News

-

ukrinform.net - 12:53 Sep 15, 2025

President Volodymyr Zelensky has awarded state honors to the best tank soldiers. -

JPost.com - Banking & Finance - 12:50 Sep 15, 2025

Managing a financial process as significant as a mortgage highlights the need for a professional mortgage bank

-

JPost.com - Business & Innovation - 12:50 Sep 15, 2025

Managing a financial process as significant as a mortgage highlights the need for a professional mortgage bank

-

Focus.ua - 12:50 Sep 15, 2025

В Российской Федерации установили на беспилотный летательный аппарат БМ-39 новую антенну. Кроме того, дрон оснащен несколькими контактными детонаторами. -

Focus.ua - 12:46 Sep 15, 2025

Харьков впервые за долгое время прожил неделю без обстрелов. Несмотря на это городские власти отмечают, что опасность сохраняется, ведь война продолжается и угроза авиационных и ракетных атак никуда не исчезла. -

Cointelegraph.com - 12:44 Sep 15, 2025

Crypto ETPs recovered last week, recording $3.3 billion in inflows and lifting the overall assets under management to $239 billion. Crypto investment products reversed their recent outflow trends last week, with Bitcoin, Ether and Solana exchange-traded products (ETPs) recording significant inflows. Global crypto ETPs saw $3.3 billion in inflows last week, lifting overall assets under management (AUM) to $239 million, near the record high in August. Last month, crypto ETPs saw an all-time high AUM of $244 billion. The inflows came as underlying assets showed modest gains over the week. Bitcoin (BTC), which traded at $111,900 on Sept. 8, rose 3.3% to $115,600 on Friday. Ether (ETH) went from $4,300 to $4,500 last week, a 4.6% gain in five days. Read more

Crypto ETPs recovered last week, recording $3.3 billion in inflows and lifting the overall assets under management to $239 billion. Crypto investment products reversed their recent outflow trends last week, with Bitcoin, Ether and Solana exchange-traded products (ETPs) recording significant inflows. Global crypto ETPs saw $3.3 billion in inflows last week, lifting overall assets under management (AUM) to $239 million, near the record high in August. Last month, crypto ETPs saw an all-time high AUM of $244 billion. The inflows came as underlying assets showed modest gains over the week. Bitcoin (BTC), which traded at $111,900 on Sept. 8, rose 3.3% to $115,600 on Friday. Ether (ETH) went from $4,300 to $4,500 last week, a 4.6% gain in five days. Read more -

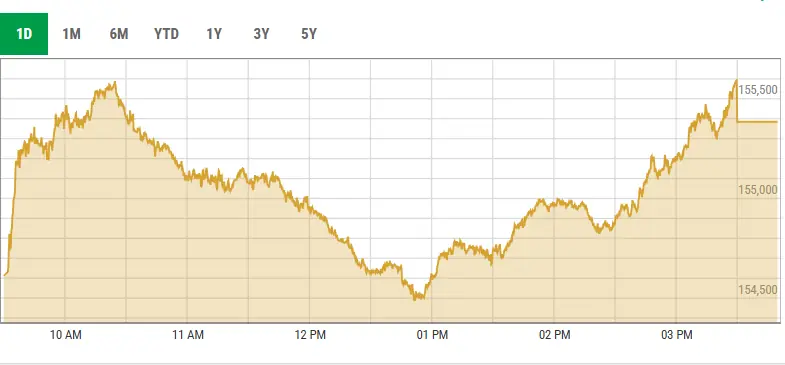

Dawn - 12:43 Sep 15, 2025

The State Bank of Pakistan (SBP) maintained its policy rate steady at 11 per cent on Monday for a third straight meeting as policymakers weighed inflation risks from flood-hit crops against a fragile economic recovery. After slashing the interest rate by 1,000 basis points (bps) from 22pc since June 2024 in seven intervals, the central bank has maintained it at 11pc since May. However, the business community had expressed disappointment over the decision. “The Monetary Policy Committee (MPC) decided to keep the policy rate unchanged at 11 per cent in its meeting today,” an SBP statement said. The MPC noted that inflation remained “relatively moderate in both July and August, whereas core inflation continued to decline at a slower pace”. “Economic activity — as captured by high-frequency economic indicators, including large-scale manufacturing (LSM) — gained further momentum. However, the near-term macroeconomic outlook has deteriorated slightly in the wake of the ongoing floods,” the committee noted. It cauti...

The State Bank of Pakistan (SBP) maintained its policy rate steady at 11 per cent on Monday for a third straight meeting as policymakers weighed inflation risks from flood-hit crops against a fragile economic recovery. After slashing the interest rate by 1,000 basis points (bps) from 22pc since June 2024 in seven intervals, the central bank has maintained it at 11pc since May. However, the business community had expressed disappointment over the decision. “The Monetary Policy Committee (MPC) decided to keep the policy rate unchanged at 11 per cent in its meeting today,” an SBP statement said. The MPC noted that inflation remained “relatively moderate in both July and August, whereas core inflation continued to decline at a slower pace”. “Economic activity — as captured by high-frequency economic indicators, including large-scale manufacturing (LSM) — gained further momentum. However, the near-term macroeconomic outlook has deteriorated slightly in the wake of the ongoing floods,” the committee noted. It cauti... -

ukrinform.net - 12:41 Sep 15, 2025

In Kramatorsk, Donetsk region, the number of wounded after the Russian night attack has risen to 11 people. -

CoinDesk - 12:38 Sep 15, 2025

The news could explain the weakness in bitcoin, which declined more than 1.5% over the past two hours to the current $114,900. -

Haaretz - 12:36 Sep 15, 2025

In response to legal challenges to the cabinet's decision to dismiss Attorney General Gali Baharav-Miara, the cabinet has agreed to follow the decision of the advisory committee headed by retired Justice Asher Grunis on the condition that the committee meets despite a vacancy on the panel and issues its opinion within two weeks -

Focus.ua - 12:34 Sep 15, 2025

Маленький, редкий и пугливый, белобрюхий панголин, которого часто сравнивают с сосновой шишкой, обладает одним из самых больших наборов хромосом среди всех млекопитающих на Земле. В общей сложности в его геноме 114 хромосом. -

Focus.ua - 12:30 Sep 15, 2025

Белорусский оппозиционер, политзаключенный и бывший кандидат в президенты Николай Статкевич, который был освобожден 11 сентября в числе других 52 человек, отказался покидать Беларусь и снова оказался в колонии. -

Cointelegraph.com - 12:30 Sep 15, 2025

France’s securities regulator is considering attempting to ban European license “passporting” over concerns related to MiCA regulation enforcement gaps in other EU countries. France warned it may try to block cryptocurrency companies operating locally under licenses obtained in other European countries, raising enforcement gap concerns regarding the European Union’s crypto regulatory framework. France’s securities regulator, the Autorité des Marchés Financiers (AMF), told Reuters Monday that it is concerned about potential regulatory enforcement gaps related to Europe’s Markets in Crypto-Assets Regulation (MiCA), the world’s first comprehensive crypto regulatory framework. Concerned that some crypto companies may seek licenses in more lenient EU jurisdictions, the AMF is considering a ban on operating in France under MiCA licenses obtained in other member states. Read more

France’s securities regulator is considering attempting to ban European license “passporting” over concerns related to MiCA regulation enforcement gaps in other EU countries. France warned it may try to block cryptocurrency companies operating locally under licenses obtained in other European countries, raising enforcement gap concerns regarding the European Union’s crypto regulatory framework. France’s securities regulator, the Autorité des Marchés Financiers (AMF), told Reuters Monday that it is concerned about potential regulatory enforcement gaps related to Europe’s Markets in Crypto-Assets Regulation (MiCA), the world’s first comprehensive crypto regulatory framework. Concerned that some crypto companies may seek licenses in more lenient EU jurisdictions, the AMF is considering a ban on operating in France under MiCA licenses obtained in other member states. Read more -

Haaretz - 12:21 Sep 15, 2025

The nudity ban at Damascus University's Faculty of Fine Arts has ignited a fierce debate over artistic freedom in post-Assad Syria, reviving old questions about nudity and its place in Islamic art -

Focus.ua - 12:20 Sep 15, 2025

Украинский певец Валерий Харчишин рассказал о своей личной жизни и прокомментировал слухи о романе с журналисткой Яниной Соколовой. Фронтмен группы "Друга Ріка" лаконично отметил, что накануне получил от нее сообщение. -

Focus.ua - 12:19 Sep 15, 2025

Оккупанты пытаются спрятаться от FPV-дронов ВСУ причудливыми методами из-за того, что тепловизионных плащей не хватает на всех. В частности россияне идут на штурм в раскрытых палатках или прыгают в черные пакеты, когда к ним приближается украинский беспилотник. -

CoinDesk - 12:19 Sep 15, 2025

The reorganization was pinned on Qubic, which has acquired over half of Monero's mining power last month and uses XMR rewards to buy and burn its own token. -

Focus.ua - 12:17 Sep 15, 2025

Во время военных учений "Запад-2025" Вооруженные силы Российской Федерации показали свои возможности для наземных ударов "Искандеров" по Европе и для охоты на атомные субмарины в Арктике. Для удара по субмарине комплексно работали Ту-95 и вертолеты. -

Focus.ua - 12:16 Sep 15, 2025

Компания Zendure, известная своими решениями для хранения энергии, представила концепт грузового электровелосипеда с гигантской батареей и возможностью зарядки от солнца. Заявленный запас хода в экономном режиме достигает 400 километров. -

Decrypt - 12:15 Sep 15, 2025

New creators poured into Pump.fun over the weekend, generating millions of dollars in fees and driving the PUMP token price up.