News

-

FD - 14:00 Aug 13, 2025

Critici noemen de inzet van de Nationale Garde een ‘autoritaire zet’, waarmee de Amerikaanse president zijn macht wil consolideren. -

FD - 14:00 Aug 13, 2025

Eigenaar TA Associates wil het softwarebedrijf volgend jaar voor ongeveer €4 mrd verkopen. Hoe realistisch is dat? -

Focus.ua - 13:57 Aug 13, 2025

Более 150 обысков одновременно проходят по всей Украине. Правоохранители перекрывают каналы незаконного выезда мужчин призывного возраста через "Шлях" и поддельные медицинские документы. -

CryptoPotato - 13:57 Aug 13, 2025

Ethereum continues its impressive rally, pushing closer to its all-time high. After breaking through the crucial $4.5K level, the market shows strong potential for a move toward the $4.8K threshold, fueled by technical and on-chain factors. Technical Analysis By Shayan The Daily Chart ETH has entered a powerful impulsive rally, signaling robust demand and renewed […] -

FD - 13:56 Aug 13, 2025

NOK is met afstand de grootste private aanbieder van obesitaschirurgie. Met de Belgische private-equityfirma Vendis aan boord hoopt de onderneming ook verder te groeien met obesitasmedicatie. -

FD - 13:54 Aug 13, 2025

De Britse frontvrouw van The Wall Street Journal voert met steun van mediamagnaat Rupert Murdoch een stevige reorganisatie door bij de Amerikaanse zakenkrant. -

The Express Tribune - 13:53 Aug 13, 2025

The festivities concluded with a magnificent fireworks display, adding a spectacular touch to the celebrations -

The Nation - National - 13:53 Aug 13, 2025

With just a day left until August 14, preparations for Pakistan’s Independence Day are in full swing, filling cities, towns, and villages with patriotic fervor. -

Focus.ua - 13:51 Aug 13, 2025

Приближается 28-я годовщина смерти принцессы Дианы, а ее сыновья Уильям и Гарри остаются отчужденными, но продолжают чтить свою мать публичной и благотворительной деятельностью. -

JPost.com - Antisemitism - 13:49 Aug 13, 2025

The previous July 10, 2024, attack saw vandals set fire to the synagogue's electrical box

-

Cointelegraph.com - 13:49 Aug 13, 2025

Altcoin season may finally upon us — but it’s not the altseason you remember. Wall Street money and infinite memecoins have changed the game. Theres probably nothing more reliable in crypto than traders yelling ALTSEASON IS HERE every time Bitcoin stumbles against altcoins. Heck, theyve been saying it religiously since mid-2024, and theyre starting to do it again now after Bitcoin dominance fell under 60% over the weekend, its lowest level since February. Except this time, they may be onto something; ETH is within sight of new all-time highs, and other altcoins are looking ready to pounce. Read more

Altcoin season may finally upon us — but it’s not the altseason you remember. Wall Street money and infinite memecoins have changed the game. Theres probably nothing more reliable in crypto than traders yelling ALTSEASON IS HERE every time Bitcoin stumbles against altcoins. Heck, theyve been saying it religiously since mid-2024, and theyre starting to do it again now after Bitcoin dominance fell under 60% over the weekend, its lowest level since February. Except this time, they may be onto something; ETH is within sight of new all-time highs, and other altcoins are looking ready to pounce. Read more -

Focus.ua - 13:47 Aug 13, 2025

В новом трейлере нового сезона сериала "С любовью, Меган", который снимает Меган Маркл для Netflix, зрители отметили отсутствие трех важных фигур. -

Cointelegraph.com - 13:47 Aug 13, 2025

Ethereum's $1 trillion security initiative aims to attract institutional capital, but the chain’s transparent mempool enables $1.8 billion in malicious MEV extraction. Opinion by: Loring Harkness, Head of Commercial at brainbot GmbH and Shutter Earlier this year, the Ethereum Foundation launched a $1 trillion security initiative, a development in its wider campaign to tailor the chain’s image for its new audience of non-crypto retail investors, Wall Street and traditional financial institutions. On paper, the initiative is nothing but a good thing. Ethereum, recognizing its shortcomings, is refreshing. The proposed approach also offers a clear path to being “far greater” regarding security — a direction that will provide the industry we hope to attract to crypto with peace of mind. For Ethereum’s security problem, however, too much transparency is fundamentally the problem. Read more

Ethereum's $1 trillion security initiative aims to attract institutional capital, but the chain’s transparent mempool enables $1.8 billion in malicious MEV extraction. Opinion by: Loring Harkness, Head of Commercial at brainbot GmbH and Shutter Earlier this year, the Ethereum Foundation launched a $1 trillion security initiative, a development in its wider campaign to tailor the chain’s image for its new audience of non-crypto retail investors, Wall Street and traditional financial institutions. On paper, the initiative is nothing but a good thing. Ethereum, recognizing its shortcomings, is refreshing. The proposed approach also offers a clear path to being “far greater” regarding security — a direction that will provide the industry we hope to attract to crypto with peace of mind. For Ethereum’s security problem, however, too much transparency is fundamentally the problem. Read more -

Cointelegraph.com - 13:45 Aug 13, 2025

A viral run on Zora pushed Base ahead of Pump.fun and LetsBonk, but Solana still leads in users, transactions and overall activity. Base is testing Solana’s dominance in token launches, with a recent burst of SocialFi activity pushing the Ethereum layer-2 network to the top of the industry’s leaderboard. In recent years, Solana has been the go-to chain for new tokens. Its low fees and high throughput are drawing traders away from Ethereum. It’s become a hub for memecoins, with launchpads like Pump.fun spawning tens of thousands of tokens daily. The surge on Coinbase’s Base is coming from a different kind of token economy, built on social media posts, viral moments and a new wave of creator tools. Coinbase recently introduced the Base App by rebranding its wallet, sparking a surge in SocialFi activity on applications like Zora. Read more

A viral run on Zora pushed Base ahead of Pump.fun and LetsBonk, but Solana still leads in users, transactions and overall activity. Base is testing Solana’s dominance in token launches, with a recent burst of SocialFi activity pushing the Ethereum layer-2 network to the top of the industry’s leaderboard. In recent years, Solana has been the go-to chain for new tokens. Its low fees and high throughput are drawing traders away from Ethereum. It’s become a hub for memecoins, with launchpads like Pump.fun spawning tens of thousands of tokens daily. The surge on Coinbase’s Base is coming from a different kind of token economy, built on social media posts, viral moments and a new wave of creator tools. Coinbase recently introduced the Base App by rebranding its wallet, sparking a surge in SocialFi activity on applications like Zora. Read more -

The Nation - National - 13:44 Aug 13, 2025

The National Assembly on Wednesday passed the Anti-terrorism (Amendment) Bill, 2024 with majority of votes, rejecting amendments proposed by JUI-F member Aliya Kamran while incorporating an amendment proposed by PPP member Syed Naveed Qamar. -

Dawn - 13:43 Aug 13, 2025

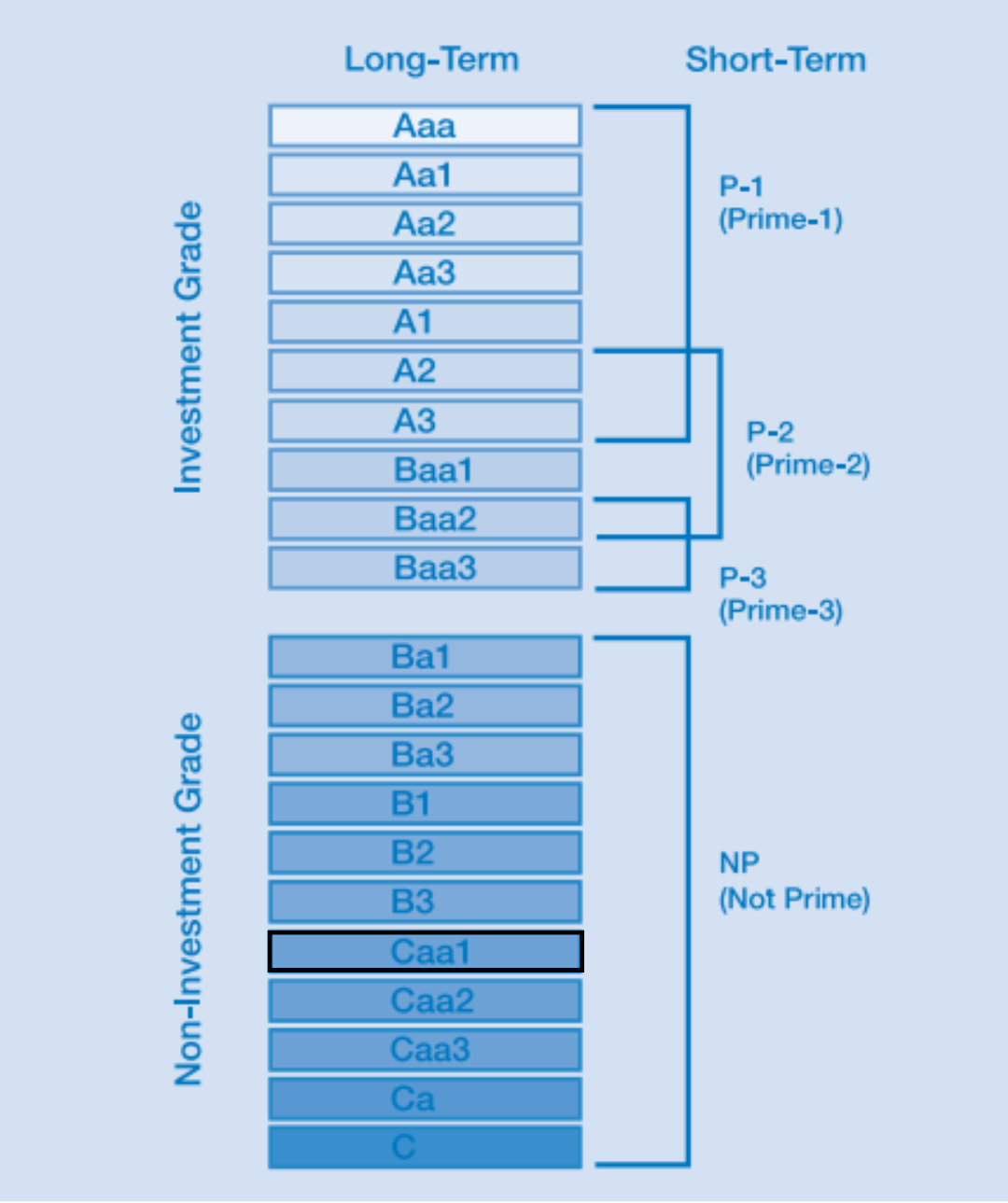

Global rating agency Moody’s on Wednesday upgraded Pakistan’s credit rating by one notch to Caa1 from Caa2, citing Islamabad’s improving external position, and changed its outlook from positive to stable. Moody’s Ratings is a credit rating system that evaluates the creditworthiness of borrowers, such as governments, corporations, or financial instruments. According to its website, the agency uses letter grades (Aaa, Aa, A, Baa, etc) to indicate the likelihood of timely repayment, with Aaa being the highest quality and C the lowest. These ratings help investors assess risk before lending or investing. Within this scale, Caa1, Caa2, and Caa3 all fall into the “Caa” category, signalling very high credit risk and poor standing. Caa1 is the highest within this group (slightly less risky), Caa2 is one notch lower, and Caa3 is the last, meaning the greatest vulnerability to default among the three. “Moody’s Ratings (Moody’s) has today upgraded the Government of Pakistan’s local and foreign currency issuer and senior...

Global rating agency Moody’s on Wednesday upgraded Pakistan’s credit rating by one notch to Caa1 from Caa2, citing Islamabad’s improving external position, and changed its outlook from positive to stable. Moody’s Ratings is a credit rating system that evaluates the creditworthiness of borrowers, such as governments, corporations, or financial instruments. According to its website, the agency uses letter grades (Aaa, Aa, A, Baa, etc) to indicate the likelihood of timely repayment, with Aaa being the highest quality and C the lowest. These ratings help investors assess risk before lending or investing. Within this scale, Caa1, Caa2, and Caa3 all fall into the “Caa” category, signalling very high credit risk and poor standing. Caa1 is the highest within this group (slightly less risky), Caa2 is one notch lower, and Caa3 is the last, meaning the greatest vulnerability to default among the three. “Moody’s Ratings (Moody’s) has today upgraded the Government of Pakistan’s local and foreign currency issuer and senior... -

Decrypt - 13:41 Aug 13, 2025

Ethereum nears its record high as analysts point to institutional buying and stablecoin growth as catalysts for the next rally. -

The Nation - National - 13:38 Aug 13, 2025

Pakistan Peoples Party (PPP) Chairman Bilawal Bhutto Zardari has called on the federal government to allocate more funds for Sindh’s development. -

ukrinform.net - 13:38 Aug 13, 2025

Ukrainian citizens abroad should not support Russian cultural products, and EU countries, particularly Poland, should not provide venues for performers who promote the “Russian world.”