Trump | News

-

CryptoSlate - 22:15 Sep 03, 2025

American Bitcoin Corp. (ABTC), backed by Donald Trump Jr. and Eric Trump, filed with the Securities and Exchange Commission (SEC) on Sept. 3 seeking to raise $2.1 billion through share sales. The filing follows a volatile Nasdaq debut that saw ABTC stock surge 91% in one hour before crashing lower than the opening price by […] The post Trump brothers seek $2.1B raise via share sales amid American Bitcoin’s volatile Nasdaq debut appeared first on CryptoSlate. -

Dawn - 18:28 Sep 03, 2025

United States President Donald Trump said on Wednesday he plans to hold talks about the war in Ukraine in the coming days after his Alaska summit with Russian President Vladimir Putin in August failed to achieve a breakthrough. Trump has been frustrated at his inability to put a halt to the fighting, which began with Russia’s invasion of Ukraine in February 2022, after he initially predicted he would be able to end the war swiftly when he took office in January. Trump said he would be holding talks in the next few days. A White House official said Trump is expected to speak on the phone on Thursday with Ukrainian President Volodymyr Zelensky. The French presidency said earlier today that several European leaders, including Zelensky and France’s Emmanuel Macron, would call Trump on Thursday afternoon. That call was expected to follow a mostly virtual meeting on Thursday, hosted by France, of some 30 countries to discuss their latest efforts to provide Ukraine with security support once there is a peace agreeme... -

AD.nl - 17:15 Sep 03, 2025

President Trump belt naar eigen zeggen in de komende dagen weer met zijn Russische ambtgenoot Poetin. Trump wil ‘antwoorden’ en sprak dreigend dat ‘er dingen gaan gebeuren als hij niet gelukkig is met de antwoorden van Poetin’. Sowieso wordt er komende dagen weer druk gesproken. Zo bellen de Oekraïense president Zelensky en Europese leiders donderdag met Trump. Volg alle ontwikkelingen over de oorlog in Oekraïne in ons liveblog. -

Defense News - 21:01 Sep 02, 2025

Twice Tuesday, Trump said Colorado’s mail-in voting policies influenced his decision to move SPACECOM headquarters from Colorado Springs to Huntsville. -

AD.nl - 19:19 Sep 02, 2025

Trump heeft opnieuw zijn teleurstelling in zijn Russische ambtgenoot Vladimir Poetin uitgesproken. „Ik ben erg teleurgesteld in hem”, zei hij in de radioshow van Scott Jennings. Lees alles over de oorlog in Oekraïne en de situatie in Rusland in ons liveblog. -

CoinDesk - 18:35 Sep 02, 2025

Crypto options platform PowerTrade reports that traders are betting on a strong year-end rally in several altcoins, including SOL, XRP, TRUMP, HYPE, LINK. -

Cryptonews.com - 17:44 Sep 02, 2025

Claude predicts continued strength across crypto markets. XRP adoption has accelerated, Memecore has rallied to near a $1B cap, and Trump memecoin has gained traction after WLFI’s launch. Meanwhile, Ethereum has reached a fresh high and Bitcoin has reclaimed $111K with sentiment leaning bullish. The post Leading AI Claude Predicts the Price of XRP, MemeCore and TRUMP by the End of 2025 appeared first on Cryptonews. -

Defense News - 15:39 Sep 02, 2025

Trump is set to announce U.S. Space Command's move to Alabama, reversing a Biden-era decision to keep it at its temporary headquarters in Colorado. -

FD - 22:30 Sep 01, 2025

De boodschap van Modi, Xi en Poetin aan Trump: wij zijn samen economisch machtiger dan jij, dus zoek het maar lekker uit met je heffingen. -

CryptoSlate - 22:16 Sep 01, 2025

California Governor Gavin Newsom said he will intensify his attacks on President Donald Trump by launching a memecoin and expanding a wave of social media posts designed to parody the former president’s online persona, NBC Los Angeles reported. The governor made the revelations during a recent appearance as a guest co-host on the “Pivot” podcast […] The post California gov Gavin Newsom to launch memecoin to continue ‘trolling’ Trump appeared first on CryptoSlate. -

Cointelegraph.com - 20:45 Sep 01, 2025

The crypto company tied to the US president and his family unlocked 24.6 billion tokens, making their holdings worth about $5 billion. An entity tied to US President Donald Trump’s family now holds about $5 billion worth of World Liberty Financial’s governance token (WLFI) after a significant unlock on Monday. According to World Liberty Financial’s website, DT Marks DEFI LLC and “certain family members” of Trump held 22.5 billion WLFI tokens. The company reported unlocking 24.6 billion WLFI tokens on Monday as part of a scheduled move to establish an initial circulating supply, briefly boosting the price to $0.40 before it fell to about $0.21 at time of publication. World Liberty previously said the holdings of its founders — including Trump and his three sons, Donald Trump Jr., Barron Trump and Eric Trump — would initially remain locked. However, Monday’s unlocking effectively gave the Trump family’s stake a valuation of about $5 billion based on the WLFI price at the time of publication. Read more

The crypto company tied to the US president and his family unlocked 24.6 billion tokens, making their holdings worth about $5 billion. An entity tied to US President Donald Trump’s family now holds about $5 billion worth of World Liberty Financial’s governance token (WLFI) after a significant unlock on Monday. According to World Liberty Financial’s website, DT Marks DEFI LLC and “certain family members” of Trump held 22.5 billion WLFI tokens. The company reported unlocking 24.6 billion WLFI tokens on Monday as part of a scheduled move to establish an initial circulating supply, briefly boosting the price to $0.40 before it fell to about $0.21 at time of publication. World Liberty previously said the holdings of its founders — including Trump and his three sons, Donald Trump Jr., Barron Trump and Eric Trump — would initially remain locked. However, Monday’s unlocking effectively gave the Trump family’s stake a valuation of about $5 billion based on the WLFI price at the time of publication. Read more -

Haaretz - 19:04 Sep 01, 2025

Elliott Broidy, a pro-Israel Jewish-American businessman who was pardoned by Trump and has long been a vocal critic of Qatar, is a partner in an Israeli firm that operated a pro-Qatar PR campaign; 'Broidy has cut ties with the company' -

Cryptonews.com - 18:47 Sep 01, 2025

World Liberty Fi Price Prediction: Trump’s $40B Coin Set to Drop – Is WLFI the Next 1,000x Moonshot?

Trump-backed World Liberty Financial is now available on the Ethereum mainnet – World Liberty Fi Price Prediction shapes up to be the next 1,000x moonshot. The post World Liberty Fi Price Prediction: Trump’s $40B Coin Set to Drop – Is WLFI the Next 1,000x Moonshot? appeared first on Cryptonews. -

Dawn - 14:07 Sep 01, 2025

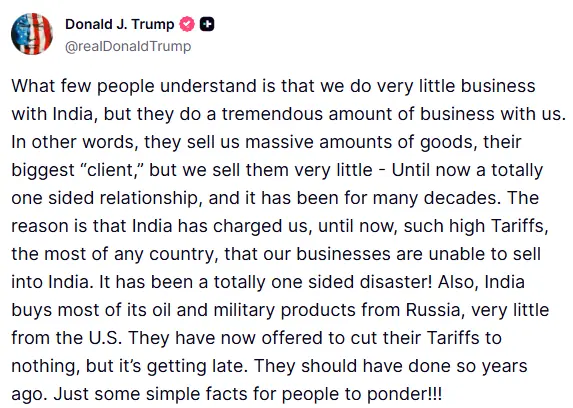

United States President Donald Trump said on Monday that India has offered to reduce its tariffs on US goods to zero amid deteriorating ties between the two countries. While calling the US’s relationship with India “one-sided”, Trump wrote on Truth Social, “They have now offered to cut their tariffs to nothing, but it’s getting late. They should have done so years ago.” The Indian Embassy in Washington did not immediately respond to Trump’s comments, which follow the implementation of total duties as high as 50 per cent on Indian goods. Relations between the two countries have plummeted, with 50pc levies on many Indian imports into the US taking effect last week as punishment for New Delhi’s massive purchases of Russian oil, a part of US efforts to pressure Moscow into ending its war in Ukraine. Since his return to the White House this year, Trump has wielded tariffs as a wide-ranging policy tool, with the levies upending global trade. Amid this dispute, India has grown closer to Beijing and Moscow. Indian Pr...

United States President Donald Trump said on Monday that India has offered to reduce its tariffs on US goods to zero amid deteriorating ties between the two countries. While calling the US’s relationship with India “one-sided”, Trump wrote on Truth Social, “They have now offered to cut their tariffs to nothing, but it’s getting late. They should have done so years ago.” The Indian Embassy in Washington did not immediately respond to Trump’s comments, which follow the implementation of total duties as high as 50 per cent on Indian goods. Relations between the two countries have plummeted, with 50pc levies on many Indian imports into the US taking effect last week as punishment for New Delhi’s massive purchases of Russian oil, a part of US efforts to pressure Moscow into ending its war in Ukraine. Since his return to the White House this year, Trump has wielded tariffs as a wide-ranging policy tool, with the levies upending global trade. Amid this dispute, India has grown closer to Beijing and Moscow. Indian Pr... -

Dawn - 18:03 Aug 30, 2025

United States President Donald Trump has scrapped plans to attend an upcoming summit of the ‘Quad’ grouping in India amid deteriorating ties between Washington and New Delhi, US newspaper The New York Times (NYT) reported on Saturday. Relations between the two countries have plummeted, with 50 per cent levies on many Indian imports into the US taking effect this week as punishment for New Delhi’s massive purchases of Russian oil; a part of US efforts to pressure Moscow into ending its war in Ukraine. As ties between both nations deteriorate, NYT reported on Saturday that the breakdown in relations was caused after a phone call on June 17. “After telling [Indian Prime Minister Narendra] Modi that he would travel to India later this year for the Quad summit, Mr Trump no longer has plans to visit in the fall, according to people familiar with the president’s schedule,” the NYT reported, citing “interviews with more than a dozen people in Washington and New Delhi”. The NYT mentioned how Trump’s repeated claims ab... -

Adevarul Romania - 17:47 Aug 30, 2025

O declarație ambiguă a vicepreședintelui J.D. Vance a alimentat un zvon fals pe rețelele sociale, potrivit căruia „Trump a murit”. Lipsa aparițiilor publice ale președintelui american și speculațiile despre sănătatea sa au dus la o avalanșă de postări virale. -

Cointelegraph.com - 07:03 Aug 30, 2025

Bitcoin and Ether ETFs saw outflows on Friday after the Fed reported rising core inflation, driven in part by Trump’s tariff policies. Spot Bitcoin and Ether ETFs recorded outflows on Friday as the Federal Reserve released key inflation data showing price pressures are creeping higher under President Donald Trump’s trade policies. According to SoSoValue data, Ether (ETH) ETFs saw a net outflow of $164.64 million, reversing five straight days of inflows that had added more than $1.5 billion to the asset class. Bitcoin (BTC) ETFs also turned negative with $126.64 million in net outflows, their first daily loss since Aug. 22. Total assets under management dropped to $28.58 billion for Ethereum and $139.95 billion for Bitcoin. Read more

Bitcoin and Ether ETFs saw outflows on Friday after the Fed reported rising core inflation, driven in part by Trump’s tariff policies. Spot Bitcoin and Ether ETFs recorded outflows on Friday as the Federal Reserve released key inflation data showing price pressures are creeping higher under President Donald Trump’s trade policies. According to SoSoValue data, Ether (ETH) ETFs saw a net outflow of $164.64 million, reversing five straight days of inflows that had added more than $1.5 billion to the asset class. Bitcoin (BTC) ETFs also turned negative with $126.64 million in net outflows, their first daily loss since Aug. 22. Total assets under management dropped to $28.58 billion for Ethereum and $139.95 billion for Bitcoin. Read more -

Haaretz - 03:00 Aug 29, 2025

Hamas signaled readiness for a deal on August 18, but Netanyahu has yet to respond, stalling talks while convincing Trump that Gaza City can be swiftly conquered. 'Anyone who abandons the fallen will abandon the living,' warned hostage families, as protests grow louder -

AD.nl - 00:34 Aug 29, 2025

Trump was ‘niet blij’ toen hij hoorde over de grote Russische luchtaanval op Oekraïne. Dat verklaarde zijn woordvoerster Karoline Leavitt, die zei dat de president er later meer over zal zeggen. „Hij was niet blij met dit nieuws, maar het verbaasde hem ook niet”, zei Leavitt. Lees alles over de oorlog in Oekraïne en de situatie in Rusland in ons liveblog. -

Dawn - 07:56 Aug 28, 2025

US President Donald Trump’s administration moved on Thursday to impose stricter limits on how long foreign students and journalists can stay in the United States, the latest bid to tighten legal immigration in the country. Under a proposed change, foreigners would not be allowed to stay for more than four years on student visas in the US. Foreign journalists would be limited to stays of just 240 days, although they could apply to extend by additional 240-day periods — except for Chinese journalists who would get just 90 days. The US, until now, has generally issued visas for the duration of a student’s educational programme or a journalist’s assignment, although no non-immigrant visas are valid for more than 10 years. The proposed changes were published in the Federal Register, initiating a short period for public comment before they can go into effect. Trump’s Department of Homeland Security alleged that an unspecified number of foreigners were indefinitely extending their studies so they could remain in the...