Hyperliquid | Crypto

"Hyperliquid" in Crypto feed

-

CryptoSlate - 20:20 Aug 25, 2025

Hyperliquid registered more trading volume than Robinhood for the third consecutive month, with July marking the largest gap between platforms at 39.1%. DefiLlama data shows the decentralized derivatives exchange traded $330.8 billion in combined spot and perpetual volume during July, while Robinhood processed $237.8 billion across all products. Robinhood’s July volume was made up of […] The post Hyperliquid surpasses Robinhood in monthly trading volume for the third consecutive month appeared first on CryptoSlate. -

Cryptonews.com - 18:04 Aug 25, 2025

Altcoin season has returned to trading desks, though its form in late August looks different from past cycles. Liquidity is still concentrated, but pockets of activity show investors shifting into tokens with distinct functions. Beyond price moves, three projects—Hyperliquid, VeChain, and Algorand—show how utility, adoption, and design can all carry weight during altseason.Broader conditions remain […] The post Altcoin Season Alert: Hyperliquid, VeChain, Algorand Could Be Your Ticket to Wealth appeared first on Cryptonews. -

Cointelegraph.com - 11:29 Aug 22, 2025

Andrew Tate is back on the memecoin bandwagon but hasn’t nailed the trading game as his wallet approaches losses of $700,000 on Hyperliquid. Former kickboxing champion and controversial influencer Andrew Tate is among the latest celebrities to dive into Kanye West’s newly launched YZY token, but his bets are already deep in the red. A wallet address linked to Tate opened a 3x leveraged short position on the recently launched, West-linked YZY token at $0.85 and was sitting on a $16,000 loss on the position. Tate “doesn’t seem to be good at perps trading,” as his cumulative losses are nearing $700,000 on this single Hyperliquid account, wrote blockchain analytics platform Lookonchain in a Friday X post. “So far, he's made 80 trades on #Hyperliquid — only 29 were profitable (win rate: 36.25%) — with total losses of $699K.” Read more

Andrew Tate is back on the memecoin bandwagon but hasn’t nailed the trading game as his wallet approaches losses of $700,000 on Hyperliquid. Former kickboxing champion and controversial influencer Andrew Tate is among the latest celebrities to dive into Kanye West’s newly launched YZY token, but his bets are already deep in the red. A wallet address linked to Tate opened a 3x leveraged short position on the recently launched, West-linked YZY token at $0.85 and was sitting on a $16,000 loss on the position. Tate “doesn’t seem to be good at perps trading,” as his cumulative losses are nearing $700,000 on this single Hyperliquid account, wrote blockchain analytics platform Lookonchain in a Friday X post. “So far, he's made 80 trades on #Hyperliquid — only 29 were profitable (win rate: 36.25%) — with total losses of $699K.” Read more -

CryptoSlate - 22:00 Aug 20, 2025

Hyperliquid has achieved the highest revenue per employee globally, at $106 million, surpassing traditional technology giants and the previous record holder, Tether Limited. The revenue-per-employee metric places Hyperliquid significantly ahead of established technology companies. Data gathered by Hyperliquid France puts Tether in second with $93 million per employee, while OnlyFans ranks third at $37.6 million. […] The post Hyperliquid achieves record revenue per employee globally at $106M appeared first on CryptoSlate. -

CoinDesk - 14:00 Aug 19, 2025

The DEX takes over Hyperliquid’s second-largest liquid staking token, part of an ecosystem where staking makes up more than half of $2.26 billion in TVL. -

Cointelegraph.com - 11:36 Aug 07, 2025

Hyperliquid processed $319B in trades last month, accounting for the majority of DeFi perpetual futures volume as decentralized exchanges gain traction. Trading volume on the decentralized exchange Hyperliquid reached a new monthly high in July, setting a record among DeFi perpetual futures platforms as user activity continued to rise. According to DefiLlama data, the platform processed $319 billion in trades during the month — the highest monthly volume ever recorded in the DeFi perpetual futures space. Hyperliquid’s record is a sign of more traders using decentralized exchanges, which are starting to cut into the market share of centralized cryptocurrency exchanges (CEXs). Read more

Hyperliquid processed $319B in trades last month, accounting for the majority of DeFi perpetual futures volume as decentralized exchanges gain traction. Trading volume on the decentralized exchange Hyperliquid reached a new monthly high in July, setting a record among DeFi perpetual futures platforms as user activity continued to rise. According to DefiLlama data, the platform processed $319 billion in trades during the month — the highest monthly volume ever recorded in the DeFi perpetual futures space. Hyperliquid’s record is a sign of more traders using decentralized exchanges, which are starting to cut into the market share of centralized cryptocurrency exchanges (CEXs). Read more -

Cryptonews.com - 19:44 Aug 04, 2025

In early August, Altcoin Season speculation has continued even as Bitcoin commands 60% dominance. Traders have rotated into Hyperliquid for its on-chain derivatives, Pump.fun for meme-driven liquidity, and Conflux for utility-led activity, seeking pockets of performance while the index rises. The post Hyperliquid, Pump.fun, Conflux Lead August Altcoin Season Mini-Rally – Is a Rotation Here? appeared first on Cryptonews. -

CryptoPotato - 15:06 Aug 04, 2025

[PRESS RELEASE – Helsinki, Finland, August 4th, 2025] Apu Apustaja ($APU), a cross-chain memecoin, has announced that its native token is now available for spot trading on Hyperliquid, a leading fully on-chain orderbook exchange. Hyperliquid currently facilitates billions in daily trading volume and manages over $7 billion in total value locked (TVL). The addition of […] -

Cointelegraph.com - 12:49 Aug 04, 2025

Hyperliquid’s rapid response may boost confidence in decentralized trading platforms, which are gaining market share. Decentralized exchange Hyperliquid has reimbursed nearly $2 million to users affected by a brief outage last week, a move that may strengthen confidence in decentralized trading platforms. The Hyperliquid platform’s application programming interface (API) suffered an outage Tuesday, which saw traders sidelined from order execution for about 37 minutes before resuming operations, its website shows. On Monday, Hyperliquid issued refunds totaling $1.99 million in USDC (USDC) to affected users, onchain data from Hypurrscan shows. Read more

Hyperliquid’s rapid response may boost confidence in decentralized trading platforms, which are gaining market share. Decentralized exchange Hyperliquid has reimbursed nearly $2 million to users affected by a brief outage last week, a move that may strengthen confidence in decentralized trading platforms. The Hyperliquid platform’s application programming interface (API) suffered an outage Tuesday, which saw traders sidelined from order execution for about 37 minutes before resuming operations, its website shows. On Monday, Hyperliquid issued refunds totaling $1.99 million in USDC (USDC) to affected users, onchain data from Hypurrscan shows. Read more -

CryptoSlate - 21:17 Aug 01, 2025

Decentralized exchanges (DEX) reached $1 trillion in monthly trading volume for the first time in July. According to DefiLlama data, spot trading volume grew 29.4% and reached nearly $514 billion last month, bested only by January’s all-time high of $568 billion. At the same time, perpetual futures’ monthly volume increased 33.6% to register a new […] The post DEX trading volume tops $1T for the first time in July, Hyperliquid leads record perp surge appeared first on CryptoSlate. -

Cryptonews.com - 22:30 Jul 18, 2025

DeepSeek AI predicts prominent altcoins will achieve unprecedented price milestones in H2 2025, driven by Bitcoin's rally to $122,838. The platform forecasts XRP reaching $5 by year-end, DOGE hitting $1 during the bull phase, and HYPE token climbing to $100 by New Year. The post China’s DeepSeek AI Predicts the Price of XRP, Dogecoin and Hyperliquid by the End of July 2025 appeared first on Cryptonews. -

Cryptonews.com - 16:26 Jul 11, 2025

Hyperliquid ($HYPE) recently rallied to a new all-time high of $46.22 after rising more than 10% in the past 24 hours, although it has slipped back to trade at about $45.59 at press time.Over the last week, bullish momentum lifted the token from a $37.18 trough to its recent peak of $46.22, an impressive 24% […] The post Hyperliquid ($HYPE) Soars 24% to All-Time High Amid Growing Interest for DeFi Derivatives appeared first on Cryptonews. -

CryptoPotato - 15:54 Jul 10, 2025

The most in-depth guide on Hyperliquid airdrop farming you will find. -

Cointelegraph.com - 19:33 Jul 09, 2025

Hyperliquid’s expansion across the DEX landscape and its growing user base could trigger a HYPE price rally above $45. Key point: Hyperliquid’s solid growth trajectory could retain investors’ interest in HYPE. Hyperliquid (HYPE) has witnessed a strong growth trajectory in the past year, with average trading volume soaring, reaching $3 billion to $5 billion from less than $100 million, according to CoinGlass’ semi-annual crypto derivatives outlook. Read more

Hyperliquid’s expansion across the DEX landscape and its growing user base could trigger a HYPE price rally above $45. Key point: Hyperliquid’s solid growth trajectory could retain investors’ interest in HYPE. Hyperliquid (HYPE) has witnessed a strong growth trajectory in the past year, with average trading volume soaring, reaching $3 billion to $5 billion from less than $100 million, according to CoinGlass’ semi-annual crypto derivatives outlook. Read more -

Cointelegraph.com - 19:46 Jun 23, 2025

HYPE is up 300%, and Hyperliquid leads the DEX perp market. But with a $38B valuation and just 21 validators, some question whether the rise is sustainable. Key takeaways: HYPE has surged over 300% since April, driven by growing usage of the Hyperliquid exchange and rising investor interest. Hyperliquid now leads the decentralized perpetuals market, processing over 70% of DEX perp volume. Read more

HYPE is up 300%, and Hyperliquid leads the DEX perp market. But with a $38B valuation and just 21 validators, some question whether the rise is sustainable. Key takeaways: HYPE has surged over 300% since April, driven by growing usage of the Hyperliquid exchange and rising investor interest. Hyperliquid now leads the decentralized perpetuals market, processing over 70% of DEX perp volume. Read more -

Cointelegraph.com - 12:44 Jun 19, 2025

The $600 million treasury announcement came on the same day Nasdaq-listed ophthalmic technologies firm Eyenovia shared plans for a Hyperliquid token treasury. Update June 19, 1:58 pm UTC: This article has been updated to include comments from Bitget Wallet’s CMO. Nasdaq-listed Lion Group Holding (LGHL) is establishing a $600 million cryptocurrency treasury reserve, with the Hyperliquid (HYPE) token as its main asset, signaling a growing institutional interest in altcoins beyond Bitcoin. The Singapore-based trading platform said it secured a $600 million facility from ATW Partners to fund the launch of its Hyperliquid (HYPE) token treasury and other blockchain initiatives. According to the company, $10.6 million of the capital will be deployed by Friday. Read more

The $600 million treasury announcement came on the same day Nasdaq-listed ophthalmic technologies firm Eyenovia shared plans for a Hyperliquid token treasury. Update June 19, 1:58 pm UTC: This article has been updated to include comments from Bitget Wallet’s CMO. Nasdaq-listed Lion Group Holding (LGHL) is establishing a $600 million cryptocurrency treasury reserve, with the Hyperliquid (HYPE) token as its main asset, signaling a growing institutional interest in altcoins beyond Bitcoin. The Singapore-based trading platform said it secured a $600 million facility from ATW Partners to fund the launch of its Hyperliquid (HYPE) token treasury and other blockchain initiatives. According to the company, $10.6 million of the capital will be deployed by Friday. Read more -

CryptoPotato - 11:10 Jun 14, 2025

The only guide explaining how to trade on Hyperliquid in a step-by-step manner you will ever need. -

Cointelegraph.com - 13:58 May 29, 2025

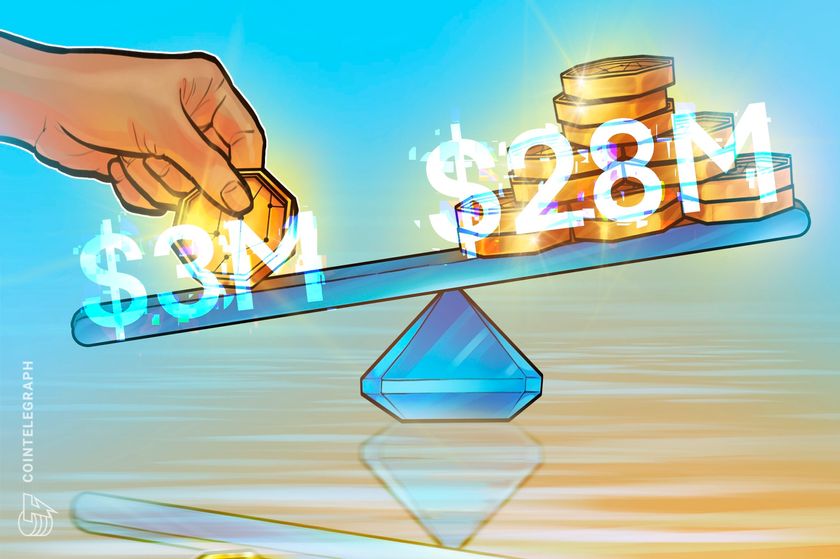

A crypto trader profited over $27 million on decentralized exchange Hyperliquid after placing high-leverage, all-long bets during a major market rally. A Hyperliquid trader has pulled off an explosive and high-risk trading run, turning a $3 million deposit into $27.5 million in profit in just 52 days. Between April 7 and April 9, the trader deposited nearly $3 million on the platform and placed aggressive leveraged bets, going fully long on various crypto assets. Hyperliquid allows users to trade perpetual futures onchain without custodians or intermediaries. The trader went all-in on long positions, betting that crypto prices would increase. The trader used different leverage levels for various assets, meaning that for each dollar they put in, they were controlling more value. Read more

A crypto trader profited over $27 million on decentralized exchange Hyperliquid after placing high-leverage, all-long bets during a major market rally. A Hyperliquid trader has pulled off an explosive and high-risk trading run, turning a $3 million deposit into $27.5 million in profit in just 52 days. Between April 7 and April 9, the trader deposited nearly $3 million on the platform and placed aggressive leveraged bets, going fully long on various crypto assets. Hyperliquid allows users to trade perpetual futures onchain without custodians or intermediaries. The trader went all-in on long positions, betting that crypto prices would increase. The trader used different leverage levels for various assets, meaning that for each dollar they put in, they were controlling more value. Read more -

CryptoSlate - 10:45 May 26, 2025

Bitcoin saw a mild bounce during early trading in Asia, rising 3% to briefly touch $110,256 before settling at $109,652, CryptoSlate data showed. This uptick followed a weekend pullback from recent record highs. Market analysts suggest that BTC’s price trajectory remains solid, backed by favorable regulatory developments and steady institutional participation. Valentin Fournier, Lead Analyst […] The post Bitcoin price rebound to $110,000 wipes out a $1 billion short on Hyperliquid appeared first on CryptoSlate. -

CryptoSlate - 14:57 May 23, 2025

Hyperliquid’s native token, HYPE, surged to a new record high following a significant increase in trading activity and open interest on the platform. This momentum mirrors the broader market upswing driven by Bitcoin’s latest price milestone and coincides with Hyperliquid’s public response to regulatory discussions with the US Commodity Futures Trading Commission (CFTC). Hyperliquid’s open […] The post Hyperliquid’s HYPE token soars to new ATH amid trading surge and CFTC collaboration appeared first on CryptoSlate.