News

-

Focus.ua - 12:10 Jul 31, 2025

Украинский певец Олег Винник откровенно рассказал о своей музе-жене. По слухам, он женат на певице Таюне, которая выступала с артистом на бэк-вокале. -

Dawn - 12:09 Jul 31, 2025

The provincial ombudsman for protection against harassment of women at workplaces on Thursday ordered the removal of K-Electric (KE) Chief Executive Officer Moonis Alvi after finding him guilty of workplace harassment. Alvi, along with other KE employees, was accused of workplace harassment by the company’s former chief marketing and communication officer, Mahreen Aziz Khan, said the order issued by provincial ombudsman Justice (R) Shahnawaz Tariq. In her application, Khan had accused Alvi, Chief People Officer Rizwan Dallia, Chief of Security Col (R) Wahid Asghar, and Member of the Board of Directors and Chairman Board HR Committee Khalid Rafi, of “causing harassment, intimidation and mental agony”. The ombudsman’s order said that Alvi had “committed harassment, created a hostile environment and caused mental agony at the workplace to [Khan] and her team”. Consequently, Alvi was penalised under Section 4(4)(ii)(c) of the Protection against Harassment of Women at the Workplace Act, 2010, and ordered removed f... -

Dawn - 12:09 Jul 31, 2025

Pakistan successfully launched a remote sensing satellite from a launch centre in China on Thursday that aims to strengthen Pakistan’s agricultural monitoring and disaster management, among other capabilities, according to a Foreign Office statement. Pakistan has held strong bilateral relations with China which has supported it through many investments and development projects such as the China-Pakistan Economic Corridor (CPEC), termed as a “lifeline” for the country’s economy. “In a major milestone for space exploration and technological progress, Pakistan today successfully launched its Remote Sensing Satellite from the Xichang Satellite Launch Centre (XSLC) in China,” a statement by the foreign ministry said. The satellite was launched by Pakistan’s national space agency, the Pakistan Space and Upper Atmosphere Research Commission (Suparco), in collaboration with the China Electronics Technology Group Corporation (CETC) and Microsat China, according to the ministry. According to the statement, the satellit... -

The Nation - National - 12:08 Jul 31, 2025

A special anti-terrorism court (ATC) in Faisalabad on Thursday sentenced several senior Pakistan Tehreek-e-Insaf (PTI) leaders, including Omar Ayub, Shibli Faraz, and Zartaj Gul, to 10 years in prison over their involvement in the May 9, 2023, riots. -

Focus.ua - 12:07 Jul 31, 2025

Электрический кроссовер BYD Yuan UP получил дешевую базовую версию. Она стоит всего 10 400 долларов и имеет запас хода 300 км. -

Dawn - 12:07 Jul 31, 2025

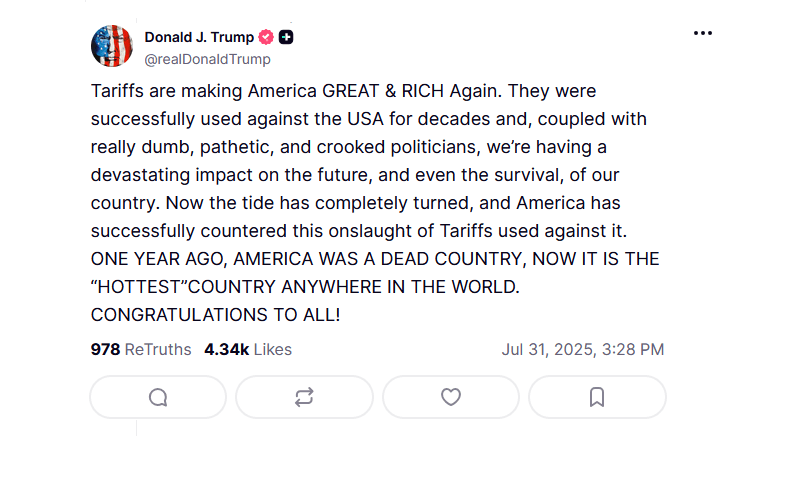

United States President Donald Trump said on Thursday that the sweeping tariffs he has imposed on nations around the world were making the country “great and rich again”, as governments raced to strike deals with Washington less than 24 hours before an August 1 deadline. “Tariffs are making America great and rich again,” he wrote on his Truth Social platform. “One year ago, America was a dead country, now it is the ‘hottest’ country anywhere in the world,” he added. A day earlier, the US president imposed new tariffs to punish or favour several major trading partners — the latest round of sweeping measures that have roiled markets around the world. South Korea squeezed in at the last moment, securing agreement on a 15 per cent tariff for exports to the US — significantly below the 25pc that Trump had earlier threatened to introduce. But Trump also announced crippling 50pc tariffs on Brazil and a 25pc levy on Indian exports, while warning Canada it would face trade repercussions for planning to recognise a Pal...

United States President Donald Trump said on Thursday that the sweeping tariffs he has imposed on nations around the world were making the country “great and rich again”, as governments raced to strike deals with Washington less than 24 hours before an August 1 deadline. “Tariffs are making America great and rich again,” he wrote on his Truth Social platform. “One year ago, America was a dead country, now it is the ‘hottest’ country anywhere in the world,” he added. A day earlier, the US president imposed new tariffs to punish or favour several major trading partners — the latest round of sweeping measures that have roiled markets around the world. South Korea squeezed in at the last moment, securing agreement on a 15 per cent tariff for exports to the US — significantly below the 25pc that Trump had earlier threatened to introduce. But Trump also announced crippling 50pc tariffs on Brazil and a 25pc levy on Indian exports, while warning Canada it would face trade repercussions for planning to recognise a Pal... -

Focus.ua - 12:03 Jul 31, 2025

В устье реки Кататумбо гроза, по словам исследователей, не похожа ни на одну другую на планете. Количество грозовых дней в регионе может достигать почти 300, что делает это место невероятно уникальным. -

Focus.ua - 12:01 Jul 31, 2025

Первая космическая ракета, созданная в Австралии, потерпела крушение через 14 секунд после старта. Тем не менее первый испытательный полет трехступенчатой ракеты Eris ее компания-производитель не считает совсем неудачным. -

ukrinform.net - 11:58 Jul 31, 2025

Information about the alleged capture of the village of Kamianske in the Vasylivsky district of the Zaporizhzhia region by Russian troops is not true; there are Ukrainian positions on the outskirts of the village and fighting is ongoing. -

Focus.ua - 11:55 Jul 31, 2025

Производителям оружия не придется обновлять отдельные документы, поскольку все разрешения будут действовать пока действует новое Постановление. -

AD.nl Economie - 11:55 Jul 31, 2025

KLM zit nog altijd in de rode cijfers, waardoor bezuinigingen volgens de luchtvaartmaatschappij noodzakelijk blijven. ‘We zien dat de opeenstapeling van heffingen in Nederland ons minder concurrerend maakt.’ -

Первомайская Слобожанка - 11:52 Jul 31, 2025

На російсько-українській війні під час виконання бойового завдання загинув златопілець Владислав Володимирович Коваленко. Про це повідомляє сайт Златопільської міськради. Владислав Коваленко народився 11 грудня 1998 року в місті Златопіль (раніше – Первомайський) Харківської області. Отримавши дві вищі освіти в Українській інженерно-педагогічній академії, він міг присвятити себе викладацькій справі та залишитися в тилу. Але 24 лютого […] -

NRC.nl Economie - 11:50 Jul 31, 2025

Net als Air France-KLM en Unilever, waar economiecollega’s vanochtend al over schreven in dit blog, opende Shell vandaag zijn boeken. -

ZF English - 11:44 Jul 31, 2025

Rezolv Energy has selected Austrian infrastructure group PORR for infrastructure works on Phase 2 of the VIFOR Wind Farm in Buzau County, Romania, while Vestas will supply 42 EnVentus V162-6.4MW turbines – the largest-capacity turbines installed in Romania to date.

Rezolv Energy has selected Austrian infrastructure group PORR for infrastructure works on Phase 2 of the VIFOR Wind Farm in Buzau County, Romania, while Vestas will supply 42 EnVentus V162-6.4MW turbines – the largest-capacity turbines installed in Romania to date. -

Cointelegraph.com - 11:44 Jul 31, 2025

The guidelines are expected to cover leverage limits, user eligibility and risk disclosures for crypto lending activities. South Korea’s financial regulators plan to release guidelines on cryptocurrency lending services next month in an effort to tighten oversight and protect investors amid growing concerns over leveraged crypto products. The Financial Services Commission (FSC) and Financial Supervisory Service (FSS) on Thursday announced the formation of a joint task force to develop a regulatory framework for crypto lending, according to local media Yonhap News Agency (YNA). The move follows new lending services introduced by South Korean exchanges Upbit and Bithumb. According to YNA, Bithumb has allowed users to borrow as much as four times their collateral, while Upbit has offered loans worth up to 80% of users’ asset value. Read more

The guidelines are expected to cover leverage limits, user eligibility and risk disclosures for crypto lending activities. South Korea’s financial regulators plan to release guidelines on cryptocurrency lending services next month in an effort to tighten oversight and protect investors amid growing concerns over leveraged crypto products. The Financial Services Commission (FSC) and Financial Supervisory Service (FSS) on Thursday announced the formation of a joint task force to develop a regulatory framework for crypto lending, according to local media Yonhap News Agency (YNA). The move follows new lending services introduced by South Korean exchanges Upbit and Bithumb. According to YNA, Bithumb has allowed users to borrow as much as four times their collateral, while Upbit has offered loans worth up to 80% of users’ asset value. Read more -

The Nation - National - 11:42 Jul 31, 2025

US-Pakistan trade deal a diplomatic milestone with economic advantages for public, Bilal Kiyani says

Minister of State for Finance Bilal Azhar Kiyani Thursday praised the strengthening of the bilateral partnership between Pakistan and the United States, describing it as a historic trade deal that will not only boost exports but also mark a diplomatic triumph for the Pakistani government. -

The Nation - National - 11:39 Jul 31, 2025

Pakistan Tehreek-e-Insaf (PTI) Chairman Barrister Gohar Ali Khan has stated that the party will soon decide whether to boycott the assemblies or launch a protest movement in response to recent court verdicts against its leadership. -

Focus.ua - 11:38 Jul 31, 2025

69-летний журналист и исполнительный продюсер "Суспільного" Юрий Макаров не стал жертвой нападения — экспертиза установила, что телесные повреждения он нанес себе самостоятельно.