News

-

ukrinform.net - 12:30 Dec 13, 2025

Air Defense Forces destroyed 417 Russian drones, four Iskander-K cruise missiles, and nine Kalibr missiles. -

Focus.ua - 12:30 Dec 13, 2025

Алгарве, солнечный южный регион Португалии, известный как "Калифорния Европы", получил титул лучшего пляжного направления мира в 2025 году по версии World Travel Awards. Регион обошел Маврикий, Мальдивы и острова Теркс и Кайкос, став единственным в мире, который получал это звание четыре раза. -

Focus.ua - 12:17 Dec 13, 2025

Исполнителей из России будут блокировать на Spotify, Apple Music и других стриминговых платформах по решению Совета национальной безопасности и обороны Украины (СНБО). -

Adevarul Romania - 12:14 Dec 13, 2025

Viitorul premier al Cehiei, Andrej Babis, a avertizat sâmbătă, 13 decembrie, că țara sa nu va accepta să furnizeze nicio garanţie pentru finanţarea Ucrainei. -

Focus.ua - 12:12 Dec 13, 2025

До конца 2025 года все четыре воинские части Сухопутных войск ВСУ, известные под названием "Интернациональные легионы", должны быть расформированы. -

Adevarul Romania - 12:09 Dec 13, 2025

Fostul premier Victor Ponta cere jurnaliștilor de la Recorder să realizeze un reportaj despre ceea ce el numește „capturarea Justiției” în România. Ponta afirmă că deține documente și probe care arată blocaje de ani de zile în dosare penale. -

Cointelegraph.com - 12:07 Dec 13, 2025

Strategy remains in the Nasdaq 100 as MSCI considers excluding firms whose crypto holdings exceed 50% of total assets. Strategy held on to its place in the Nasdaq 100 during this year’s rebalancing, securing its first successful test in the benchmark since joining the index in December last year. The company, previously known as MicroStrategy, has become the largest corporate holder of Bitcoin (BTC). With its latest purchase of 10,624 Bitcoin for around $962.7 million last week, Strategy’s total holdings stand at 660,624 BTC, worth nearly $60 billion. The latest Nasdaq 100 adjustment saw Biogen, CDW, GlobalFoundries, Lululemon, On Semiconductor and Trade Desk removed from the tech-heavy gauge, while Alnylam Pharmaceuticals, Ferrovial, Insmed, Monolithic Power Systems, Seagate and Western Digital entered the lineup, according to Reuters. Read more

Strategy remains in the Nasdaq 100 as MSCI considers excluding firms whose crypto holdings exceed 50% of total assets. Strategy held on to its place in the Nasdaq 100 during this year’s rebalancing, securing its first successful test in the benchmark since joining the index in December last year. The company, previously known as MicroStrategy, has become the largest corporate holder of Bitcoin (BTC). With its latest purchase of 10,624 Bitcoin for around $962.7 million last week, Strategy’s total holdings stand at 660,624 BTC, worth nearly $60 billion. The latest Nasdaq 100 adjustment saw Biogen, CDW, GlobalFoundries, Lululemon, On Semiconductor and Trade Desk removed from the tech-heavy gauge, while Alnylam Pharmaceuticals, Ferrovial, Insmed, Monolithic Power Systems, Seagate and Western Digital entered the lineup, according to Reuters. Read more -

CryptoPotato - 12:03 Dec 13, 2025

The ETFs are well in the green in terms of net inflows, but what about XRP's price? -

Adevarul Romania - 12:01 Dec 13, 2025

Un tânăr de 19 ani din Slatina și-a pierdut viața sâmbătă, după ce autoturismul pe care îl conducea a luat foc într-un accident rutier produs în zona localității Găneasa. -

1kr.ua - 12:01 Dec 13, 2025

Криворожская теплоцентраль в круглосуточном режиме восстанавливает теплоснабжение на жилом массиве «Южный ГОК» после аварийного отключения электричества.Об Подробнее

Криворожская теплоцентраль в круглосуточном режиме восстанавливает теплоснабжение на жилом массиве «Южный ГОК» после аварийного отключения электричества.Об Подробнее -

CoinDesk - 12:00 Dec 13, 2025

While legislative language circulates among all four corners of the talks — industry, White House, Republicans and Democrats — the process is still mid-stride. -

Focus.ua - 12:00 Dec 13, 2025

Грядущее обновление оболочки для смартфонов Samsung существенно изменит принципы работы энергосбережения. Разработчики предоставят пользователям больше свободы в настройке пресета максимальной автономности и переработают интерфейс. -

Focus.ua - 11:51 Dec 13, 2025

Пассажиров поезда "Перемышль -Киев" вывели на улицу посреди поля после того, как поступило сообщение о минировании. -

Cryptonews.com - 11:45 Dec 13, 2025

Itaú Asset Management joins major Wall Street firms in advising small Bitcoin allocations, citing uncorrelated returns as BTC tests $90,000 support following sharp correction from October highs. The post Bitcoin Price Prediction: Brazil’s Largest Private Bank Itaú Supports Bitcoin Exposure — Can 3% allocation Push BTC Higher? appeared first on Cryptonews. -

Cryptonews.com - 11:45 Dec 13, 2025

Vanguard's $12 trillion platform now allows Bitcoin ETF trading following CEO transition, though executives continue labeling crypto speculative and compare it to collectibles rather than productive assets. The post Bitcoin Is a “Digital Labubu,” Says Vanguard — Yet It Opens ETF Trading appeared first on Cryptonews. -

Haaretz - 11:42 Dec 13, 2025

Concert visuals at the band's London show included animations combining the Nazi symbol and a Star of David, along with images of destruction in Gaza and the caption, 'Our government is complicit in genocide.' A Jewish group filed a complaint with the police -

Focus.ua - 11:31 Dec 13, 2025

Министерство иностранных дел Турции выступило с призывом к немедленному прекращению войны между Россией и Украиной после российской ракетной атаки 12 декабря на судно турецкой компании в украинском порту Черноморск, Одесской области. -

Focus.ua - 11:17 Dec 13, 2025

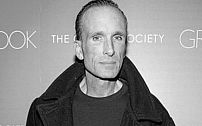

Американский актер Питер Грин, известный по ролям злодеев в таких фильмах, как "Криминальное чтиво" и "Маска", найден накануне мертвым в своей квартире на Нижнем Ист-Сайде на Манхэттене с травмой лица. -

1kr.ua - 11:06 Dec 13, 2025

В пятницу в Нью-Йорке скончался актер Питер Грин, известный по ролям злодеев в культовых фильмах 90-х. Ему было 60 лет.Об этом сообщает NBC news.Грина нашли мертвым Подробнее

В пятницу в Нью-Йорке скончался актер Питер Грин, известный по ролям злодеев в культовых фильмах 90-х. Ему было 60 лет.Об этом сообщает NBC news.Грина нашли мертвым Подробнее -

Cointelegraph.com - 11:05 Dec 13, 2025

Bitfinex said the recent 66% slide in spot trading volumes echoes lulls seen before next leg in the cycle. Bitfinex says crypto spot trading activity has fallen sharply this quarter, with volumes down 66% from January’s peak as traders step back amid softer ETF inflows and an uncertain macro backdrop. In a Sunday post on X, the exchange noted that the slowdown mirrors periods seen in earlier market cycles, where extended lulls often “precede the next leg in the cycle.” According to data from CoinMarketCap, 30-day crypto spot volumes have slipped from over $500 billion in early November to roughly $250 billion this week. Read more

Bitfinex said the recent 66% slide in spot trading volumes echoes lulls seen before next leg in the cycle. Bitfinex says crypto spot trading activity has fallen sharply this quarter, with volumes down 66% from January’s peak as traders step back amid softer ETF inflows and an uncertain macro backdrop. In a Sunday post on X, the exchange noted that the slowdown mirrors periods seen in earlier market cycles, where extended lulls often “precede the next leg in the cycle.” According to data from CoinMarketCap, 30-day crypto spot volumes have slipped from over $500 billion in early November to roughly $250 billion this week. Read more