Crypto

-

Cryptonews.com - 12:11 Sep 05, 2025

Stablecoin reserves on centralized crypto exchanges have reached an all-time high, climbing to $68 billion in early September, accoridng to latest data from CryptoQuant. The post Stablecoin Reserves on Exchanges Hit Record $68B as Binance Commands 67%: CryptoQuant appeared first on Cryptonews. -

Decrypt - 12:05 Sep 05, 2025

Qubic attempted a 51% attack on Monero while training its AI model AIGarth. It's now posting on social media—and the public isn’t impressed. -

CoinDesk - 12:00 Sep 05, 2025

Implied volatility indexes suggest moderate price swings in major cryptocurrencies like bitcoin and ether, with larger changes in XRP and SOL. -

Cryptonews.com - 11:57 Sep 05, 2025

Sora Ventures has launched Asia’s $1B Bitcoin Fund with a $200M institutional commitment, aiming to build a centralized treasury pool within six months The post Asia’s $1B Bitcoin Fund Launched by Sora Ventures in Bold Institutional Play appeared first on Cryptonews. -

CoinDesk - 11:55 Sep 05, 2025

The fund aims to strengthen Asia's network of bitcoin treasury firms and has secured $200 million from investors in the region. -

Decrypt - 11:54 Sep 05, 2025

With some real firepower, big backing and huge partners already lined up, this will be a new L1 blockchain to take very seriously. -

Cointelegraph.com - 11:43 Sep 05, 2025

South Korea’s Financial Services Commission introduced new rules for crypto lending, banning leveraged loans, capping interest at 20% and restricting use to the top coins. South Korea’s Financial Services Commission (FSC) set new rules for crypto lending. The FSC said on Friday that interest on crypto lending is now capped at 20% in South Korea, and leveraged lending is not allowed. Crypto lending is restricted to the top 20 tokens by market capitalization or those listed on at least three won-based exchanges. The new rules follow late July reports that South Korea’s financial regulators had plans to release guidelines on cryptocurrency lending services to tighten oversight and protect investors. The move also followed the introduction of leveraged lending services by local crypto exchanges. Read more

South Korea’s Financial Services Commission introduced new rules for crypto lending, banning leveraged loans, capping interest at 20% and restricting use to the top coins. South Korea’s Financial Services Commission (FSC) set new rules for crypto lending. The FSC said on Friday that interest on crypto lending is now capped at 20% in South Korea, and leveraged lending is not allowed. Crypto lending is restricted to the top 20 tokens by market capitalization or those listed on at least three won-based exchanges. The new rules follow late July reports that South Korea’s financial regulators had plans to release guidelines on cryptocurrency lending services to tighten oversight and protect investors. The move also followed the introduction of leveraged lending services by local crypto exchanges. Read more -

CoinDesk - 11:11 Sep 05, 2025

The blockchain analytics specialist has released a due diligence product for stablecoins that's tailored to banks and compliance departments. -

CoinDesk - 11:04 Sep 05, 2025

Bullish, whose parent company Bullish Group is also the owner of CoinDesk, began trading on the New York Stock Exchange last month. -

Cointelegraph.com - 10:48 Sep 05, 2025

Sora Ventures said the fund is backed by an initial capital commitment of $200 million from institutional partners across Asia. Crypto venture capital company Sora Ventures announced a $1 billion Bitcoin treasury fund, and said it plans to acquire the full amount within six months. On Friday at Taipei Blockchain Week, Sora Ventures founder Jason Fang unveiled what he called “Asia’s first $1 billion Bitcoin treasury fund” during a discussion titled, Introducing BTC Strategy into Major Asia Equity Markets. Sora said the fund is backed by a $200 million capital commitment from institutional partners across the region. In an article shared by Fang, the company said it aims to accelerate Bitcoin adoption among corporate treasuries. Read more

Sora Ventures said the fund is backed by an initial capital commitment of $200 million from institutional partners across Asia. Crypto venture capital company Sora Ventures announced a $1 billion Bitcoin treasury fund, and said it plans to acquire the full amount within six months. On Friday at Taipei Blockchain Week, Sora Ventures founder Jason Fang unveiled what he called “Asia’s first $1 billion Bitcoin treasury fund” during a discussion titled, Introducing BTC Strategy into Major Asia Equity Markets. Sora said the fund is backed by a $200 million capital commitment from institutional partners across the region. In an article shared by Fang, the company said it aims to accelerate Bitcoin adoption among corporate treasuries. Read more -

Cointelegraph.com - 10:42 Sep 05, 2025

From BitMine’s massive 1.5 million ETH reserve to Coinbase’s dual-purpose holdings, corporate treasuries are rewriting the Ether playbook in 2025. Companies aren’t just holding ETH; they are staking and restaking to generate steady onchain income. Mega-holders like BitMine (1.5 million ETH) can sway liquidity, validator distribution and even upgrade dynamics. Weekly ETH disclosures from firms like SharpLink give investors real-time insight into accumulation and staking rewards. Read more

From BitMine’s massive 1.5 million ETH reserve to Coinbase’s dual-purpose holdings, corporate treasuries are rewriting the Ether playbook in 2025. Companies aren’t just holding ETH; they are staking and restaking to generate steady onchain income. Mega-holders like BitMine (1.5 million ETH) can sway liquidity, validator distribution and even upgrade dynamics. Weekly ETH disclosures from firms like SharpLink give investors real-time insight into accumulation and staking rewards. Read more -

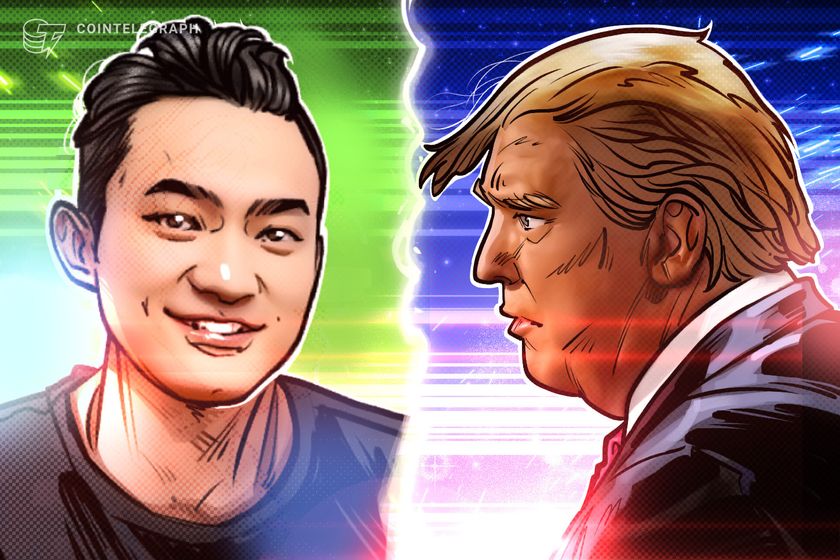

Cointelegraph.com - 10:37 Sep 05, 2025

Sun said his WLFI pre-sale allocation was “unreasonably frozen” in a move that could damage the reputation of the Trump-family-linked decentralized finance platform. Update Sept. 5, 11:20 a.m. UTC: This article has been updated to include insights from Coinbase’s Conor Grogan. Tron founder Justin Sun is urging World Liberty Financial (WLFI), a crypto project linked to the Trump family, to unfreeze his token allocation. His wallets were blacklisted after suspicious transactions flagged by blockchain trackers sparked accusations of selling. Sun’s World Liberty Financial (WLFI) token address was blacklisted on Thursday, after blockchain data from Nansen and Arkham flagged the address for a $9 million transfer, Cointelegraph reported. Read more

Sun said his WLFI pre-sale allocation was “unreasonably frozen” in a move that could damage the reputation of the Trump-family-linked decentralized finance platform. Update Sept. 5, 11:20 a.m. UTC: This article has been updated to include insights from Coinbase’s Conor Grogan. Tron founder Justin Sun is urging World Liberty Financial (WLFI), a crypto project linked to the Trump family, to unfreeze his token allocation. His wallets were blacklisted after suspicious transactions flagged by blockchain trackers sparked accusations of selling. Sun’s World Liberty Financial (WLFI) token address was blacklisted on Thursday, after blockchain data from Nansen and Arkham flagged the address for a $9 million transfer, Cointelegraph reported. Read more -

Decrypt - 10:28 Sep 05, 2025

The abduction of a Swiss citizen marks the latest in a string of brutal “wrench attacks” targeting cryptocurrency holders. -

CoinDesk - 09:57 Sep 05, 2025

Company holds 52,477 BTC, advances Texas wind farm and European growth while shares face year-to-date decline. -

Cointelegraph.com - 09:50 Sep 05, 2025

Bitcoin’s relief bounce above $112,000 liquidated shorts as analysts said BTC price may get an additional boost from the US jobs report. Key takeaways: Bitcoin breaks back above $112,000 on Friday as bulls clinch key support. More crypto market volatility is expected after the release of the US jobs report later on Friday. Read more

Bitcoin’s relief bounce above $112,000 liquidated shorts as analysts said BTC price may get an additional boost from the US jobs report. Key takeaways: Bitcoin breaks back above $112,000 on Friday as bulls clinch key support. More crypto market volatility is expected after the release of the US jobs report later on Friday. Read more -

Decrypt - 06:55 Sep 05, 2025

Nearly a year of former Chair Gary Gensler’s government texts were erased after a chain of avoidable IT decisions, the OIG said Wednesday. -

Decrypt - 05:25 Sep 05, 2025

Ark Invest disclosed a stake in Figma after its first earnings sent shares tumbling, as the firm stressed it’s focused on design, not Bitcoin. -

Decrypt - 05:10 Sep 05, 2025

Bitcoin is holding steady as traders await Friday’s U.S. jobs report, seen as pivotal for the Federal Reserve’s September policy decision. -

CryptoSlate - 01:00 Sep 05, 2025

Bitcoin (BTC) trades within a consolidation range between $104,000 and $116,000, with on-chain data revealing critical levels that could determine the next directional move. According to a Sept. 4 report by Glassnode, Bitcoin entered a volatile downtrend following its mid-August all-time high, declining to $108,000 before rebounding toward current levels. The UTXO Realized Price Distribution […] The post Bitcoin consolidates between $104,000 and $116,000 as market faces critical decision Point appeared first on CryptoSlate.