Gemini | Crypto

"Gemini" in Crypto feed

-

CryptoSlate - 11:30 Sep 17, 2025

The SEC and Gemini, the exchange founded by Tyler and Cameron Winklevoss, reached a settlement in principle to resolve the agency’s 2023 lawsuit over the Gemini Earn program, with a court deadline for an update on final papers set for Dec. 15. Per Reuters, the filing states the agreement would completely resolve the litigation pending […] The post Gemini stock could sink if yield ambitions die under harsh SEC settlement terms appeared first on CryptoSlate. -

CryptoSlate - 21:00 Sep 12, 2025

Gemini made a strong entrance on Wall Street on Sept. 12, with its stock price surging over 50% within the intial hours of their first day of trading on the Nasdaq. The stock, listed under the symbol GEMI, opened at $28 per share and quickly advanced in the opening hours. Prices briefly touched $40 before […] The post Gemini shares hit $40 within hours of Nasdaq debut, showcasing Wall Street’s crypto appetite appeared first on CryptoSlate. -

Cointelegraph.com - 18:18 Sep 12, 2025

Gemini’s $425 million Nasdaq debut marks the latest in a wave of blockbuster crypto IPOs, as investor demand surges for digital asset equities. Shares of Gemini Space Station (GEMI), the digital asset exchange founded by Cameron and Tyler Winklevoss, surged in their market debut on Friday, signaling strong institutional appetite for crypto-related equities. Gemini shares briefly topped $40 on Friday, according to Yahoo Finance data, before retreating later in the session. By the afternoon, Gemini was trading near $35 a share, up 24% on the day, for a market cap of around $1.3 billion. The company priced its initial public offering at $28 per share late Thursday — well above its initial target range of $17 to $19, and even higher than the upwardly revised $24 to $26 range. Read more

Gemini’s $425 million Nasdaq debut marks the latest in a wave of blockbuster crypto IPOs, as investor demand surges for digital asset equities. Shares of Gemini Space Station (GEMI), the digital asset exchange founded by Cameron and Tyler Winklevoss, surged in their market debut on Friday, signaling strong institutional appetite for crypto-related equities. Gemini shares briefly topped $40 on Friday, according to Yahoo Finance data, before retreating later in the session. By the afternoon, Gemini was trading near $35 a share, up 24% on the day, for a market cap of around $1.3 billion. The company priced its initial public offering at $28 per share late Thursday — well above its initial target range of $17 to $19, and even higher than the upwardly revised $24 to $26 range. Read more -

Cryptonews.com - 22:30 Sep 11, 2025

Gemini predicts outcomes for XRP, Dogecoin and Cardano as crypto has rebounded. It has projected XRP near $9 by 2025, DOGE toward $0.40 this year, and ADA up to $10 by 2026, with U.S. policy moves and Bitcoin’s record high having set the backdrop into the holiday season. The post Google’s Gemini AI Predicts the Price of XRP, Dogecoin and Cardano by the End of 2025 appeared first on Cryptonews. -

Cointelegraph.com - 22:07 Sep 11, 2025

The crypto exchange capped proceeds at $425 million after reportedly halting new orders, with Nasdaq among its investors. Gemini’s upcoming initial public offering (IPO), expected Friday, has reportedly been oversubscribed more than 20 times, as crypto and blockchain companies continue to attract investor attention. According to Reuters on Thursday, citing people familiar with the matter, Gemini and its bankers stopped accepting new orders for shares on Thursday, ahead of the crypto exchange’s debut. The move, called “unusual” in an IPO, reportedly capped proceeds at $425 million. Gemini had initially upped its raise to $433 million, with its prospective listing share price ranging between $24 and $26, from $17 to $19 floor price. Read more

The crypto exchange capped proceeds at $425 million after reportedly halting new orders, with Nasdaq among its investors. Gemini’s upcoming initial public offering (IPO), expected Friday, has reportedly been oversubscribed more than 20 times, as crypto and blockchain companies continue to attract investor attention. According to Reuters on Thursday, citing people familiar with the matter, Gemini and its bankers stopped accepting new orders for shares on Thursday, ahead of the crypto exchange’s debut. The move, called “unusual” in an IPO, reportedly capped proceeds at $425 million. Gemini had initially upped its raise to $433 million, with its prospective listing share price ranging between $24 and $26, from $17 to $19 floor price. Read more -

Cointelegraph.com - 14:17 Sep 11, 2025

From watchlists to trading loops, Google Gemini AI offers day traders new ways to cut through noise, manage risk and act on market catalysts with confidence. Gemini AI serves as a powerful tool for researching day trade strategies but cannot be used to execute trades directly. It summarizes fundamentals and compares assets to support daily trade decisions but still requires access to data sets. Gemini AI helps manage trading discipline by turning watchlists, catalysts and post-mortems into structured loops that prevent traders from chasing noise. Read more

From watchlists to trading loops, Google Gemini AI offers day traders new ways to cut through noise, manage risk and act on market catalysts with confidence. Gemini AI serves as a powerful tool for researching day trade strategies but cannot be used to execute trades directly. It summarizes fundamentals and compares assets to support daily trade decisions but still requires access to data sets. Gemini AI helps manage trading discipline by turning watchlists, catalysts and post-mortems into structured loops that prevent traders from chasing noise. Read more -

CryptoSlate - 22:43 Sep 10, 2025

Crypto exchange Gemini lifted the price range for its initial public offering to $24 to $26 per share, setting up a debut that could value the company at about $3.2 billion, according to a filing this week. The New York-based exchange, run by Cameron and Tyler Winklevoss, previously aimed for a range of $17 to […] The post Gemini raises IPO price range to $19 at the top end, targeting $435M raise appeared first on CryptoSlate. -

Cryptonews.com - 21:59 Sep 09, 2025

Bitcoin price prediction: Nasdaq invests $50M in Gemini IPO, Ripple teams with BBVA, and Vietnam launches 5-year crypto pilot as BTC eyes $117K breakout. The post Bitcoin Price Prediction: Nasdaq’s $50M Gemini Bet and Global Crypto Shake-Up appeared first on Cryptonews. -

CryptoSlate - 19:15 Sep 09, 2025

Gemini, the cryptocurrency exchange founded by Cameron and Tyler Winklevoss, has lined up Nasdaq as a strategic investor as it prepares to go public in New York this week, Reuters reported on Sept. 9, citing people briefed on the matter. According to the report, the share sale could raise up to $317 million, with Nasdaq […] The post Winklevoss twins’ Gemini gears up for public debut this week with Nasdaq backing appeared first on CryptoSlate. -

Cryptonews.com - 20:21 Sep 04, 2025

Gemini predicts sustained momentum for digital assets, with Bitcoin regaining support, XRP adoption boosted by Mastercard and ETF prospects, and Solana moving toward its largest upgrade yet. Pepe and Maxi Doge also remain in focus within the evolving memecoin market. The post Google’s Gemini AI Predicts the Price of XRP, Solana and Pepe by the End of 2025 appeared first on Cryptonews. -

Cointelegraph.com - 13:42 Sep 02, 2025

Winklevoss brothers-founded crypto exchange Gemini has filed for an IPO, seeking to raise up to $317 million as an “emerging growth company.” Gemini, a crypto exchange founded by Cameron and Tyler Winklevoss, announced the launch of an initial public offering (IPO) of 16.67 million shares of Class A common stock. Gemini Space Station filed a Form S-1 for IPO on Tuesday, planning to sell the shares priced between $17 and $19 per share, to raise up to $317 million. Subject to completion, the filing comes weeks after the company filed with the US Securities and Exchange Commission to list its Class A common stock on the Nasdaq Global Select Market under the ticker GEMI on Aug. 16. Read more

Winklevoss brothers-founded crypto exchange Gemini has filed for an IPO, seeking to raise up to $317 million as an “emerging growth company.” Gemini, a crypto exchange founded by Cameron and Tyler Winklevoss, announced the launch of an initial public offering (IPO) of 16.67 million shares of Class A common stock. Gemini Space Station filed a Form S-1 for IPO on Tuesday, planning to sell the shares priced between $17 and $19 per share, to raise up to $317 million. Subject to completion, the filing comes weeks after the company filed with the US Securities and Exchange Commission to list its Class A common stock on the Nasdaq Global Select Market under the ticker GEMI on Aug. 16. Read more -

Cryptonews.com - 18:35 Aug 28, 2025

Gemini predicts continued upside for XRP, Cronos and Solana into 2025, tying momentum to real-world utility and ecosystem growth. Ethereum has reached a record high, Bitcoin has traded below its peak, and analysts have described conditions as supportive despite recent cooling across altcoins. The post Google’s Gemini AI Predicts the Price of XRP, Solana, and Cronos by the End of 2025 appeared first on Cryptonews. -

Cointelegraph.com - 10:18 Aug 21, 2025

The Winklevoss twins-owned Gemini exchange continues its expansion in Europe, securing a Markets in Crypto-Assets Regulation license in Malta. Cryptocurrency exchange Gemini received a Markets in Crypto-Assets Regulation (MiCA) license in Malta, supporting the company’s ongoing expansion in Europe. The Cameron and Tyler Winklevoss-owned exchange secured a MiCA license from the Malta Financial Services Authority (MFSA) on Wednesday, according to official MFSA records. “Receiving this approval marks a critical milestone in our regulated European expansion, as it will allow us to expand our secure and reliable crypto products for customers in over 30 European countries and jurisdictions,” Gemini said in a statement shared with Cointelegraph. Read more

The Winklevoss twins-owned Gemini exchange continues its expansion in Europe, securing a Markets in Crypto-Assets Regulation license in Malta. Cryptocurrency exchange Gemini received a Markets in Crypto-Assets Regulation (MiCA) license in Malta, supporting the company’s ongoing expansion in Europe. The Cameron and Tyler Winklevoss-owned exchange secured a MiCA license from the Malta Financial Services Authority (MFSA) on Wednesday, according to official MFSA records. “Receiving this approval marks a critical milestone in our regulated European expansion, as it will allow us to expand our secure and reliable crypto products for customers in over 30 European countries and jurisdictions,” Gemini said in a statement shared with Cointelegraph. Read more -

CryptoSlate - 22:00 Aug 18, 2025

Gemini has filed for a Nasdaq IPO under the ticker GEMI, revealing a $282.5 million net loss for the first half of 2025. The exchange also disclosed a $75 million credit agreement with Ripple in the Aug. 15 filing submitted to the US Securities and Exchange Commission (SEC), The exchange, founded by Cameron and Tyler […] The post Gemini IPO filing reveals Ripple credit deal, $282M net loss in 2025 appeared first on CryptoSlate. -

Cointelegraph.com - 21:00 Aug 18, 2025

Gemini’s lead comes after a series of updates, while OpenAI’s ChatGPT and xAI’s Grok have suffered missteps. Bettors on Kalshi, a prediction market, forecast that Google’s Gemini will emerge as the top artificial intelligence text model by the end of 2025. The positions reflect the ongoing developments of Gemini’s competitors as the large language model (LLM) race heats up. Since Tuesday, Gemini has taken a commanding lead with 57% of users betting on the model, up from 48.1% on the previous date. During that same time, OpenAI’s ChatGPT model has fallen to 20% from 25.4%, and xAI’s Grok odds have decreased to 15% from 18.8%. This particular Kalshi prediction scenario will resolve on Dec. 31, with bettors of the winning model receiving their allotted amount. The LM Arena Leaderboard, “an open platform where everyone can [...] access, explore and interact with the world’s leading AI models,” will verify the outcome. Currently, $7.4 million in volume has been seen on this prediction scenario. Read more

Gemini’s lead comes after a series of updates, while OpenAI’s ChatGPT and xAI’s Grok have suffered missteps. Bettors on Kalshi, a prediction market, forecast that Google’s Gemini will emerge as the top artificial intelligence text model by the end of 2025. The positions reflect the ongoing developments of Gemini’s competitors as the large language model (LLM) race heats up. Since Tuesday, Gemini has taken a commanding lead with 57% of users betting on the model, up from 48.1% on the previous date. During that same time, OpenAI’s ChatGPT model has fallen to 20% from 25.4%, and xAI’s Grok odds have decreased to 15% from 18.8%. This particular Kalshi prediction scenario will resolve on Dec. 31, with bettors of the winning model receiving their allotted amount. The LM Arena Leaderboard, “an open platform where everyone can [...] access, explore and interact with the world’s leading AI models,” will verify the outcome. Currently, $7.4 million in volume has been seen on this prediction scenario. Read more -

Cointelegraph.com - 07:49 Aug 16, 2025

Gemini, the Winklevoss-founded crypto exchange and custodian, has filed to list on Nasdaq under ticker GEMI, revealing steepening losses ahead of its IPO. Gemini Space Station, the crypto exchange and custodian founded by Cameron and Tyler Winklevoss, has filed with the US Securities and Exchange Commission to list its Class A common stock on the Nasdaq Global Select Market under the ticker GEMI. Founded in 2014, Gemini operates a regulated crypto exchange, custody service, and a range of blockchain-based products, including the US dollar-backed Gemini Dollar (GUSD) stablecoin and a crypto-rewards credit card, the platform said in the filing submitted on Friday. According to its filing, the IPO will mark the first time its shares are publicly traded, with pricing expected between an undisclosed range. The offering will be led by a syndicate of major banks, including Goldman Sachs, Morgan Stanley, Citigroup and others. Read more

Gemini, the Winklevoss-founded crypto exchange and custodian, has filed to list on Nasdaq under ticker GEMI, revealing steepening losses ahead of its IPO. Gemini Space Station, the crypto exchange and custodian founded by Cameron and Tyler Winklevoss, has filed with the US Securities and Exchange Commission to list its Class A common stock on the Nasdaq Global Select Market under the ticker GEMI. Founded in 2014, Gemini operates a regulated crypto exchange, custody service, and a range of blockchain-based products, including the US dollar-backed Gemini Dollar (GUSD) stablecoin and a crypto-rewards credit card, the platform said in the filing submitted on Friday. According to its filing, the IPO will mark the first time its shares are publicly traded, with pricing expected between an undisclosed range. The offering will be led by a syndicate of major banks, including Goldman Sachs, Morgan Stanley, Citigroup and others. Read more -

Cryptonews.com - 22:30 Aug 13, 2025

Gemini predicts XRP, Chainlink and Solana may post large gains, with bullish trading trends and new U.S. crypto regulations driving optimism. Analysts point to potential breakouts as institutional interest continues to grow. The post Google’s Gemini AI Predicts the Price of XRP, Chainlink and Solana by the End of 2025 appeared first on Cryptonews. -

Cryptonews.com - 22:30 Jul 28, 2025

Gemini predicts XRP could reach $20, SHIB may rise up to 35-fold and PEPE could triple by December, while presale token TOKEN6900 eyes meme-driven upside. The AI model has based its outlook on renewed capital flows since Bitcoin has reached an all-time high of $122,838 and revived risk appetite. The post Google’s Gemini AI Predicts the Price of XRP, Shiba Inu and Pepe by the End of 2025 appeared first on Cryptonews. -

Cointelegraph.com - 10:07 Jul 26, 2025

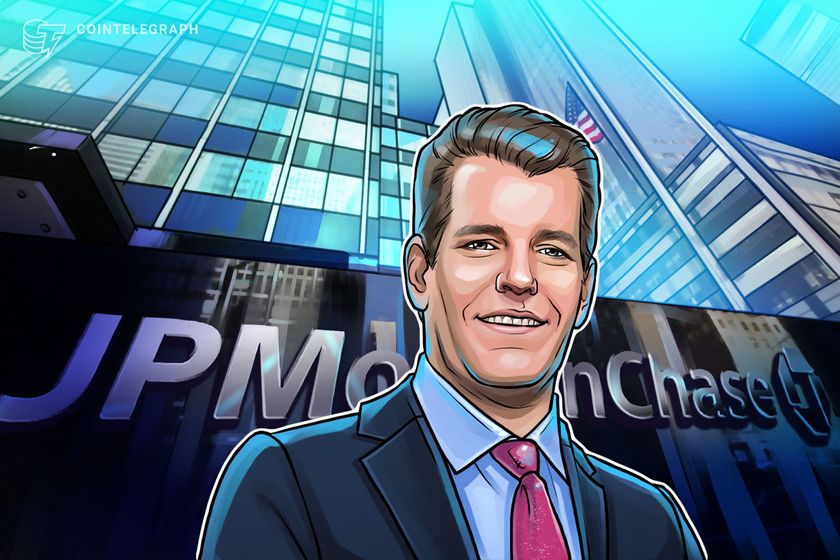

Tyler Winklevoss claims JPMorgan paused Gemini's onboarding after he criticized the bank’s data access fees, calling the move anti-competitive. Gemini co-founder Tyler Winklevoss has accused JPMorgan Chase of halting the crypto exchange’s onboarding process in response to his public criticism of the bank’s new data access policy. In a Friday post on X, Winklevoss claimed JPMorgan retaliated after he called out the banking giant’s new move as anti-competitive behavior that could harm fintech and crypto firms. “My tweet from last week struck a nerve. This week, JPMorgan told us that because of it they were pausing their re-onboarding of Gemini as a customer after they off-boarded us during Operation ChokePoint 2.0,” the Gemini boss wrote. Read more

Tyler Winklevoss claims JPMorgan paused Gemini's onboarding after he criticized the bank’s data access fees, calling the move anti-competitive. Gemini co-founder Tyler Winklevoss has accused JPMorgan Chase of halting the crypto exchange’s onboarding process in response to his public criticism of the bank’s new data access policy. In a Friday post on X, Winklevoss claimed JPMorgan retaliated after he called out the banking giant’s new move as anti-competitive behavior that could harm fintech and crypto firms. “My tweet from last week struck a nerve. This week, JPMorgan told us that because of it they were pausing their re-onboarding of Gemini as a customer after they off-boarded us during Operation ChokePoint 2.0,” the Gemini boss wrote. Read more -

Cryptonews.com - 22:30 Jul 21, 2025

Gemini predicts that Bitcoin’s record $122,838 peak has galvanised market optimism, outlining pathways for XRP to surge toward $45, Shiba Inu to rise sevenfold and Solana to approach $370 by late-2025, provided institutional inflows expand and ongoing US regulatory clarity supports liquidity. The post Google’s Gemini AI Predicts the Price of XRP, Shiba Inu and Solana by the End of 2025 appeared first on Cryptonews.