News

-

Adevarul Romania - 22:30 Dec 08, 2025

Istoricul Armand Goșu, expert în istoria Rusiei și al fostului spațiu sovietic, explică, pentru „Adevărul”, cât de importantă este România deopotrivă pentru aliați și pentru Rusia, în realitate. -

Cryptonews.com - 22:30 Dec 08, 2025

Claude has reviewed the late-2025 crypto recovery, outlining upside scenarios for XRP after ETF progress, Solana’s growth in stablecoins, Pepe’s memecoin role and Maxi Doge’s emergence during the broader market rebound. The post Leading AI Claude Predicts the Price of XRP, Solana, PEPE by the End of 2025 appeared first on Cryptonews. -

Decrypt - 22:28 Dec 08, 2025

The CFTC has introduced a pilot allowing Bitcoin, Ethereum, and USDC to be used as margin, while updating rules to support tokenized assets. -

Cryptonews.com - 22:25 Dec 08, 2025

Complaints have emerged that DEX Jupiter had overstated how its risk architecture works – Solana price predictions could be impacted as its native chain. The post Solana Price Prediction: “Zero Risk” Turns Out to Be Wrong – Did This Exchange Expose a Hidden Danger in Crypto? appeared first on Cryptonews. -

Dawn - 22:13 Dec 08, 2025

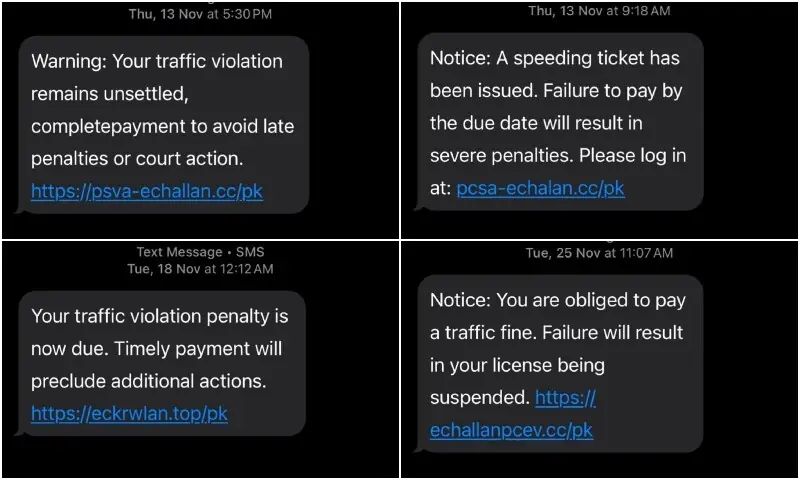

LAHORE: The Punjab Safe Cities Authority (PSCA) has lodged a complaint with the National Cyber Crime Investigation Agency (NCCIA) to track down and take legal action against unknown suspects who cloned the authority’s official website and sent fraudulent alerts to citizens, urging them to pay fines for pending e-challans. Separately, it wrote to the Punjab Police to trace the mobile phone numbers of the suspects, who had created the fake website and disseminated the fraudulent link. The PSCA took action when the link, containing fraudulent pending e-challans, was sent to citizens. The link urged recipients to visit the fake website and follow the steps to pay fines. The authority said that the website and link were not legitimate and confirmed that it was a phishing scheme. A collage of fraudulent text messages sent to citizens, urging them to pay traffic fines. PSCA Managing Director Ahsan Younas told Dawn that scammers use the internet for online fraud and apply various tactics to deceive citizens for finan...

LAHORE: The Punjab Safe Cities Authority (PSCA) has lodged a complaint with the National Cyber Crime Investigation Agency (NCCIA) to track down and take legal action against unknown suspects who cloned the authority’s official website and sent fraudulent alerts to citizens, urging them to pay fines for pending e-challans. Separately, it wrote to the Punjab Police to trace the mobile phone numbers of the suspects, who had created the fake website and disseminated the fraudulent link. The PSCA took action when the link, containing fraudulent pending e-challans, was sent to citizens. The link urged recipients to visit the fake website and follow the steps to pay fines. The authority said that the website and link were not legitimate and confirmed that it was a phishing scheme. A collage of fraudulent text messages sent to citizens, urging them to pay traffic fines. PSCA Managing Director Ahsan Younas told Dawn that scammers use the internet for online fraud and apply various tactics to deceive citizens for finan... -

Adevarul Romania - 22:05 Dec 08, 2025

PrEuropa refuză să-și recunoască declinul, deși datele îl arată clar, susține profesorul Bogdan Glăvan. În opinia sa, continentul a abandonat valorile care i-au adus prosperitatea, înlocuindu-le cu hiper-reglementare și planificare centralizată, ceea ce a accelerat alunecarea spre irelevanță. -

Cointelegraph.com - 22:03 Dec 08, 2025

Improving retail crypto and TradFi investor sentiment align with the recent uptick in Bitcoin price, but sell orders and short positions in the $93,000 range threaten to cap the rally. Over the past two weeks, Bitcoin price repeatedly revisited the $90,000 range as retail investor sentiment improved, fund managers restated their bullish expectations for a potential end-of-year rally, and Strategy announced a sizable BTC purchase. According to VanEck head of digital asset research, Matthew Sigel, Bernstein wrote that “the Bitcoin cycle has broken the 4-year pattern (cycle peaking every 4 years) and is now in an elongated bull-cycle with more sticky institutional buying offsetting any retail panic selling.” Bernstein’s comments follow BlackRock chair and CEO Larry Fink mentioning that sovereign wealth funds are “incrementally” buying Bitcoin as it “has fallen from its $126,000 peak.” Read more

Improving retail crypto and TradFi investor sentiment align with the recent uptick in Bitcoin price, but sell orders and short positions in the $93,000 range threaten to cap the rally. Over the past two weeks, Bitcoin price repeatedly revisited the $90,000 range as retail investor sentiment improved, fund managers restated their bullish expectations for a potential end-of-year rally, and Strategy announced a sizable BTC purchase. According to VanEck head of digital asset research, Matthew Sigel, Bernstein wrote that “the Bitcoin cycle has broken the 4-year pattern (cycle peaking every 4 years) and is now in an elongated bull-cycle with more sticky institutional buying offsetting any retail panic selling.” Bernstein’s comments follow BlackRock chair and CEO Larry Fink mentioning that sovereign wealth funds are “incrementally” buying Bitcoin as it “has fallen from its $126,000 peak.” Read more -

Adevarul Romania - 22:01 Dec 08, 2025

La data de 9 decembrie 1946 a început, la Nürnberg, primul proces împotriva medicilor naziști, acuzați de experimente pe oameni, sterilizări forțate și eutanasie, moment care a dus la stabilirea principiilor etice internaționale în cercetarea medicală. -

NU.nl - 21:58 Dec 08, 2025

Manchester United heeft maandagavond in de uitwedstrijd tegen Wolverhampton Wanderers de ruimste overwinning van het seizoen geboekt. Het werd 1-4, mede dankzij twee doelpunten van Bruno Fernandes. -

AD.nl - 21:58 Dec 08, 2025

Manchester United heeft in de Premier League zonder veel problemen afgerekend met hekkensluiter Wolverhampton Wanderers. The Red Devils wonnen de uitwedstrijd met 1-4 en staan nu in punten gelijk met nummer vijf Chelsea. -

ukrinform.net - 21:57 Dec 08, 2025

France is very supportive of Ukraine, but raising funds for aid is becoming more difficult. At the same time, French volunteers remain mobilized and continue to hold fundraisers, in particular preparing to transfer another STABNET—a stabilization container of medical aid “at zero”—to the 37th Marine Brigade. -

Focus.ua - 21:56 Dec 08, 2025

В одном из заведений питания в селе Зимняя Вода, что под Львовом, на полную громкость включили русскую музыку. Это возмутило общественность, а администрации заведения пришлось объяснять как так случилось. -

Cryptonews.com - 21:55 Dec 08, 2025

Bitcoin has moved back above $92K as analysts track XRP, Dogecoin, Shiba Inu and Bitcoin Hyper as Best Crypto candidates. XRP has seen steady ETF inflows despite heavy shorting, memecoins have retested key demand zones, and a large HYPER presale has raised questions about the next cycle leaders. The post Best Crypto to Buy Today 8 December – XRP, Dogecoin, Shiba Inu appeared first on Cryptonews. -

CoinDesk - 21:55 Dec 08, 2025

Acting Chair Caroline Pham has unveiled a first-of-its-kind U.S. program to permit tokenized collateral in derivatives markets, citing "clear guardrails" for firms. -

ZF English - 21:55 Dec 08, 2025

Chimcomplex Borzesti (CRC.RO) has notified shareholders and investors that by the decision of the Board of Directors on December 8, 2025, the mandate of general manager Cosmin Soaita ended on that date and Stefan Vuza was appointed interim general manager for a 12-month term starting December 8, 2025.

Chimcomplex Borzesti (CRC.RO) has notified shareholders and investors that by the decision of the Board of Directors on December 8, 2025, the mandate of general manager Cosmin Soaita ended on that date and Stefan Vuza was appointed interim general manager for a 12-month term starting December 8, 2025. -

Adevarul Romania - 21:52 Dec 08, 2025

Volodimir Zelenski a subliniat luni că nu are nici dreptul legal, nici dreptul moral să cedeze Rusiei teritorii ucrainene, problema teritorială fiind un punct central al negocierilor în curs asupra unui plan de pace sub mediere americană. -

Cointelegraph.com - 21:51 Dec 08, 2025

Speaking in Abu Dhabi, the Strategy CEO said nations could use Bitcoin reserves and tokenized credit markets to offer regulated accounts with higher yields. Michael Saylor, CEO of the world’s largest Bitcoin treasury holder, is pushing nation-states to develop Bitcoin-backed digital banking systems that offer high-yield, low-volatility accounts capable of attracting trillions of dollars in deposits. Speaking at the Bitcoin MENA event in Abu Dhabi, Saylor said countries could use overcollateralized Bitcoin (BTC) reserves and tokenized credit instruments to create regulated digital bank accounts that offer higher yields than traditional deposits. Saylor noted that bank deposits in Japan, Europe and Switzerland offer little to no yield, while euro money-market funds pay roughly 150 basis points, and US money-market rates are closer to 400 basis points. He said this explains why investors turn to the corporate bond market, which “wouldn’t exist if people weren’t so disgusted with their bank account.” Read more

Speaking in Abu Dhabi, the Strategy CEO said nations could use Bitcoin reserves and tokenized credit markets to offer regulated accounts with higher yields. Michael Saylor, CEO of the world’s largest Bitcoin treasury holder, is pushing nation-states to develop Bitcoin-backed digital banking systems that offer high-yield, low-volatility accounts capable of attracting trillions of dollars in deposits. Speaking at the Bitcoin MENA event in Abu Dhabi, Saylor said countries could use overcollateralized Bitcoin (BTC) reserves and tokenized credit instruments to create regulated digital bank accounts that offer higher yields than traditional deposits. Saylor noted that bank deposits in Japan, Europe and Switzerland offer little to no yield, while euro money-market funds pay roughly 150 basis points, and US money-market rates are closer to 400 basis points. He said this explains why investors turn to the corporate bond market, which “wouldn’t exist if people weren’t so disgusted with their bank account.” Read more -

NU.nl - 21:48 Dec 08, 2025

In Amsterdam zijn de Decembermoorden van 1982 in Suriname herdacht. Het is de eerste herdenkingsdag sinds de dood van oud-president Desi Bouterse, die is veroordeeld voor de moorden. Vanwege zijn dood in december 2024 was maandagavond de laatste herdenkingsdienst in Amsterdam.