Canada | News

-

Defense News - 10:58 Feb 05, 2026

The statement is the latest effort by Saab in sweetening the pot for Canada to give the Swedish company a slice of its fighter jet business. -

Cointelegraph.com - 12:01 Feb 04, 2026

The Canadian self-regulatory organization outlined custody limits, capital thresholds and reporting rules while long-term regulation remains in progress. The Canadian Investment Regulatory Organization (CIRO) has formalized its interim framework governing the custody of crypto and tokenized assets. The move outlined how dealer members are expected to safeguard client holdings while permanent crypto-specific rules remain under development. In a Tuesday notice, CIRO said the framework sets out its supervisory expectations for investment dealers operating crypto trading platforms, including custody limits, segregation standards, reporting obligations and tiered requirements for third-party crypto custodians. Read more

The Canadian self-regulatory organization outlined custody limits, capital thresholds and reporting rules while long-term regulation remains in progress. The Canadian Investment Regulatory Organization (CIRO) has formalized its interim framework governing the custody of crypto and tokenized assets. The move outlined how dealer members are expected to safeguard client holdings while permanent crypto-specific rules remain under development. In a Tuesday notice, CIRO said the framework sets out its supervisory expectations for investment dealers operating crypto trading platforms, including custody limits, segregation standards, reporting obligations and tiered requirements for third-party crypto custodians. Read more -

ukrinform.net - 17:07 Jan 28, 2026

Canada would not change its pro-Ukrainian position even if pressure were exerted by the current U.S. administration. -

Adevarul Romania - 16:48 Jan 24, 2026

Președintele SUA, Donald Trump, a amenințat sâmbătă Canada cu impunerea unor taxe vamale de 100% asupra exporturilor către Statele Unite. -

Dawn - 14:59 Jan 24, 2026

US President Donald Trump on Saturday said he would impose a 100 per cent tariff on Canada if it makes a trade deal with China and warned Canadian Prime Minister Mark Carney that a deal would endanger his country. “China will eat Canada alive, completely devour it, including the destruction of their businesses, social fabric, and general way of life,” Trump wrote on Truth Social. “If Canada makes a deal with China, it will immediately be hit with a 100pc Tariff against all Canadian goods and products coming into the USA.” Carney during a recent visit to China called the Asian superpower a “reliable and predictable partner” and in Davos encouraged European leaders to seek investment from the world’s second-largest economy. Trump suggested that China would try to use Canada to evade US tariffs. “If Governor Carney thinks he is going to make Canada a ‘Drop Off Port’ for China to send goods and products into the United States, he is sorely mistaken.” Tensions between the U.S. and its northern neighbour have grown... -

Dawn - 06:18 Jan 23, 2026

United States President Donald Trump withdrew on Thursday an invitation for Canada to join his Board of Peace initiative aimed at resolving global conflicts. Trump’s about-face follows Canadian Prime Minister Mark Carney’s speech at the World Economic Forum in Davos, where he openly decried powerful nations using economic integration as weapons and tariffs as leverage. “Please let this Letter serve to represent that the Board of Peace is withdrawing its invitation to you regarding Canada’s joining, what will be, the most prestigious Board of Leaders ever assembled, at any time,” Trump wrote in a Truth Social post directed at Carney. Neither Carney’s office nor the White House immediately responded to Reuters’ requests for comment on Thursday evening. Last week, Carney’s office said he had been invited to serve on the board and planned to accept. Carney received a rare standing ovation in Davos after the speech, in which he urged nations to accept the end of a rules-based global order. Canada, which recently s... -

CryptoSlate - 17:05 Jan 21, 2026

Canada's Prime Minister, Mark Carney, walked onto the World Economic Forum's Davos stage yesterday and said the quiet part out loud. The rules-based order, the thing leaders love to invoke when they want the world to behave, is fading. Carney called it a “pleasant fiction.” He said we are living through a “rupture.” He said […] The post Bitcoin is now your only lifeboat as Canada says the current world order is merely a “pleasant fiction” appeared first on CryptoSlate. -

NRC.nl Economie - 14:18 Jan 18, 2026

Dat de heffingenpolitiek van de Amerikaanse president Trump de economische verhoudingen in de wereld doet verschuiven, toont een handelsakkoord dat Canada heeft gesloten met China. Een jaar geleden zag de Canadese premier Carney China nog als de grootste bedreiging voor de veiligheid van het land. -

Dawn - 02:52 Jan 17, 2026

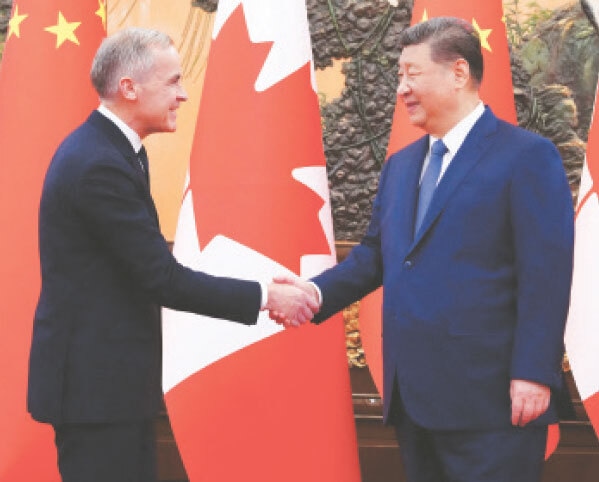

Canadian PM Mark Carney shakes hands with Chinese President Xi Jinping at the People’s Great Hall in Beijing.—Reuters BEIJING: Canada’s Prime Minister Mark Carney and Chinese President Xi Jinping agreed on a raft of measures from trade to tourism on Friday at the first meeting between the countries’ leaders in Beijing in eight years. The Canadian premier hailed a “landmark deal” under a “new strategic partnership” with China, turning the page on years of diplomatic spats, retaliatory arrests of each other’s citizens and tariff disputes. Carney has sought to reduce his country’s reliance on the United States, its key economic partner and traditional ally, as President Donald Trump has aggressively raised tariffs on Canadian products. “Canada and China have reached a preliminary but landmark trade agreement to remove trade barriers and reduce tariffs,” Carney told a news conference after meeting with Xi. Under the deal, China — which used to be Canada’s largest market for canola seed — is expected to reduce tar...

Canadian PM Mark Carney shakes hands with Chinese President Xi Jinping at the People’s Great Hall in Beijing.—Reuters BEIJING: Canada’s Prime Minister Mark Carney and Chinese President Xi Jinping agreed on a raft of measures from trade to tourism on Friday at the first meeting between the countries’ leaders in Beijing in eight years. The Canadian premier hailed a “landmark deal” under a “new strategic partnership” with China, turning the page on years of diplomatic spats, retaliatory arrests of each other’s citizens and tariff disputes. Carney has sought to reduce his country’s reliance on the United States, its key economic partner and traditional ally, as President Donald Trump has aggressively raised tariffs on Canadian products. “Canada and China have reached a preliminary but landmark trade agreement to remove trade barriers and reduce tariffs,” Carney told a news conference after meeting with Xi. Under the deal, China — which used to be Canada’s largest market for canola seed — is expected to reduce tar... -

Dawn - 12:32 Jan 13, 2026

Pakistan International Airlines (PIA) announced on Tuesday that it had partnered with rail companies in Canada and the United Kingdom (UK) in a bid to facilitate its passengers. In a press release, the national flag carrier’s spokesperson said that for the convenience of its passengers travelling to Toronto and destinations in the UK, special arrangements had been made to provide access to rail facilities. “PIA has launched an ‘air-to-rail’ partnership with renowned rail services in Canada and the UK, providing passengers with extensive travel facilities,” he said. Under the agreement, PIA passengers can now, after their air travel, reach their final destination by train on a single ticket without the hassle of booking separately, he said. “PIA passengers will now be able to book their rail tickets along with air tickets to reach their final destination via rail, saving time and effort in booking trains separately,” he added. “Passengers arriving in Toronto on PIA can connect to eight major cities in Canada t... -

JPost.com - Antisemitism - 20:26 Jan 12, 2026

The petition is based on the Crimes Against Humanity and War Crimes Act (CAHWCA), which allows the prosecution of crimes listed in the act, regardless of where they were committed.

-

ukrinform.net - 22:35 Jan 04, 2026

Canada welcomes the opportunity to help create conditions for freedom, democracy, peace, and prosperity in Venezuela and supports the right of its people to build their future. -

Dawn - 06:27 Jan 02, 2026

Canada’s transport regulator has asked Air India to investigate an incident of a pilot reporting for duty under the influence of alcohol and failing two breathalyser tests, a person familiar with the matter said. The tests were conducted by Canadian police at Vancouver International Airport, after the pilot was asked to leave the aircraft, the person said. The incident was labelled as a “serious matter” by Transport Canada in a letter to Air India, and authorities are likely to pursue enforcement action, the person added. The person requested anonymity as he was not authorised to speak to the media. Transport Canada did not respond to an emailed request for comment outside regular working hours. In a statement, Air India confirmed the flight from Vancouver to Delhi on December 23 experienced a last-minute delay due to the incident, adding that an alternate pilot was brought in to operate the flight. “The pilot has been taken off flying duties during the process of enquiry. Air India maintains a zero-tolerance... -

ukrinform.net - 21:50 Dec 27, 2025

Canada, along with its partners, is striving to achieve a fair peace that will ensure the prosperity of the Ukrainian people and deter Russia from further threats. -

Dawn - 08:48 Dec 25, 2025

Fourteen countries including Britain, Canada, France and others have condemned the Israeli security cabinet’s approval of 19 new settlements in the occupied West Bank, prompting strong criticism from Tel Aviv. On Sunday, Israel’s far-right Finance Minister Bezalel Smotrich announced that authorities had greenlit the settlements, saying the move was aimed at preventing the establishment of a Palestinian state. “On the ground, we are blocking the establishment of a Palestinian terror state,” said Smotrich, a vocal proponent of settlement expansion and a settler himself. Subsequently, fourteen countries, including Britain, France, Germany, Spain and Canada, issued a statement late on Wednesday urging Israel to reverse its decision. “We call on Israel to reverse this decision, as well as the expansion of settlements,” said a joint statement released by Britain, Belgium, Canada, Germany, Denmark, France, Italy, Iceland, Ireland, Japan, Malta, the Netherlands, Norway and Spain. Such unilateral actions, they said, “... -

Cointelegraph.com - 00:03 Dec 17, 2025

Canada’s central bank will approve only fiat-backed, high-quality stablecoins to ensure they are “good money” as part of the country’s plan to modernize its financial system. The Bank of Canada has signaled it will only approve high-quality stablecoins tied to central bank currencies to ensure stablecoins serve as “good money” under the country’s upcoming stablecoin regulations, expected in 2026. “We want stablecoins to be good money, like bank notes or money on deposit at banks,” Governor Tiff Macklem told the Montreal Chamber of Commerce on Tuesday. Macklem wants the stablecoins to be pegged at a one-to-one ratio to a central bank currency and backed by “high-quality liquid assets” that can be easily converted into cash. Such assets typically include Treasury bills and government bonds. Read more

Canada’s central bank will approve only fiat-backed, high-quality stablecoins to ensure they are “good money” as part of the country’s plan to modernize its financial system. The Bank of Canada has signaled it will only approve high-quality stablecoins tied to central bank currencies to ensure stablecoins serve as “good money” under the country’s upcoming stablecoin regulations, expected in 2026. “We want stablecoins to be good money, like bank notes or money on deposit at banks,” Governor Tiff Macklem told the Montreal Chamber of Commerce on Tuesday. Macklem wants the stablecoins to be pegged at a one-to-one ratio to a central bank currency and backed by “high-quality liquid assets” that can be easily converted into cash. Such assets typically include Treasury bills and government bonds. Read more -

AD.nl - 01:19 Dec 10, 2025

Het Vaticaan heeft een zestigtal objecten van Canadese inheemse gemeenschappen na bijna een eeuw teruggeven aan Canada. De spullen werden dinsdag tentoongesteld in een Canadees museum. -

ukrinform.net - 00:25 Dec 03, 2025

Canada has completed negotiations on its participation in the Security Action for Europe (SAFE) program and will become the first non-European country to take part in this defense initiative. -

Dawn - 07:17 Nov 24, 2025

Canada and India have agreed to restart stalled talks for a new trade deal, the Indian government said on Sunday, after discussions between the two countries paused following a diplomatic spat two years ago. Prime Minister Mark Carney met with India’s Prime Minister Narendra Modi for a bilateral discussion on the sidelines of the G20 summit in Johannesburg, South Africa. “The leaders agreed to begin negotiations on a high-ambition Comprehensive Economic Partnership Agreement (CEPA), aimed at doubling bilateral trade to USD 50 billion by 2030,” the statement from India’s Prime Minister’s Office said. “PM Modi and I met at the G20 summit today, and launched negotiations for a trade deal that could more than double our trade to more than C$70 billion,” Carney said in a post on social media platform X. “India is the world’s fifth largest economy, and that means big new opportunities for Canadian workers and businesses.” Both sides reaffirmed their longstanding civil nuclear cooperation and noted the ongoing discu... -

Dawn - 15:17 Nov 21, 2025

A Pakistan International Airlines flight attendant has reportedly gone missing in Canada, prompting the airline to launch an inquiry into his disappearance. According to PIA spokesperson Abdullah Hafeez Khan, the attendant did not report for flight PK-798 from Toronto to Lahore. “When contacted, he cited ill health as an excuse,” the spokesperson said, adding that the matter is being investigated. “In case of illegal disappearance, departmental action will be initiated against the flight attendant,” Khan said. Missing PIA crew members, particularly in Canada, have been reported in the past, too. Last year in October, a cabin crew member was reportedly gone missing while on duty. The missing crew member, based in Islamabad, had disappeared during a layover in Toronto. Similarly, a 47-year-old PIA steward was reportedly gone missing in Canada in March 2024. In February 2024, another member of the airline’s cabin crew was reported missing while on duty. The member had arrived in Toronto on PIA flight PK-782 fro...