By the end of Q1, Sui still climbed two spots from Q4 2024 to rank as the 13th largest cryptocurrency by market cap.

Sui's fees include all gas fees generated from transactions on the network, which consist of computation costs and non-refundable storage fees. These fees are subsequently distributed to network validators. In Q1 2025, total quarterly fees decreased 33.3% QoQ from all-time highs to $3.6 million (equivalent to 1.0 million SUI). While the price of SUI decreased by 40.3% QoQ, contributing to the decline in fees when measured in USD, fees denominated in SUI declined by 44.4% QoQ. This indicates that while price depreciation played a role, other factors drove the decrease in network activity and fee generation.

SUI has a fixed total supply of 10 billion, with 1 billion tokens set aside for staking rewards. Relative to the remaining 9 billion tokens, SUI’s annualized inflation rate from staking reward issuance was 0.30% at the end of Q1 2025. This rate is set to continue decreasing by 10% every three months until all 1 billion tokens are distributed.

Other inflationary pressures came from token supply unlocks. By the end of Q1 2025, 31.70% of SUI’s total supply was distributed, an 8.30% QoQ increase from Q4 2024. This increase in supply came from unlocks that occurred on the following dates. All values are based on SUI’s price on March 31, 2025.

- Jan. 1, 2025:

- Ecosystem: 12.6 million SUI ($28.6 million) unlocked for the Community Reserve.

- Team: 12.5 million SUI ($28.3 million) unlocked for the Early Contributors and Mysten Labs Treasury.

- Private Investors: 39.2 million SUI ($88.9 million) unlocked for the Series A and Series B investors

- Staking Rewards: 17.8 million SUI ($40.4 million) unlocked for the Staking Subsidies.

- Total: 82.0 million SUI ($186 million) unlocked - 0.91% of total tokens vesting and 0.82% of total token supply.

- Feb. 1, 2025:

- Ecosystem: 12.6 million SUI ($28.6 million) unlocked for the Community Reserve.

- Team: 12.5 million SUI ($28.3 million) unlocked for the Early Contributors and Mysten Labs Treasury.

- Private Investors: 39.2 million SUI ($88.9 million) unlocked for the Series A and Series B investors.

- Staking Rewards: 16.0 million SUI ($36.3 million) unlocked for the Staking Subsidies.

- Total: 80.2 million SUI ($181.9 million) unlocked - 0.89% of total tokens vesting and 0.80% of total token supply.

- March 1, 2025:

- Ecosystem: 12.6 million SUI ($28.6 million) unlocked for the Community Reserve.

- Team: 12.5 million SUI ($28.3 million) unlocked for the Early Contributors and Mysten Labs Treasury.

- Private Investors: 39.2 million SUI ($88.9 million) unlocked for the Series A and Series B investors.

- Staking Rewards: 16.0 million SUI ($36.3 million) unlocked for the Staking Subsidies

- Total: 80.2 million SUI ($181.9 million) unlocked - 0.89% of total tokens vesting and 0.80% of total token supply.

In total, 242.5 million SUI tokens ($549.9 million) were unlocked in Q1 2025, which is 2.42% of the total supply. At the end of Q1 2025, 77.3% of the eligible supply was staked, a 1.6% QoQ decrease. Locked tokens can still be staked and earn liquid staking rewards, so the supply eligible to be staked is SUI’s total supply rather than its circulating supply. With such a high stake rate, SUI’s annualized real yield is slightly below zero, at -0.14%.

Network Analysis

Usage

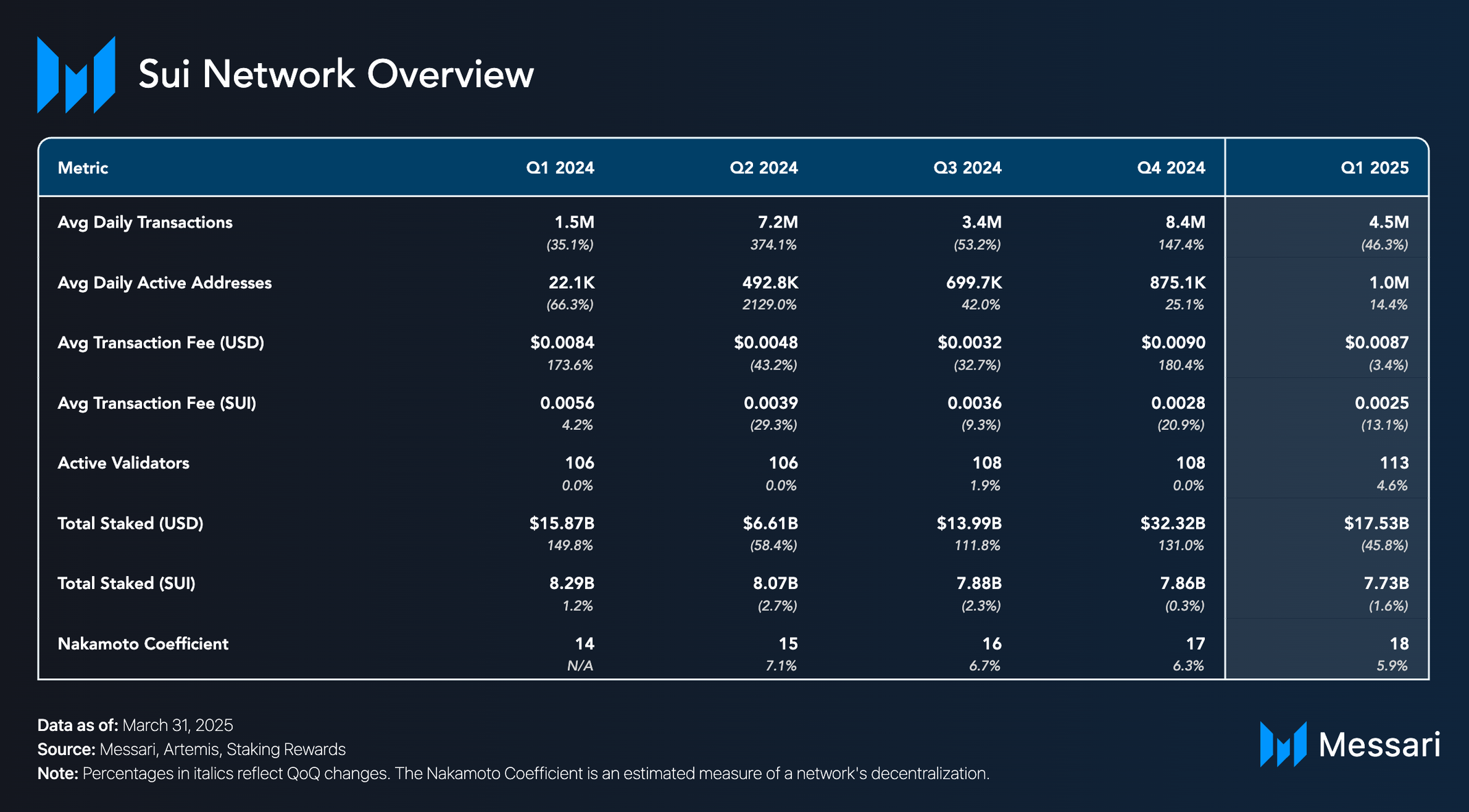

In Q1, Sui’s average transaction fee decreased by 13.1% QoQ to 0.0025 SUI ($0.0087), making millions of daily transactions viable. In addition to providing gas fees at a fraction of a penny, Sui enables dApps and other entities to abstract away gas fees from end users via sponsored transactions. During Q1, on average, 23.4% of all transactions on Sui were sponsored.

Security and Decentralization

The total amount of staked SUI declined gradually from its Q1 2024 peak of 8.29 billion SUI (82.9% of the eligible supply) to 7.73 billion SUI (77.3%) by the end of Q1 2025. With SUI’s price appreciation in Q4 2024 and subsequent decrease in Q1 2025, the decline in staked SUI denominated in USD was more pronounced, down 45.8% QoQ to $17.5 billion. As a result, Sui dropped one position in the rankings to become the fourth-largest network by staked market cap at quarter’s end.

Active validators on Sui have remained relatively steady since launch, increasing slightly from 104 to 113. The Sui Foundation holds a significant portion of the total SUI supply on behalf of the Ecosystem allocation and helps distribute stakes equally among validators. As a result, Sui ended Q1 2025 with a Nakamoto coefficient of 18, which is above the median for a curated selection of Proof-of-Stake networks.

Upgrades

Sui frequently upgrades its protocol. It entered Q1 2025 on Sui Protocol Version 70 and concluded Q1 2025 on Version 78. Notable new features include:

- Consensus Garbage Collection: Introduced onchain garbage collection, improved block linearization, and smart commit logic, reducing consensus state size and validator hardware requirements.

- Zstandard Compression: Applied zstandard compression to consensus-layer gRPC traffic, reducing bandwidth usage and improving finality under load.

- AWS Nitro Enclave Attestation: Introduced a native Move function to verify Nitro Enclave reports, unlocking confidential computing use cases like secure bridges and offchain order books.

- Passkey and Multisig Support: Enabled native FIDO2 passkey integration, including within multisig accounts, for phishing-resistant, passwordless authentication in wallets and applications.

- Transaction Contexts and Sponsor Objects: Added protocol-level support for sponsored transactions, simplifying gasless UX patterns.

On Jan. 27, 2025, the Sui Wallet received an upgrade focused on usability and DeFi portfolio management. The update introduced an Earn tab, allowing users to track their DeFi positions, view APYs, and discover lending and vault opportunities directly within the wallet. The release also added Vaults for passive yield generation and revamped the Chrome extension with a unified interface and one-password access, aligning the UX across mobile and desktop.

On Feb. 3, 2025, Sui Bridge added support for wrapped Bitcoin (wBTC), enabling users to bridge wBTC from Ethereum to Sui. This expanded Bitcoin liquidity on the network and unlocked new BTCfi use cases, with protocols like Bluefin, NAVI, and Suilend supporting wBTC from launch.

On Feb. 14, 2025, Sui version 1.42 introduced the --verify-compatibility flag in the Sui CLI, enhancing the debugging process for smart contract upgrades. The flag provides detailed error context during local simulations, helping developers catch incompatibilities before publishing and supporting a range of upgrade policies.

On February 19, 2025, SP1 zkVM was integrated into the Sui ecosystem through a collaboration between Soundness Labs, Succinct Labs, and the Sui Foundation. This addition allows developers to build scalable, privacy-preserving zkApps on Sui using standard Rust code, without needing deep cryptographic expertise. The integration includes an open-sourced SP1 Groth16 SNARK verifier, making zero-knowledge proofs generated by SP1 fully compatible with Sui’s native zk infrastructure.

Ecosystem Overview

DeFi

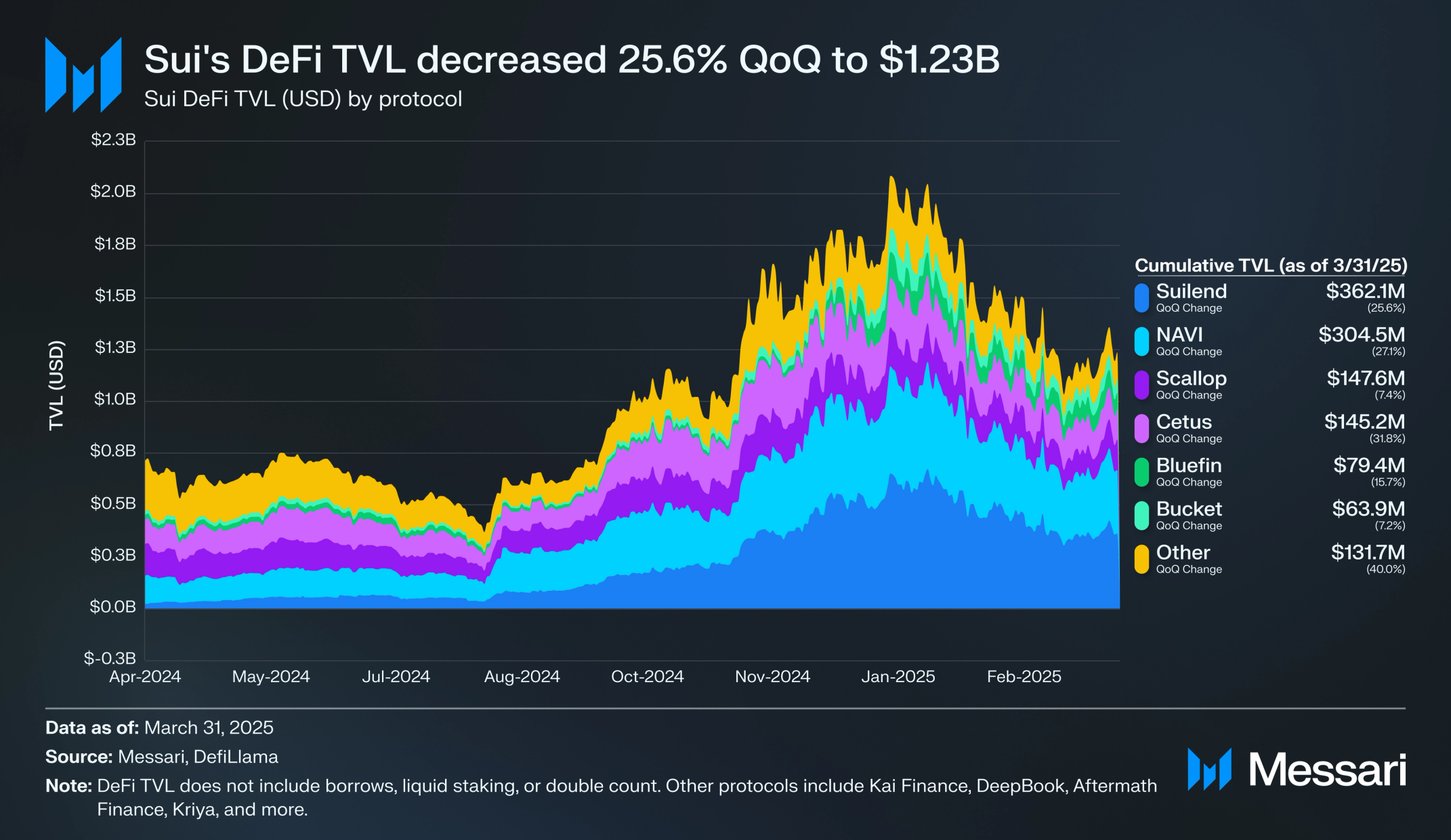

Lending protocol Suilend concluded Q1 2025 as Sui’s top protocol by TVL, with $362.1 million in TVL, a 25.6% QoQ decrease. Suilend captured a 29.3% market share despite launching just one year earlier in March 2024. During the quarter, Suilend announced support for additional swap functionality via integrations with Cetus Protocol and 7K Aggregator. It also launched STEAMM, a “superfluid” Automated Market Maker (AMM) that automatically deploys idle LP liquidity into Suilend, enabling users to earn both swap fees and lending yields. SpringSui, Suilend’s liquid staking protocol, reached $300.0 million in TVL, and its flagship liquid staking token (LST), sSUI, became the largest LST by circulating supply on Sui.

Lending protocol NAVI concluded Q1 with $304.5 million in TVL, a 24.7% market share. During the quarter, NAVI rebranded its ecosystem, renaming its aggregator NAVI.ag to Astros and updating the logos for both NAVI and Volo. NAVI also secured an OKX listing for its NAVX token. Astros launched cross-chain swaps using Mayan Finance’s MCTP, enabling near-instant native-to-native swaps across major blockchains.

Lending protocol Scallop concluded Q1 with $147.6 million in TVL, an 11.9% market share. During the quarter, Scallop surpassed $300.0 million in total swap volume, launched multicurrency support, and reached $200.0 million in combined supply and collateral deposits. Its native token, SCA, was also listed on BTSE, WEEX, CoinW, and Coinstore.

Sui’s average daily DEX volume hit another all-time high of $304.3 million in Q1, a 14.6% QoQ increase. Cetus and Bluefin led with $171.0 million and $68.5 million in average daily DEX volume, respectively. Other top DEXs by volume included Kriya ($25.0 million), DeepBook ($17.3 million), Turbos ($10.3 million), Haedal ($4.6 million), and METASTABLE ($4.1 million).

Cetus, the leading DEX on Sui, concluded Q1 with $145.2 million in TVL, an 11.8% market share. On March 31, 2025, Cetus surpassed $50.00 billion in total trading volume, representing 60.9% of all Sui DEX volume. In Q1 alone, Cetus processed $15.39 billion, 56.1% of the quarter’s total Sui DEX volume. During that same period, Cetus reached 10 million users and crossed over 100 million transactions. Product developments in Q1 included the launch of Cetus Terminal, a lightweight integration solution for liquidity aggregation and one-click swaps, along with CLMM-based flash loans, fast mode transactions via Shio, and a redesigned UI/UX.

Bluefin, the leading perps protocol on Sui, concluded Q1 with $80.9 million in TVL. In November 2024, the protocol launched Bluefin Spot, a Concentrated Liquidity Market Maker (CLMM), that attracted over $80 million in deposits and generated around $4.2 billion in trading volume from more than 160,000 users by the end of January 2025. During the quarter, Bluefin introduced an auto-rebalancer for Bluefin Spot, partnered with Printr and Arttoo, and surpassed $100 million in total protocol deposits. It also unveiled BluefinX, a product designed to connect the protocol with a permissionless network of execution agents through protocol-controlled auctions, aiming to reduce execution costs and improve reliability for actively traded pairs on Sui. Additionally, Bluefin acquired a strategic stake in Insidex, a DeFi data analysis platform, to further its goal of becoming the “most advanced onchain trading venue” and rebranded it to Nexa.

DeepBook, Sui's native liquidity layer, is integrated across multiple protocols, including Cetus, Kriya, FlowX, and Hop Aggregator. Its V2 was used by 740,000 wallets in 100 million transaction blocks. DeepBook V3 launched on Oct. 14, 2024. It introduced dynamic trading fees, improved gas efficiency, flash loans, shared liquidity across pools, and the DEEP token. By the end of Q1, DeepBook V3 had $21.9 million in TVL (a decrease of 35.9% QoQ) and $2.62 billion in cumulative volume (an increase of 141.9% QoQ). On Feb. 3, 2025, DeepBook V3 reached a daily trading volume all-time high of $54.6 million.

Kriya, a multi-product DeFi protocol on Sui offering an AMM, limit orders, strategy vaults, and leveraged perpetuals, reached $100 million TVL during Q1 but ended the quarter at $13.8 million. On Jan. 19, 2025, Kriya launched its native token, KDX, distributing 50% of the total supply via an airdrop. TVL peaked the day prior to the launch, indicating heightened user activity around the airdrop. KDX debuted at $0.150 with a circulating supply of 54.7 million (54.7% of total supply), but declined 66% to $0.051 by quarter’s end. Following the token launch, Kriya initiated its governance process by launching a DAO forum and passing its first proposal, KIP-1, which set withdrawal and performance fees to 0% across all strategy vaults.

Other notable DeFi protocols on Sui include Turbos, a hyper-efficient decentralized crypto marketplace; Haedal, a one-click liquid staking platform; METASTABLE, a stablecoin protocol; Aftermath Finance, a DEX aggregator, liquid staking, and yield farming protocol; and AlphaFi, a yield aggregator.

Native-to-native cross-chain swaps to Sui went live via Mayan Finance’s MCTP, powered by Wormhole, enabling seamless one-click swaps from Solana and EVM chains to any token on Sui. Lombard Protocol and Babylon Labs launched LBTC, the first institutional-grade liquid-staked Bitcoin, allowing users to stake native BTC and mint LBTC directly on Sui. Bucket Protocol launched its native token, BUT, and Haedal Protocol closed its seed round with backing from investors including Hashed, OKX Ventures, Animoca Brands, Cetus, Scallop, and the Sui Foundation. First Digital Labs' FDUSD stablecoin, which launched in late 2024, surpassed $100.0 million in TVL by February 2025. Two new protocols also launched in Q1: Magma Finance, a permissionless AMM DEX with concentrated liquidity and ve(3,3) tokenomics, and METASTABLE, a stablecoin platform enabling slippage-free swaps.

Consumer

In Q1 2025, Sui continued its expansion beyond DeFi with significant progress in consumer apps such as gaming, NFTs, and RWAs.

Gaming

The official design of Sui’s upcoming handheld gaming device, SuiPlay0X1, was released. Built to support both traditional and blockchain-native games, the SuiPlay0X1 will host titles such as Samurai Shodown R and Panzerdogs.

BIRDS is a Telegram-based mini-game designed to onboard mainstream users into Web3 through simple, gamified mechanics. Players hatch and evolve digital birds, engaging in cooperative gameplay, with all interactions executed onchain via Sui’s infrastructure. As of January 2025, BIRDS attracted over 9 million users and averaged 550,000 daily transactions, supported by deep integrations with Sui Wallet, Sui Kiosk, and object-based asset management.

Pebble City, a mobile Web3 social casino game, launched on Sui in February 2025. The game combines elements of traditional mobile gaming with blockchain-based features such as NFT membership, token rewards, and onchain asset interactions. Built using Sui’s infrastructure, including zkLogin and Sui Kiosk, Pebble City aims to provide a Web2-like user experience while incorporating blockchain functionality in a way that minimizes onboarding friction.

South Korean game studio Nimblebites announced Super-B, a multiplayer game set in a brick-world environment where players can fight, build, and socialize through customizable avatars. The game incorporates digital asset ownership and user-generated content using Sui’s infrastructure, including support for zkLogin, sponsored transactions, and onchain storage via Walrus.

Blockchain infrastructure provider Venly integrated its developer tools with Sui to simplify Web3 game development. The integration offers wallet solutions, NFT and token APIs, and fiat-enabled payments, reducing technical complexity for developers. These features enable faster, more accessible deployment of scalable gaming experiences on the Sui network.

Meta-X announced Dark Machine, a team-based mech shooter integrating Sui’s Dynamic NFTs to enable evolving, player-owned assets. Built on Unreal Engine 5 and launching on PC and SuiPlay0X1, the game features destructible environments, onchain item progression, and decentralized, user-hosted esports tournaments.

Parasol, a Mysten Labs subsidiary focused on blockchain gaming infrastructure, announced that CODE OF JOKER: EVOLUTIONS, a SEGA-licensed digital trading card game, will launch on Sui. The game brings the CODE OF JOKER franchise onchain for the first time. Set to release on iOS, Android, and web browsers in late summer 2025, this marks the first in a series of planned collaborations bringing classic gaming IP to the Sui ecosystem.

A list of significant game releases in 2025 can be found here.

NFTs

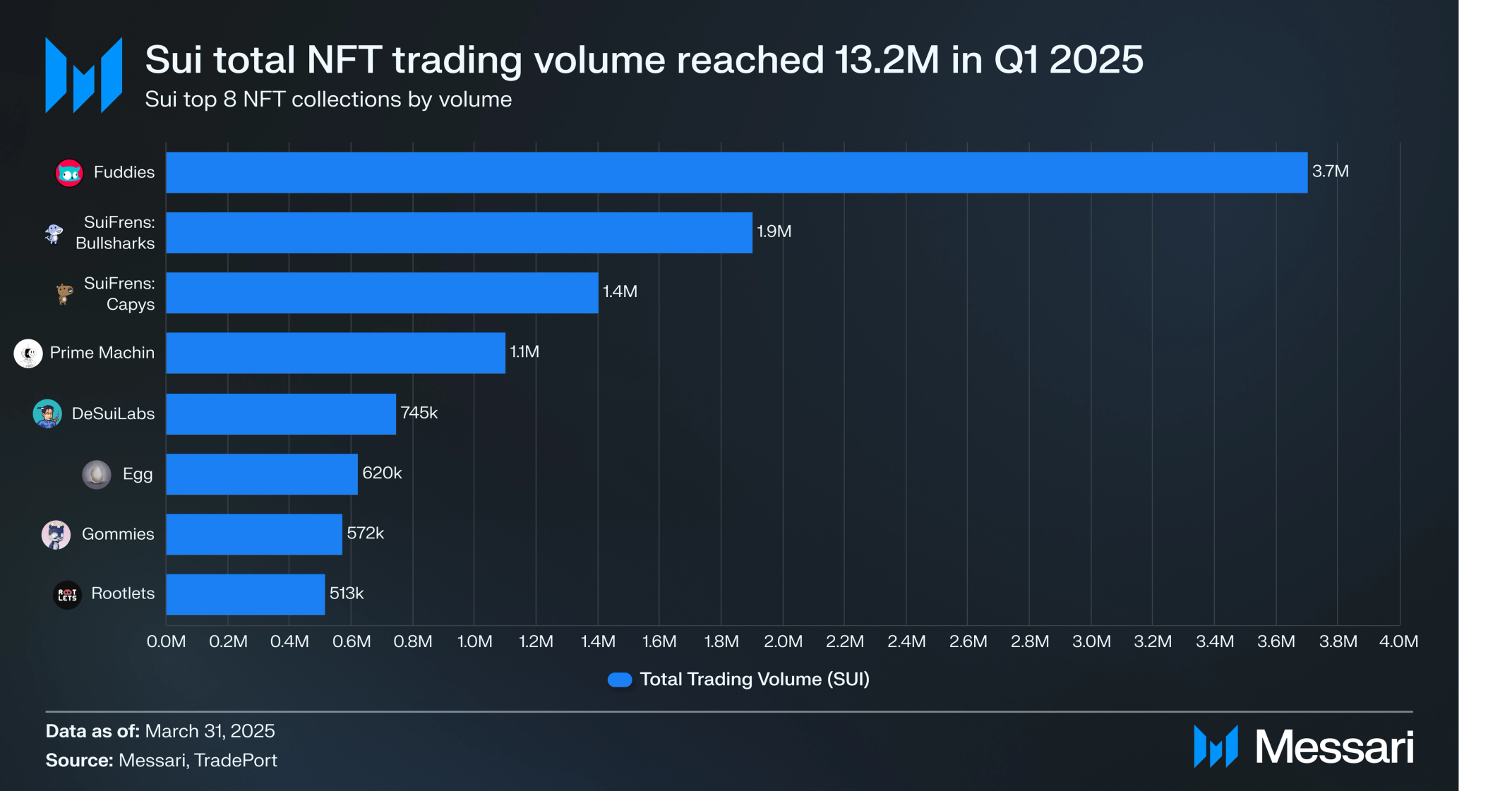

Since the launch of Sui mainnet to the end of Q1 2025, there has been 13.2 million SUI in total NFT trading volume. Leading marketplaces by volume include Clutchy (6.1 million SUI), TradePort (3.3 million SUI), and BlueMove (2.5 million SUI). Top NFT collections by volume include Fuddies (3.7 million SUI), SuiFrens: Bullsharks (1.9 million SUI), SuiFrens: Capys (1.4 million SUI), Prime Machin (1.1 million SUI), DeSuiLabs (745,000 SUI), Egg (620,000 SUI), Gommies (572,000 SUI), and Rootlets (513,000 SUI).

Artinals launched its open-source NFT protocol on Sui, enabling users to create and mint ART20 collections through a no-code dashboard while earning real-time rewards. The platform features Elementals, a Telegram-based create-to-earn game where players generate elements and earn incentives. Through daily rewards and a leaderboard system, Artinals focuses on accessible, interactive NFT participation.

Project J launched an official collaboration with Science Ninja Team Gatchaman, bringing the iconic Japanese anime franchise onchain for the first time. The Gatchaman NFTs, minted on Sui, were offered through a free mint campaign and will unlock perks in the upcoming Project J battle game, as well as potential eligibility for future token airdrops.

The Sui Foundation launched a pre-order campaign for the SuiPlay0X1, offering buyers a soulbound NFT as proof of purchase and access pass to exclusive ecosystem rewards. Available in two tiers, Mythic and Exalted, these non-transferable NFTs unlock benefits from Sui-based projects, including token airdrops, NFT giveaways, and in-game perks. Early rewards include Pebble City’s STBL airdrop, with additional planned campaigns from teams like Aftermath, Scallop, and LumiWave.

Other Use Cases

RECRD, a SocialFi platform focused on short-form video content, launched globally with full onchain integration on Sui. The platform enables creators to earn up to 100% of ad revenue, sell content directly, and engage fans through interactive video responses.

In May 2024, FanTV, a video-sharing platform, migrated from its previous blockchain to Sui. The platform rewards creators and users with tokens for their engagement, leveraging Sui’s object-based data structure. By February 2025, FanTV onboarded over 8 million wallets and processed over 29 million transactions, making it Sui's top video streaming platform. Also in Q1, FanTV launched AI agents for generating videos, music, visuals, and scripts, and raised $3.0 million in a strategic funding round from Mysten Labs, Cypher Capital, CoinSwitch Ventures, and Illuminati Capital.

Talus integrated Sui to power its AI agent platform, enabling real-time, onchain automation across DeFi, gaming, and social applications. The launch includes Nexus, Talus’s agentic framework, and IDOL.fun, an AI launchpad. Talus also selected Walrus, a decentralized storage protocol on Sui, to support onchain data needs such as AI model storage, historical data analysis, and dynamic dataset retrieval.

SongBits launched on Sui, offering a platform where fans can purchase tokenized shares of streaming revenue, called “bits,” from their favorite songs. Using Sui technologies such as Sui Kiosk, Enoki, and zkLogin, SongBits enables musicians to monetize their work directly while allowing fans to engage more deeply through ownership and rewards. The platform aims to rebalance the artist-fan relationship by introducing a new model for music rights distribution and participation.

Institutional Interest

Institutional interest in Sui continued to grow throughout Q1 2025, marked by new investment products, custody integrations, and strategic partnerships that expanded access to Sui-based assets and infrastructure.

On Jan. 8, 2025, Grayscale Investments added SUI to its Smart Contract Platform Ex-Ethereum Fund (GSCPxE) as part of its Q4 2024 portfolio rebalancing. SUI comprised 7.93% of the fund, joining other assets such as Solana, Cardano, and Avalanche.

On Feb. 6, 2025, Libre Capital launched the Libre Gateway on Sui, enabling institutional and accredited investors to access tokenized investment funds directly onchain. Offerings include the Laser Carry Fund (LCF), a market-neutral strategy developed by Laser Digital, as well as tokenized funds from asset managers such as BlackRock, Brevan Howard, and Hamilton Lane.

On Feb. 28, 2025, Anchorage Digital expanded its support for the Sui ecosystem by adding custody services for Sui tokens such as DeepBook (DEEP) and SuiNS (NS). This addition broadens institutional access to Sui-based assets, as Anchorage Digital Bank, Anchorage Digital Singapore, and self-custody via Porto already offer custody solutions for Sui tokens.

On March 6, 2025, World Liberty Financial (WLFI), a DeFi protocol inspired by U.S. President Donald Trump, announced a strategic collaboration with Sui to explore the joint development of next-generation blockchain applications. As part of the partnership, WLFI added SUI to its “Macro Strategy” token reserve and named Sui its preferred blockchain for future initiatives.

On March 17, 2025, Canary Capital filed with the SEC to register the first-ever U.S.-based SUI Exchange Traded Fund (ETF), marking a significant step toward broader institutional access to the Sui network. If approved, the ETF would offer a regulated vehicle for both institutional and retail investors to gain exposure to SUI.

Infrastructure

Mysten Labs announced the release of Walrus in June 2024, a decentralized blob storage network powered by Sui for blockchain apps and autonomous agents. Walrus aims to provide cost-effective and high-resilience data storage. On March 27, 2025, Walrus mainnet was launched, bringing fully decentralized, programmable blob storage to production on Sui. To support its growth, the Walrus Foundation announced a $140 million private token sale led by Standard Crypto, with participation from a16z crypto, Electric Capital, Franklin Templeton Digital Assets, and others. The funding will be used to expand protocol infrastructure, support ecosystem development, and advance use cases for onchain data storage.

Alongside the mainnet launch, the Walrus Foundation introduced a Request for Proposals (RFP) program to fund projects in areas such as developer tooling, integrations, and storage-based applications. Throughout Q1 2025, several projects integrated Walrus, including 3DOS, Linera, Itheum, Plume, Chainbase, and TradePort. These integrations span applications from decentralized 3D printing and AI data economies to NFT metadata storage and real-world asset verification, highlighting Walrus’s growing role as foundational infrastructure for data-rich Web3 platforms.

In January 2025, the Sui Foundation partnered with Chainalysis to enhance onchain compliance and security monitoring across the Sui network. Leveraging data from the Sui Guardian program, Chainalysis now provides deeper insights into illicit activity, supporting risk assessments for major exchanges and compliance platforms.

Phantom officially integrated support for SUI on Jan. 29, 2025, making Sui the first Move-based blockchain and third Layer-1 supported by the wallet. With over 15 million monthly active users, Phantom now offers its user base the ability to manage SUI, swap tokens, and access Sui-based applications within a familiar multichain interface.

In February 2025, RedStone integrated its cross-chain oracle infrastructure with Sui, providing real-time, onchain price feeds for Bitcoin and other assets. The integration supports the growth of Sui’s BTCfi ecosystem by enabling accurate pricing for DeFi applications such as lending, borrowing, and liquidations. RedStone’s deployment enhances collateral efficiency and market reliability, building on Sui’s recent Bitcoin staking initiatives and expanding utility for Bitcoin within the network.

Also in February, Binance completed its integration of native USDC on Sui, enabling direct deposits and withdrawals without requiring third-party bridges. This integration streamlines access to USDC on Sui, offering users faster and more efficient transfers through the world’s largest exchange by trading volume.

In March 2025, Wallet in Telegram enabled support for SUI, allowing its more than 100 million registered users to buy, sell, and hold SUI directly within Telegram.

Development and Growth

In Q1 2025, four projects building on Sui announced funding rounds totaling $5.5 million, a 45% decrease from Q4 2024’s $10 million. The four projects that raised money in Q1 include Haedal Protocol, SEED Combinator, Printr, and M10, with the Sui Foundation participating in all rounds and leading two.

Mysten Labs acquired Parasol: On March 7, 2025, Mysten Labs acquired Parasol, a Web3 gaming infrastructure startup focused on enabling seamless blockchain integration for game developers. Parasol offers developer-friendly REST APIs for features like in-game item tokenization, marketplaces, and onchain gameplay, now exclusively supported on Sui. The acquisition brings Parasol’s network of gaming partners into the Sui ecosystem and strengthens Mysten Labs’ ongoing commitment to Web3 gaming.

Gas Futures Request for Proposals (RFP) Program: The Sui Foundation launched an RFP Program focused on developing gas futures functionality to help mitigate volatility in transaction costs on the Sui network. The RFP invites builders to design decentralized, risk-managed gas futures solutions that allow users and businesses to lock in predictable pricing.

SuiNS RFP Grant Program: The Sui Foundation launched an RFP program for SuiNS, Sui’s decentralized naming service. The program invites developers to submit proposals aimed at improving SuiNS functionality and aligning development with community-driven priorities, as approved by the SuiNS DAO.

Sui Hydropower Fellowship: In January 2025, the Sui Foundation concluded the first cohort of the Sui Hydropower Fellowship, supporting 12 early-stage teams over an eight-week program focused on product development, technical mentorship, and fundraising. The second Hydropower cohort launched in March, welcoming another 12 teams for a 12-week program.

Sui AI Agent Typhoon Hackathon: From Jan. 31, 2025, to Feb. 10, 2025, the Sui Foundation hosted its first AI Agent Hackathon in collaboration with Atoma Network and elizaOS, featuring a $100,000 prize pool. Builders competed across multiple tracks, including DeFi automation, gaming, and developer tooling, with a focus on using Atoma’s decentralized AI infrastructure and the Eliza agent framework. Winning teams received cash prizes and interviews for the Sui Hydropower Accelerator.

Events

In Q1 2025, the Sui Foundation hosted and supported a global slate of community and developer-focused events to grow ecosystem engagement. Key highlights included Sui Connect meetups in Hong Kong, Dubai, and London; the Sui Gaming Summit in San Francisco during the Game Developers Conference; and Sui Presents Walrus in Denver during ETHDenver. These events featured networking, product showcases, and ecosystem updates.

Across Asia, the Sui community was highly active with regular gatherings at SuiHub Vietnam, meetups across Indonesia and Turkey, and university events such as Sui On Campus in Yogyakarta and Surabaya. The Foundation also supported localized initiatives, including game development sessions, DeFi discussions, and the first Walrus Vietnam Meetup, further deepening grassroots adoption and developer participation.

Closing Summary

In Q1 2025, Sui continued expanding across DeFi, gaming, and infrastructure despite a broader market downturn. Average daily DEX volume reached a new high of $304.3 million, led by Cetus and Suilend, while activity across lending, stablecoins, and cross-chain swaps reinforced overall network usage. In consumer and gaming, new titles, the release of the SuiPlay0X1 design, and broader integration of Sui infrastructure signaled growing adoption beyond financial applications.

Walrus launched on mainnet with $140 million in funding, bringing decentralized storage to production and driving a wave of new integrations. Institutional interest accelerated with Grayscale’s addition of SUI, Libre’s tokenized fund access, and Canary Capital’s U.S. ETF filing. Core infrastructure expanded with support from Phantom, Binance, RedStone, and Wallet in Telegram, while new RFPs, accelerator cohorts, and hackathons strengthened developer engagement. In the near future, Sui plans to expand its partnerships and technical integrations in the U.S., enhance its focus on BTCfi to bring programmability to Bitcoin, invest in developer training and SuiHubs to foster ecosystem growth, and continuously upgrade its network.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by the Sui Foundation. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Jake is a Research Analyst on the Protocol Research team. He previously worked as an Investment Analyst at an AI-driven crypto research platform and as a Venture Analyst at a digital assets venture fund. He advised multiple RWA tokenization projects on tokenomics. Jake graduated from the University of Southern California, where he studied Philosophy and Finance.