Cointelegraph.com

Source:

https://cointelegraph.com

Found 7276 news

-

Cointelegraph.com - 14:51 Nov 17, 2025

Brazil isn’t buying Bitcoin for sovereign reserves. Instead, cities, corporates and B3 products are creating a regulated path to treasury use. Brazil’s moves are corporate and municipal, not sovereign. B3’s spot ETFs and resized 0.01-BTC futures let treasurers gain, size and hedge exposure using familiar tools. New VASP standards (licensing, AML/CFT, governance, security), effective February 2026, reduce operational uncertainty. Read more

Brazil isn’t buying Bitcoin for sovereign reserves. Instead, cities, corporates and B3 products are creating a regulated path to treasury use. Brazil’s moves are corporate and municipal, not sovereign. B3’s spot ETFs and resized 0.01-BTC futures let treasurers gain, size and hedge exposure using familiar tools. New VASP standards (licensing, AML/CFT, governance, security), effective February 2026, reduce operational uncertainty. Read more -

Cointelegraph.com - 13:40 Nov 17, 2025

The tokenized luxury resort development plan may set a “new benchmark” for tokenized real estate investment, said Eric Trump. The Trump Organization and London-listed luxury real estate developer Dar Global are debuting a tokenized luxury hotel development project in the Maldives, one of the world’s most exclusive holiday destinations. The Trump Organization and Dar Global are tokenizing the development of a luxury hospitality project, introducing an “unprecedented financial innovation,” according to a joint announcement on Monday. Unlike most tokenized real-estate projects, which fractionalize ownership of completed or near-completed properties, the initiative will allow investors to gain exposure at the earliest stages of development. Read more

The tokenized luxury resort development plan may set a “new benchmark” for tokenized real estate investment, said Eric Trump. The Trump Organization and London-listed luxury real estate developer Dar Global are debuting a tokenized luxury hotel development project in the Maldives, one of the world’s most exclusive holiday destinations. The Trump Organization and Dar Global are tokenizing the development of a luxury hospitality project, introducing an “unprecedented financial innovation,” according to a joint announcement on Monday. Unlike most tokenized real-estate projects, which fractionalize ownership of completed or near-completed properties, the initiative will allow investors to gain exposure at the earliest stages of development. Read more -

Cointelegraph.com - 13:14 Nov 17, 2025

EU lawmakers stripped out mandatory client-side message scanning from the latest Chat Control draft, but invasive age checks and voluntary scanning remain. European Union efforts to mandate scanning of private messages have been blocked again, marking another setback for the bloc’s proposed Chat Control legislation, and another win for digital rights activists. German digital rights activist and Pirate Party Germany politician Patrick Breyer wrote in a Nov. 15 X post that a backdoor, which he said mandated client-side scanning of messages, had been removed from the latest draft of the “Regulation to Prevent and Combat Child Sexual Abuse” proposal, more commonly known as Chat Control. According to him, the addition of the following line under the Danish Presidency of the Council of the EU — which also saw the introduction of the backdoor clause — resolved the issue: The draft used vague language referring to “all possible risk mitigation measures,” which, according to critics, would allow authorities to force ...

EU lawmakers stripped out mandatory client-side message scanning from the latest Chat Control draft, but invasive age checks and voluntary scanning remain. European Union efforts to mandate scanning of private messages have been blocked again, marking another setback for the bloc’s proposed Chat Control legislation, and another win for digital rights activists. German digital rights activist and Pirate Party Germany politician Patrick Breyer wrote in a Nov. 15 X post that a backdoor, which he said mandated client-side scanning of messages, had been removed from the latest draft of the “Regulation to Prevent and Combat Child Sexual Abuse” proposal, more commonly known as Chat Control. According to him, the addition of the following line under the Danish Presidency of the Council of the EU — which also saw the introduction of the backdoor clause — resolved the issue: The draft used vague language referring to “all possible risk mitigation measures,” which, according to critics, would allow authorities to force ... -

Cointelegraph.com - 12:58 Nov 17, 2025

Corporations have quietly amassed nearly 7% of the Bitcoin supply, as analysts note a growing institutional influence on the crypto market’s liquidity. Corporate Bitcoin holdings continue to climb, but treasury executives argue the trend is strengthening, not weakening, decentralization across the network. Despite increasing concerns about concentrated Bitcoin (BTC) ownership, emerging corporate treasury firms and new institutional players are contributing to broader distribution across the ecosystem, according to several executives speaking at Bitcoin Amsterdam 2025. “At the end of the day, what we are doing is really decentralizing Bitcoin. It doesn’t seem like that, but it is the case through the demand that we provide in the market,” said Alexander Laizet, board director of Bitcoin strategy at Capital B. Read more

Corporations have quietly amassed nearly 7% of the Bitcoin supply, as analysts note a growing institutional influence on the crypto market’s liquidity. Corporate Bitcoin holdings continue to climb, but treasury executives argue the trend is strengthening, not weakening, decentralization across the network. Despite increasing concerns about concentrated Bitcoin (BTC) ownership, emerging corporate treasury firms and new institutional players are contributing to broader distribution across the ecosystem, according to several executives speaking at Bitcoin Amsterdam 2025. “At the end of the day, what we are doing is really decentralizing Bitcoin. It doesn’t seem like that, but it is the case through the demand that we provide in the market,” said Alexander Laizet, board director of Bitcoin strategy at Capital B. Read more -

Cointelegraph.com - 12:47 Nov 17, 2025

Investors retreat from crypto ETPs across major regions, resulting in a 27% decline in AUM from October’s peak as uncertainty drives a shift toward safer products. Crypto investment products logged their largest weekly outflows since February, shedding $2 billion as global risk appetite declined. Crypto exchange-traded products (ETPs) saw $2 billion in outflows last week, up by nearly 71% from $1.17 billion recorded the previous week, CoinShares reported on Monday. This marks the third consecutive week of outflows, extending the cumulative outflow streak to $3.2 billion. CoinShares’ head of research, James Butterfill, attributed the outflows to monetary policy uncertainty and selling by crypto-native whales. As a result, total assets under management (AUM) in crypto ETPs decreased to $191 billion, representing a 27% decline from their peak of $264 billion in October. Read more

Investors retreat from crypto ETPs across major regions, resulting in a 27% decline in AUM from October’s peak as uncertainty drives a shift toward safer products. Crypto investment products logged their largest weekly outflows since February, shedding $2 billion as global risk appetite declined. Crypto exchange-traded products (ETPs) saw $2 billion in outflows last week, up by nearly 71% from $1.17 billion recorded the previous week, CoinShares reported on Monday. This marks the third consecutive week of outflows, extending the cumulative outflow streak to $3.2 billion. CoinShares’ head of research, James Butterfill, attributed the outflows to monetary policy uncertainty and selling by crypto-native whales. As a result, total assets under management (AUM) in crypto ETPs decreased to $191 billion, representing a 27% decline from their peak of $264 billion in October. Read more -

Cointelegraph.com - 12:18 Nov 17, 2025

SGX is aiming to capture rising institutional crypto demand by launching the second set of Bitcoin and Ether perpetual futures products in Singapore. Singapore’s main derivatives exchange will introduce two new cryptocurrency futures products this month, citing rising institutional interest in digital assets. SGX Derivatives is launching Bitcoin (BTC) and Ether (ETH) perpetual futures, which are financial derivatives contracts enabling investors to bet on the spot price of the underlying asset without an expiration date. In a Monday announcement, SGX said it is launching new trading products to meet what it describes as the “rising institutional crypto demand, converging TradFi and crypto-native ecosystems.” Read more

SGX is aiming to capture rising institutional crypto demand by launching the second set of Bitcoin and Ether perpetual futures products in Singapore. Singapore’s main derivatives exchange will introduce two new cryptocurrency futures products this month, citing rising institutional interest in digital assets. SGX Derivatives is launching Bitcoin (BTC) and Ether (ETH) perpetual futures, which are financial derivatives contracts enabling investors to bet on the spot price of the underlying asset without an expiration date. In a Monday announcement, SGX said it is launching new trading products to meet what it describes as the “rising institutional crypto demand, converging TradFi and crypto-native ecosystems.” Read more -

Cointelegraph.com - 11:40 Nov 17, 2025

Bitcoin erased all its 2025 gains and gave up key bull-market trendlines as traders' BTC price outlooks include a return to $76,000. Bitcoin (BTC) starts a new week with the bull market at stake as BTC price predictions diverge wildly. Bitcoin traders are stuck between hope and capitulation as BTC/USD returns to its yearly open level. Price eyes a key “magnet” in the form of an old CME futures gap left over from April. Read more

Bitcoin erased all its 2025 gains and gave up key bull-market trendlines as traders' BTC price outlooks include a return to $76,000. Bitcoin (BTC) starts a new week with the bull market at stake as BTC price predictions diverge wildly. Bitcoin traders are stuck between hope and capitulation as BTC/USD returns to its yearly open level. Price eyes a key “magnet” in the form of an old CME futures gap left over from April. Read more -

Cointelegraph.com - 11:22 Nov 17, 2025

UBS and Ant International will test tokenized deposits for real-time cross-border payments and liquidity management in one of Singapore’s largest blockchain pilots. Investment bank UBS has entered a strategic partnership with financial technology company Ant International to explore tokenized deposits for real-time cross-border payments and global liquidity management, marking a notable expansion of the Swiss bank’s blockchain-based digital cash platform. The two companies signed a Memorandum of Understanding in Singapore, anchoring the deal in one of the most active hubs for institutional blockchain experimentation. The move positions tokenized bank money as a potential replacement for traditional treasury settlement rails, which are still defined by cut-offs, fragmentation and multicurrency delays. Ant International, which oversees operations within the broader Alipay+ ecosystem, announced that it will utilize UBS Digital Cash to streamline internal treasury transfers across jurisdictions. Read more

UBS and Ant International will test tokenized deposits for real-time cross-border payments and liquidity management in one of Singapore’s largest blockchain pilots. Investment bank UBS has entered a strategic partnership with financial technology company Ant International to explore tokenized deposits for real-time cross-border payments and global liquidity management, marking a notable expansion of the Swiss bank’s blockchain-based digital cash platform. The two companies signed a Memorandum of Understanding in Singapore, anchoring the deal in one of the most active hubs for institutional blockchain experimentation. The move positions tokenized bank money as a potential replacement for traditional treasury settlement rails, which are still defined by cut-offs, fragmentation and multicurrency delays. Ant International, which oversees operations within the broader Alipay+ ecosystem, announced that it will utilize UBS Digital Cash to streamline internal treasury transfers across jurisdictions. Read more -

Cointelegraph.com - 09:47 Nov 17, 2025

With just under 2 million Bitcoin that will ever be mined from here on out, Bitcoin’s “real story” is about to unfold. Bitcoin’s total circulating supply has just crossed 95% of its 21 million hard supply cap — a massive milestone baked in nearly 17 years ago when creator Satoshi Nakamoto mined the genesis block on Jan. 3, 2009. With 19.95 million Bitcoin now in circulation, this leaves just 2.05 million Bitcoin to be mined. The question is, what does this mean for the future of Bitcoin and its price? Speaking to Cointelegraph, Thomas Perfumo, a global economist at crypto exchange Kraken, said it’s an important milestone in the Bitcoin narrative, because annual supply inflation is currently around 0.8% per annum, and hard money “requires a credible narrative for people to confidently adopt a currency as a store of value.” Read more

With just under 2 million Bitcoin that will ever be mined from here on out, Bitcoin’s “real story” is about to unfold. Bitcoin’s total circulating supply has just crossed 95% of its 21 million hard supply cap — a massive milestone baked in nearly 17 years ago when creator Satoshi Nakamoto mined the genesis block on Jan. 3, 2009. With 19.95 million Bitcoin now in circulation, this leaves just 2.05 million Bitcoin to be mined. The question is, what does this mean for the future of Bitcoin and its price? Speaking to Cointelegraph, Thomas Perfumo, a global economist at crypto exchange Kraken, said it’s an important milestone in the Bitcoin narrative, because annual supply inflation is currently around 0.8% per annum, and hard money “requires a credible narrative for people to confidently adopt a currency as a store of value.” Read more -

Cointelegraph.com - 09:42 Nov 17, 2025

Adam Back says Bitcoin faces no meaningful quantum threat for at least the next 20–40 years, adding that NIST-approved post-quantum standards can be adopted in time. Adam Back, the cryptographer and cypherpunk cited in the Bitcoin white paper, said Bitcoin is unlikely to face a meaningful threat from quantum computing for at least two to four decades. Responding to an X user on Nov. 15 who asked whether Bitcoin (BTC) is at risk, Back wrote that “probably not for 20–40 years,” adding that there are already post-quantum encryption standards approved by the National Institute of Standards and Technology (NIST) that Bitcoin could implement “long before cryptographically relevant quantum computers arrive.” The discussion began with a user posting a video of Canadian-American venture capitalist and entrepreneur Chamath Palihapitiya, who predicted that the quantum threat to Bitcoin would become a reality in two to five years. He noted that to break SHA-256 — the encryption standard that Bitcoin relies on — quantum c...

Adam Back says Bitcoin faces no meaningful quantum threat for at least the next 20–40 years, adding that NIST-approved post-quantum standards can be adopted in time. Adam Back, the cryptographer and cypherpunk cited in the Bitcoin white paper, said Bitcoin is unlikely to face a meaningful threat from quantum computing for at least two to four decades. Responding to an X user on Nov. 15 who asked whether Bitcoin (BTC) is at risk, Back wrote that “probably not for 20–40 years,” adding that there are already post-quantum encryption standards approved by the National Institute of Standards and Technology (NIST) that Bitcoin could implement “long before cryptographically relevant quantum computers arrive.” The discussion began with a user posting a video of Canadian-American venture capitalist and entrepreneur Chamath Palihapitiya, who predicted that the quantum threat to Bitcoin would become a reality in two to five years. He noted that to break SHA-256 — the encryption standard that Bitcoin relies on — quantum c... -

Cointelegraph.com - 09:08 Nov 17, 2025

Bitcoin’s price is now at a “pivotal juncture” as the fate of the market cycle depends on incoming macro signals and maintaining key technical price levels. US spot Bitcoin exchange-traded funds (ETFs) closed a third straight week in the red, deepening concerns that one of Bitcoin’s biggest institutional demand engines is stalling. Spot Bitcoin (BTC) ETFs saw $1.1 billion in net negative outflows during the past trading week, marking their fourth-largest week of outflows on record, according to Farside Investors data. The ETF outflows occurred during a significant correction, as Bitcoin’s price fell by over 9.9% during the past week, to trade at $95,740 at the time of writing, Cointelegraph data shows. Read more

Bitcoin’s price is now at a “pivotal juncture” as the fate of the market cycle depends on incoming macro signals and maintaining key technical price levels. US spot Bitcoin exchange-traded funds (ETFs) closed a third straight week in the red, deepening concerns that one of Bitcoin’s biggest institutional demand engines is stalling. Spot Bitcoin (BTC) ETFs saw $1.1 billion in net negative outflows during the past trading week, marking their fourth-largest week of outflows on record, according to Farside Investors data. The ETF outflows occurred during a significant correction, as Bitcoin’s price fell by over 9.9% during the past week, to trade at $95,740 at the time of writing, Cointelegraph data shows. Read more -

Cointelegraph.com - 08:54 Nov 17, 2025

Dutch central bank governor Olaf Sleijpen warned that if stablecoins falter, issuers may be forced to liquidate their reserves, thereby magnifying stress across markets. The European Central Bank (ECB) may soon be compelled to view stablecoins not just as a regulatory concern, but also as a potential source of macroeconomic shocks, according to Dutch central bank governor Olaf Sleijpen. In a Financial Times interview, Sleijpen warned that the fast-growing dollar-pegged stablecoins could become systemically relevant to Europe’s financial ecosystem. He said that if the tokens were to destabilize, they could affect financial stability, the wider economy and even inflation. “If stablecoins are not that stable, you could end up in a situation where the underlying assets need to be sold quickly,” he said, underscoring that rapid liquidation could amplify stress across markets. Read more

Dutch central bank governor Olaf Sleijpen warned that if stablecoins falter, issuers may be forced to liquidate their reserves, thereby magnifying stress across markets. The European Central Bank (ECB) may soon be compelled to view stablecoins not just as a regulatory concern, but also as a potential source of macroeconomic shocks, according to Dutch central bank governor Olaf Sleijpen. In a Financial Times interview, Sleijpen warned that the fast-growing dollar-pegged stablecoins could become systemically relevant to Europe’s financial ecosystem. He said that if the tokens were to destabilize, they could affect financial stability, the wider economy and even inflation. “If stablecoins are not that stable, you could end up in a situation where the underlying assets need to be sold quickly,” he said, underscoring that rapid liquidation could amplify stress across markets. Read more -

Cointelegraph.com - 01:53 Nov 17, 2025

The Ivy League university held 6.8 million shares in BlackRock’s Bitcoin ETF as of Sept. 30, 2025, and has also boosted its exposure to gold. Harvard University boosted its investment in BlackRock’s Bitcoin exchange-traded fund (ETF) by over 250% in the third quarter after the Ivy League school first bought into the fund earlier this year. Harvard Management Company, the business that manages the university’s $57 billion endowment fund, reported in a regulatory filing on Friday that it held over 6.8 million shares in the iShares Bitcoin Trust ETF (IBIT) worth $442.8 million as of Sept. 30. The university disclosed in August that it had a position IBIT for the first time, holding around 1.9 million shares then worth $116.6 million. Read more

The Ivy League university held 6.8 million shares in BlackRock’s Bitcoin ETF as of Sept. 30, 2025, and has also boosted its exposure to gold. Harvard University boosted its investment in BlackRock’s Bitcoin exchange-traded fund (ETF) by over 250% in the third quarter after the Ivy League school first bought into the fund earlier this year. Harvard Management Company, the business that manages the university’s $57 billion endowment fund, reported in a regulatory filing on Friday that it held over 6.8 million shares in the iShares Bitcoin Trust ETF (IBIT) worth $442.8 million as of Sept. 30. The university disclosed in August that it had a position IBIT for the first time, holding around 1.9 million shares then worth $116.6 million. Read more -

Cointelegraph.com - 01:41 Nov 17, 2025

A Cardano holder mistakenly turned $6.9 million worth of ADA into $847,695 million worth of a little-known stablecoin after using a highly illiquid trading pool. A five-year Cardano holder accidentally torched more than $6 million in ADA after using an illiquid trading pool to facilitate a stablecoin swap. The trade, first noted by blockchain sleuth ZachXBT on Sunday, saw 14.4 million Cardano (ADA) tokens worth $6.9 million swapped for 847,695 of the US dollar Anzens (USDA) stablecoin, resulting in a loss of approximately $6.05 million. The Cardano user — with wallet address “addr…4x534” — appeared to make a test transaction of 4,437 ADA for a US dollar stablecoin with the ticker USD at 4:06 pm UTC on Sunday, just 33 seconds before the multimillion-dollar swap to USDA. Read more

A Cardano holder mistakenly turned $6.9 million worth of ADA into $847,695 million worth of a little-known stablecoin after using a highly illiquid trading pool. A five-year Cardano holder accidentally torched more than $6 million in ADA after using an illiquid trading pool to facilitate a stablecoin swap. The trade, first noted by blockchain sleuth ZachXBT on Sunday, saw 14.4 million Cardano (ADA) tokens worth $6.9 million swapped for 847,695 of the US dollar Anzens (USDA) stablecoin, resulting in a loss of approximately $6.05 million. The Cardano user — with wallet address “addr…4x534” — appeared to make a test transaction of 4,437 ADA for a US dollar stablecoin with the ticker USD at 4:06 pm UTC on Sunday, just 33 seconds before the multimillion-dollar swap to USDA. Read more -

Cointelegraph.com - 23:42 Nov 16, 2025

Bitcoin’s latest tumble pushed it below the $93,507 price it entered the year at, despite the year mostly seeing positive industry developments from corporations and governments. Bitcoin briefly lost all of its gains this year after the crypto markets bled over the weekend, despite the US government reopening on Thursday, which was expected to provide much-needed relief to the markets. Bitcoin (BTC) fell to a low of $93,029 on Sunday, down 25% from its all-time high in October. It started the year at $93,507. It has since rebounded to around $94,209, CoinGecko data shows. Read more

Bitcoin’s latest tumble pushed it below the $93,507 price it entered the year at, despite the year mostly seeing positive industry developments from corporations and governments. Bitcoin briefly lost all of its gains this year after the crypto markets bled over the weekend, despite the US government reopening on Thursday, which was expected to provide much-needed relief to the markets. Bitcoin (BTC) fell to a low of $93,029 on Sunday, down 25% from its all-time high in October. It started the year at $93,507. It has since rebounded to around $94,209, CoinGecko data shows. Read more -

Cointelegraph.com - 21:08 Nov 16, 2025

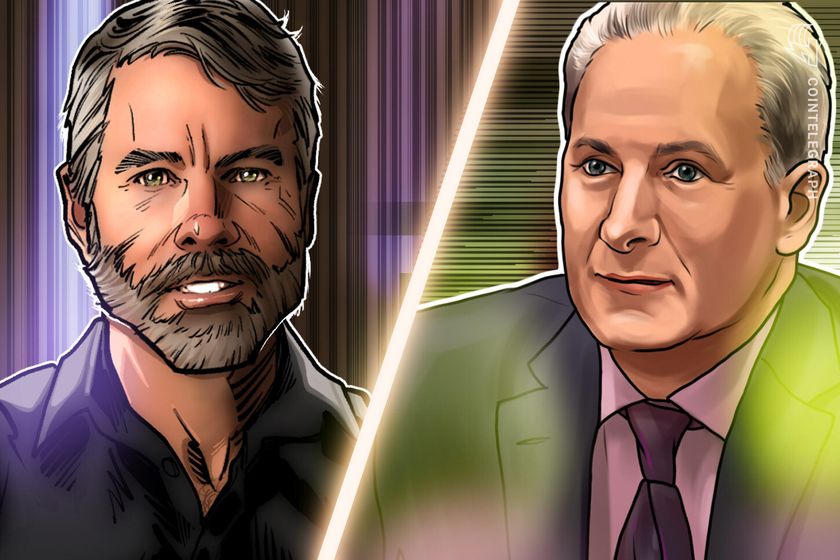

Schiff also challenged Binance co-founder Changpeng Zhao (CZ) to a debate, slated to take place in December in the United Arab Emirates. Gold investor Peter Schiff called Strategy’s business model, which hatched the biggest Bitcoin (BTC) treasury company in the world, a “fraud” on Sunday and challenged the company’s founder, Michael Saylor, to a debate. Schiff, who is one of crypto and Bitcoin’s harshest critics and a staunch gold advocate, challenged Saylor to a debate at Binance Blockchain Week in Dubai, United Arab Emirates (UAE), in December. In a separate X post, Schiff argued: Once this happens, Strategy will no longer be able to issue more debt, sparking a “death spiral,” Schiff continued. Read more

Schiff also challenged Binance co-founder Changpeng Zhao (CZ) to a debate, slated to take place in December in the United Arab Emirates. Gold investor Peter Schiff called Strategy’s business model, which hatched the biggest Bitcoin (BTC) treasury company in the world, a “fraud” on Sunday and challenged the company’s founder, Michael Saylor, to a debate. Schiff, who is one of crypto and Bitcoin’s harshest critics and a staunch gold advocate, challenged Saylor to a debate at Binance Blockchain Week in Dubai, United Arab Emirates (UAE), in December. In a separate X post, Schiff argued: Once this happens, Strategy will no longer be able to issue more debt, sparking a “death spiral,” Schiff continued. Read more -

Cointelegraph.com - 19:19 Nov 16, 2025

Individuals from both communities sparred over privacy, centralization, and market manipulation as ZEC continues to dominate the narrative. The debate between the Bitcoin (BTC) and Zcash (ZEC) communities intensified on Sunday as the price of Zcash recovered to over $700, after falling to a low of $598 on Saturday. “The ‘Bitcoin only, everything else is a scam’ crowd is going to get really twisted trying to figure out what to say about Zcash,” the CEO of investment firm Bitwise, Hunter Horsley, said in an X post, which ignited a firestorm of responses. “No, we’re pretty comfortable calling this obviously coordinated pump and dump of a VC coin a scam,” Bit Paine said in response, referencing Zcash’s 1,500% rally since October. Read more

Individuals from both communities sparred over privacy, centralization, and market manipulation as ZEC continues to dominate the narrative. The debate between the Bitcoin (BTC) and Zcash (ZEC) communities intensified on Sunday as the price of Zcash recovered to over $700, after falling to a low of $598 on Saturday. “The ‘Bitcoin only, everything else is a scam’ crowd is going to get really twisted trying to figure out what to say about Zcash,” the CEO of investment firm Bitwise, Hunter Horsley, said in an X post, which ignited a firestorm of responses. “No, we’re pretty comfortable calling this obviously coordinated pump and dump of a VC coin a scam,” Bit Paine said in response, referencing Zcash’s 1,500% rally since October. Read more -

Cointelegraph.com - 12:32 Nov 16, 2025

Japan’s FSA plans to reclassify crypto as financial products, enforce new disclosure and insider trading rules, and cut the crypto tax rate from 55% to a flat 20%. Japan’s Financial Services Agency (FSA) is preparing an overhaul of the country’s crypto regulatory framework, moving to classify digital assets as “financial products” under the Financial Instruments and Exchange Act. The plan would introduce mandatory disclosures for 105 cryptocurrencies listed on domestic exchanges, including Bitcoin (BTC) and Ether (ETH), and bring them under insider trading regulations for the first time, according to a Sunday report from Asahi Shinmun. If enacted, exchanges would be required to disclose detailed information about each of the 105 tokens they list, including whether the asset has an identifiable issuer, the blockchain technology underpinning it and its volatility profile, per the report. Read more

Japan’s FSA plans to reclassify crypto as financial products, enforce new disclosure and insider trading rules, and cut the crypto tax rate from 55% to a flat 20%. Japan’s Financial Services Agency (FSA) is preparing an overhaul of the country’s crypto regulatory framework, moving to classify digital assets as “financial products” under the Financial Instruments and Exchange Act. The plan would introduce mandatory disclosures for 105 cryptocurrencies listed on domestic exchanges, including Bitcoin (BTC) and Ether (ETH), and bring them under insider trading regulations for the first time, according to a Sunday report from Asahi Shinmun. If enacted, exchanges would be required to disclose detailed information about each of the 105 tokens they list, including whether the asset has an identifiable issuer, the blockchain technology underpinning it and its volatility profile, per the report. Read more -

Cointelegraph.com - 10:06 Nov 16, 2025

Upbit operator Dunamu posted $165 million in Q3 net income, driven by a market rebound and stronger investor confidence following new US crypto legislation. Upbit operator Dunamu reported a surge in profitability for the third quarter of the year, posting 239 billion won ($165 million) in net income. The figure marks an increase of more than 300% compared to the same period last year, which stood at $40 million, local news outlet Chosun Biz reported, citing regulatory filings with the Financial Supervisory Service. The filing reportedly showed strong momentum across all key metrics. Consolidated revenue climbed to $266 million, up 35% from the previous quarter, while operating profit rose 54% to $162 million. Net income also jumped 145% quarter-over-quarter from $67 million. Read more

Upbit operator Dunamu posted $165 million in Q3 net income, driven by a market rebound and stronger investor confidence following new US crypto legislation. Upbit operator Dunamu reported a surge in profitability for the third quarter of the year, posting 239 billion won ($165 million) in net income. The figure marks an increase of more than 300% compared to the same period last year, which stood at $40 million, local news outlet Chosun Biz reported, citing regulatory filings with the Financial Supervisory Service. The filing reportedly showed strong momentum across all key metrics. Consolidated revenue climbed to $266 million, up 35% from the previous quarter, while operating profit rose 54% to $162 million. Net income also jumped 145% quarter-over-quarter from $67 million. Read more -

Cointelegraph.com - 07:51 Nov 16, 2025

Solari Capital, led by AJ Scaramucci, has put more than $100 million into American Bitcoin, the mining firm tied to President Trump’s sons. The Scaramucci family has invested over $100 million into American Bitcoin, the mining company tied to US President Donald Trump’s sons. The funding came through Solari Capital, the investment firm founded by AJ Scaramucci, which led the company’s $220 million round in July, months before American Bitcoin went public through a reverse merger in September, according to a report from Fortune. The miner did not previously disclose its backers. AJ Scaramucci told Fortune that Solari Capital contributed “over $100 million,” though he did not reveal the exact amount. His father, Anthony Scaramucci, also participated with a smaller investment. Read more

Solari Capital, led by AJ Scaramucci, has put more than $100 million into American Bitcoin, the mining firm tied to President Trump’s sons. The Scaramucci family has invested over $100 million into American Bitcoin, the mining company tied to US President Donald Trump’s sons. The funding came through Solari Capital, the investment firm founded by AJ Scaramucci, which led the company’s $220 million round in July, months before American Bitcoin went public through a reverse merger in September, according to a report from Fortune. The miner did not previously disclose its backers. AJ Scaramucci told Fortune that Solari Capital contributed “over $100 million,” though he did not reveal the exact amount. His father, Anthony Scaramucci, also participated with a smaller investment. Read more

7276 items