News

-

Dawn - 14:00 Jan 14, 2026

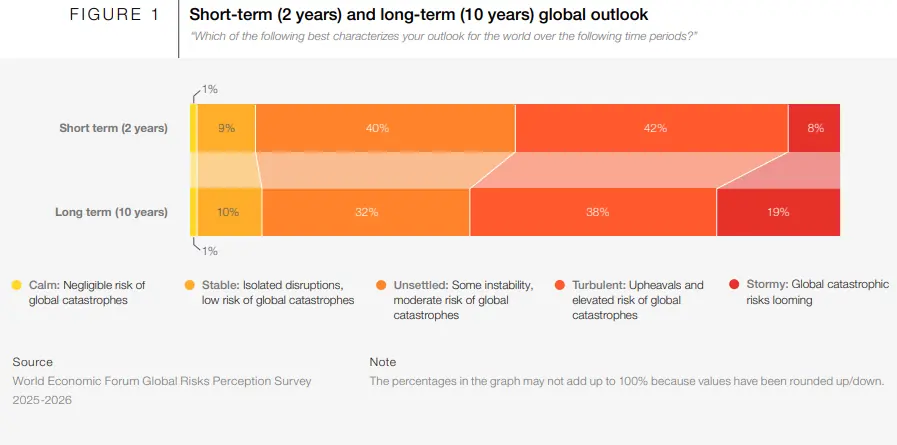

ISLAMABAD: The World Economic Forum (WEF) finds geo-economic confrontation as the top risk for 2026, followed by interstate conflict, extreme weather, societal polarisation, and misinformation and disinformation, its report said on Wednesday. The Global Risks Report 2026, a premier source of original global risks data for Switzerland-based WEF, warned that the multilateral system is under pressure. “Declining trust, diminishing transparency and respect for the rule of law, along with heightened protectionism, are threatening longstanding international relations, trade and investment and increasing the propensity for conflict,” it read. Geo-economic confrontation topped the near-term rankings, with 18 per cent of respondents viewing it as the risk most likely to trigger a global crisis in 2026. It was also ranked first for severity over the next two years, up eight positions from last year. State-based armed conflict followed in second position for 2026, dropping to fifth position in the two-year timeframe. Sh...

ISLAMABAD: The World Economic Forum (WEF) finds geo-economic confrontation as the top risk for 2026, followed by interstate conflict, extreme weather, societal polarisation, and misinformation and disinformation, its report said on Wednesday. The Global Risks Report 2026, a premier source of original global risks data for Switzerland-based WEF, warned that the multilateral system is under pressure. “Declining trust, diminishing transparency and respect for the rule of law, along with heightened protectionism, are threatening longstanding international relations, trade and investment and increasing the propensity for conflict,” it read. Geo-economic confrontation topped the near-term rankings, with 18 per cent of respondents viewing it as the risk most likely to trigger a global crisis in 2026. It was also ranked first for severity over the next two years, up eight positions from last year. State-based armed conflict followed in second position for 2026, dropping to fifth position in the two-year timeframe. Sh... -

Cointelegraph.com - 14:00 Jan 14, 2026

Crossmint has secured MiCA authorization from Spain’s CNMV to operate as a crypto asset service provider, allowing it to passport stablecoin infrastructure services across the EU. Crossmint has secured a Markets in Crypto Assets Regulation (MiCA) authorization from Spain’s securities regulator CNMV to operate as a crypto asset service provider (CASP), positioning it as a regulated stablecoin infrastructure provider across all 27 European Union member states. Miguel Angel Zapatero, Crossmint general counsel, told Cointelegraph that the company was held to “the exact same standards” as traditional financial institutions, marking an end to any notion that MiCA offers a lighter regime for crypto businesses. He said that MiCA created a “level playing field” and built confidence in the sector thanks to “consistent standards and enforcement,” adding that the days of the “wild wild west” era were over, and that MiCA brought “certainty to more traditional clients who were not confident enough in crypto technology.” ...

Crossmint has secured MiCA authorization from Spain’s CNMV to operate as a crypto asset service provider, allowing it to passport stablecoin infrastructure services across the EU. Crossmint has secured a Markets in Crypto Assets Regulation (MiCA) authorization from Spain’s securities regulator CNMV to operate as a crypto asset service provider (CASP), positioning it as a regulated stablecoin infrastructure provider across all 27 European Union member states. Miguel Angel Zapatero, Crossmint general counsel, told Cointelegraph that the company was held to “the exact same standards” as traditional financial institutions, marking an end to any notion that MiCA offers a lighter regime for crypto businesses. He said that MiCA created a “level playing field” and built confidence in the sector thanks to “consistent standards and enforcement,” adding that the days of the “wild wild west” era were over, and that MiCA brought “certainty to more traditional clients who were not confident enough in crypto technology.” ... -

CoinDesk - 14:00 Jan 14, 2026

The blockchain nonprofit is moving its base of operations back to the United States and has appointed a new board to oversee its next phase of growth. -

Focus.ua - 13:58 Jan 14, 2026

Во время недавних атак вооруженных сил РФ по Украине эксперты зафиксировали использование врагом магнитных мин для усиления ударов. В частности, такую угрозу заметили во время обстрелов железной дороги Ковель-Киев. -

FD - 13:57 Jan 14, 2026

Migranten bivakkeren massaal bij Duinkerke om van daaruit de sprong naar Engeland te wagen. Een Franse rechter noemt de omstandigheden mensonwaardig. -

Focus.ua - 13:57 Jan 14, 2026

Народная артистка Украины Светлана Билоножко рассказала, на какие средства живет после смерти мужа. Виталий Билоножко ушел из жизни два года назад. -

atn.ua - 13:55 Jan 14, 2026

Українська біатлоністка Тетяна Тарасюк виграла бронзову медаль спринтерської гонки юніорського Кубка IBU. Про це повідомляє Чемпіон. Спортсменка впевнено пройшла усю дистанцію, жодного разу не помилившись на вогневих рубежах та поступилась… -

Cointelegraph.com - 13:55 Jan 14, 2026

Bitcoin ETF flows have swung sharply in early 2026 as investors pour billions into traditional ETFs, leaving crypto funds lagging behind. Bitcoin exchange-traded funds (ETFs) have had a volatile start to 2026, with sharp swings in investor demand even as money pours into traditional ETFs at an unusually fast pace. US-listed spot Bitcoin (BTC) ETFs pulled in $753 million on Tuesday in their second consecutive day of inflows after a four-day losing streak, according to Farside Investors data. Bitcoin ETFs have raked in a total of $660 million in net inflows so far in 2026 as demand for the funds continued to fluctuate. Read more

Bitcoin ETF flows have swung sharply in early 2026 as investors pour billions into traditional ETFs, leaving crypto funds lagging behind. Bitcoin exchange-traded funds (ETFs) have had a volatile start to 2026, with sharp swings in investor demand even as money pours into traditional ETFs at an unusually fast pace. US-listed spot Bitcoin (BTC) ETFs pulled in $753 million on Tuesday in their second consecutive day of inflows after a four-day losing streak, according to Farside Investors data. Bitcoin ETFs have raked in a total of $660 million in net inflows so far in 2026 as demand for the funds continued to fluctuate. Read more -

ZF English - 13:52 Jan 14, 2026

Romania's current account deficit surged to EUR27.1 billion in January-November 2025, compared to EUR26.06 billion in the same period of 2024, central bank data showed on Wednesday (January 14, 2025).

Romania's current account deficit surged to EUR27.1 billion in January-November 2025, compared to EUR26.06 billion in the same period of 2024, central bank data showed on Wednesday (January 14, 2025). -

FD - 13:51 Jan 14, 2026

Minder geld en verdwenen data: hoe erg is het als de VS niet meer deelnemen aan klimaatorganisaties?

De VS kondigden onlangs aan uit 66 internationale organisaties te stappen, waaronder enkele belangrijke klimaatorganisaties en -verdragen van de Verenigde Naties. Wat zijn de gevolgen? -

atn.ua - 13:47 Jan 14, 2026

Спецпідрозділ поліції «Білий Янгол» разом зі старостою села здійснили евакуацію подружжя з Борівської громади. Про це повідомляє ГУНП в Харківській області. За даними поліції, родина проживала в населеному пункті, що перебуває… -

JPost.com - Business & Innovation - 13:46 Jan 14, 2026

The main investors in Arkin Bio Ventures III together with Arkin Capital are Israeli institutional investors including Phoenix Finance, Clal Insurance, and Amitim pension fund

-

Cryptonews.com - 13:46 Jan 14, 2026

PPI shocks at 3.0% vs 2.7% expected—Bitcoin at $92K as producer prices hit 7-month high, pressuring Fed policy. The post [LIVE] Bitcoin Price Alert: November PPI Surges to 3.0% vs 2.7% Expected — Highest Since July Pressures Fed appeared first on Cryptonews. -

Decrypt - 13:46 Jan 14, 2026

Allocations are up, personal holdings are up and recommendations are up across the board according to the latest Bitwise survey. -

Focus.ua - 13:44 Jan 14, 2026

В Лондоне, Англия, археологи обнаружили редкие материальные свидетельства, непосредственно связанные с жизнью детей в викторианскую эпоху. Раскопки на историческом месте у реки обнаружили следы школьных занятий и досуга, что позволило представить, как когда-то дети учились и играли в прошлом. -

Focus.ua - 13:42 Jan 14, 2026

Премьер-министр Юлия Свириденко, представляя в Верховной Раде кандидатуру Дмитрия Шмыгаля на пост главы Министерства энергетики, затронула и тему ситуации с электричеством в Украине на данный момент. -

The Nation - National - 13:40 Jan 14, 2026

Deputy Prime Minister/Foreign Minister Senator Mohammad Ishaq Dar, on Wednesday, while stressing consistency in policies, urged all stakeholders to strive further to achieve economic strength and carve a niche for Pakistan among the comity of nations. -

CryptoSlate - 13:35 Jan 14, 2026

President Donald Trump declared on Jan. 12 that the US would impose a 25% tariff on any country conducting business with Iran, “effective immediately,” via Truth Social. Bitcoin (BTC) dipped briefly below $91,000, then recovered above $92,000 within hours. No liquidation cascade materialized. No systemic unwind. The market absorbed what appeared to be a maximalist […] The post Bitcoin ignored Trump’s latest 25% tariff threat, but the $19B liquidation ghost from October is quietly resetting in the shadows appeared first on CryptoSlate. -

NRC.nl Economie - 13:33 Jan 14, 2026

Zakenbankier Hugo Peek staat twee jaar aan het roer van de Nederlandse afdeling van BNP Paribas. „Als klanten groeien of naar verre landen gaan, kunnen wij ze daar ook mee helpen. Nederlandse banken overkomt het dan dat ze moeten zeggen: nu ben je te groot. Of: daar zitten we niet.” -

Focus.ua - 13:29 Jan 14, 2026

Если не будет новых массированных российских атак, то с вечера 15 января, в Киеве возможно улучшение графиков отключения света. А тем временем в Бучанском районе экстренные отключения отменены.