Pakistan

-

The Express Tribune - 17:44 Aug 06, 2025

Resolutions on Palestinian support, digital harassment also adopted -

The Nation - National - 17:32 Aug 06, 2025

Federal Minister for National Heritage and Culture Division, Aurangzeb Khan Khichi, in a visit to the National Language Promotion Department (NLPD) on Wednesday, reviewed the institution’s various programmes and commended its contributions to the promotion of Urdu. -

Dawn - 17:20 Aug 06, 2025

The design and policy choices of X created fertile ground for inflammatory and racist narratives targeting Muslims and migrants following last year’s deadly Southport attack in the United Kingdom, a new analysis showed on Wednesday. According to research published by Amnesty International, social media platform X played a “central role” in the spread of false narratives and harmful content, which contributed to riots against Muslim and migrant communities in Britain. The technical analysis of X’s open-source code or publicly available software showed that its recommender system, also known as content-ranking algorithms, “systematically prioritises” content that sparks outrage, provokes heated exchanges, reactions and engagement, without adequate safeguards to prevent or mitigate harm. “Our analysis shows that X’s algorithmic design and policy choices contributed to heightened risks amid a wave of anti-Muslim and anti-migrant violence observed in several locations across the UK last year, and which continues t... -

Dawn - 17:18 Aug 06, 2025

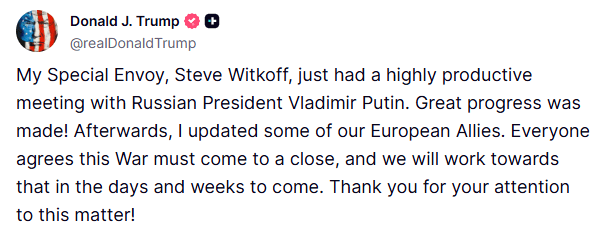

United States envoy Steve Witkoff held talks with Russian President Vladimir Putin in the Kremlin on Wednesday, two days before the expiry of a deadline set by US President Donald Trump for Russia to agree to peace in Ukraine or face new sanctions. Witkoff flew to Moscow on a last-minute mission to seek a breakthrough in the three-and-a-half-year war that began with Russia’s full-scale invasion in 2022. Russian state TV showed a brief clip of him shaking hands with Putin at the start of their meeting. Russian news agencies said the talks ended after about three hours, and Witkoff’s motor convoy was seen leaving the Kremlin. Russian investment envoy Kirill Dmitriev, who earlier greeted Witkoff on arrival and strolled with him in a park near the Kremlin, posted on social media: “Dialogue will prevail.” There was no immediate statement from either side on the substance of the talks. Later, Trump called the meeting “highly productive” in a post on Truth Social. “Great progress was made!” the US president wrote. “...

United States envoy Steve Witkoff held talks with Russian President Vladimir Putin in the Kremlin on Wednesday, two days before the expiry of a deadline set by US President Donald Trump for Russia to agree to peace in Ukraine or face new sanctions. Witkoff flew to Moscow on a last-minute mission to seek a breakthrough in the three-and-a-half-year war that began with Russia’s full-scale invasion in 2022. Russian state TV showed a brief clip of him shaking hands with Putin at the start of their meeting. Russian news agencies said the talks ended after about three hours, and Witkoff’s motor convoy was seen leaving the Kremlin. Russian investment envoy Kirill Dmitriev, who earlier greeted Witkoff on arrival and strolled with him in a park near the Kremlin, posted on social media: “Dialogue will prevail.” There was no immediate statement from either side on the substance of the talks. Later, Trump called the meeting “highly productive” in a post on Truth Social. “Great progress was made!” the US president wrote. “... -

The Express Tribune - 17:16 Aug 06, 2025

Chief collector says post-clearance audit report still awaited -

The Express Tribune - 17:16 Aug 06, 2025

Accused were detained for 'attacking police' during Aug 5 protest -

The Express Tribune - 17:16 Aug 06, 2025

Bumps and potholes contributing to a sharp rise in joint and respiratory ailments among citizens -

The Express Tribune - 17:16 Aug 06, 2025

Nahr Al Khair' aims to conserve water, address environmental challenges